Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vigoroo Ltd, the sole manufacturer of a popular new electronic item is expecting its level of sales to rise by 60 per cent in

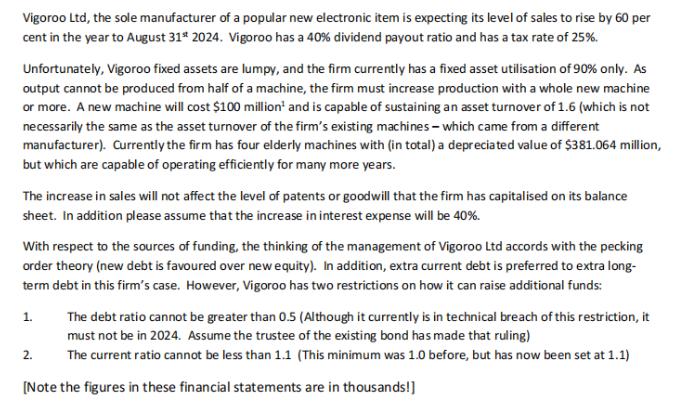

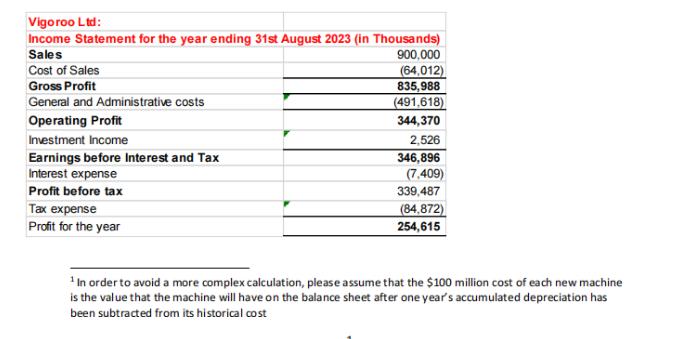

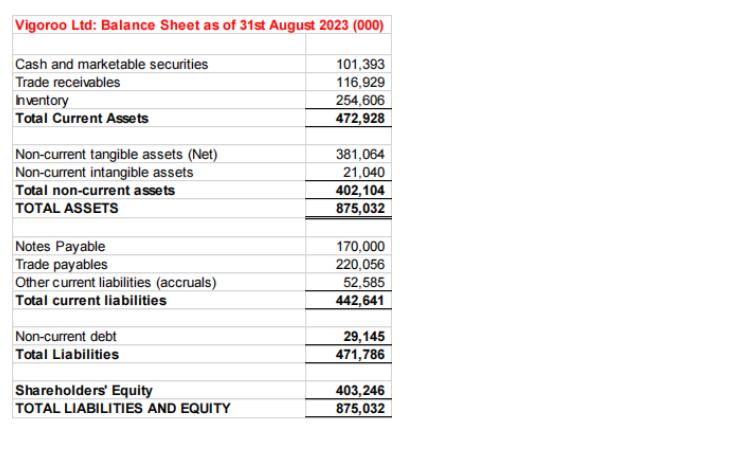

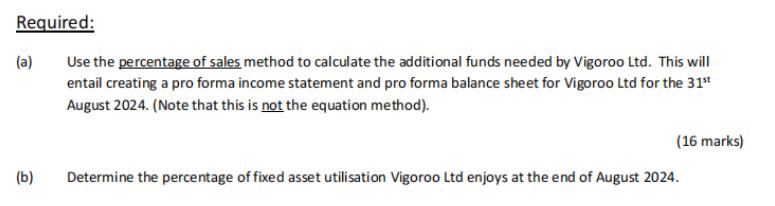

Vigoroo Ltd, the sole manufacturer of a popular new electronic item is expecting its level of sales to rise by 60 per cent in the year to August 31st 2024. Vigoroo has a 40% dividend payout ratio and has a tax rate of 25%. Unfortunately, Vigoroo fixed assets are lumpy, and the firm currently has a fixed asset utilisation of 90% only. As output cannot be produced from half of a machine, the firm must increase production with a whole new machine or more. A new machine will cost $100 million and is capable of sustaining an asset turnover of 1.6 (which is not necessarily the same as the asset turnover of the firm's existing machines - which came from a different manufacturer). Currently the firm has four elderly machines with (in total) a depreciated value of $381.064 million, but which are capable of operating efficiently for many more years. The increase in sales will not affect the level of patents or goodwill that the firm has capitalised on its balance sheet. In addition please assume that the increase in interest expense will be 40%. With respect to the sources of funding, the thinking of the management of Vigoroo Ltd accords with the pecking order theory (new debt is favoured over new equity). In addition, extra current debt is preferred to extra long- term debt in this firm's case. However, Vigoroo has two restrictions on how it can raise additional funds: The debt ratio cannot be greater than 0.5 (Although it currently is in technical breach of this restriction, it must not be in 2024. Assume the trustee of the existing bond has made that ruling) The current ratio cannot be less than 1.1 (This minimum was 1.0 before, but has now been set at 1.1) [Note the figures in these financial statements are in thousands!] 1. 2. Vigoroo Ltd: Income Statement for the year ending 31st August 2023 (in Thousands) Sales Cost of Sales Gross Profit General and Administrative costs Operating Profit Investment Income Earnings before Interest and Tax Interest expense Profit before tax Tax expense Profit for the year 900,000 (64,012) 835,988 (491.618) 344,370 2,526 346,896 (7,409) 339,487 (84,872) 254,615 In order to avoid a more complex calculation, please assume that the $100 million cost of each new machine is the value that the machine will have on the balance sheet after one year's accumulated depreciation has been subtracted from its historical cost Vigoroo Ltd: Balance Sheet as of 31st August 2023 (000) Cash and marketable securities Trade receivables Inventory Total Current Assets Non-current tangible assets (Net) Non-current intangible assets Total non-current assets TOTAL ASSETS Notes Payable Trade payables Other current liabilities (accruals) Total current liabilities Non-current debt Total Liabilities Shareholders' Equity TOTAL LIABILITIES AND EQUITY 101,393 116,929 254,606 472,928 381,064 21,040 402,104 875,032 170,000 220,056 52,585 442,641 29,145 471,786 403,246 875,032 Required: Use the percentage of sales method to calculate the additional funds needed by Vigoroo Ltd. This will entail creating a pro forma income statement and pro forma balance sheet for Vigoroo Ltd for the 31st August 2024. (Note that this is not the equation method). (a) (b) (16 marks) Determine the percentage of fixed asset utilisation Vigoroo Ltd enjoys at the end of August 2024.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started