Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Image caption VII. During 2020, the organization has the following transactions: 1. Received unrestricted cash donations of $210,000. 2. Received restricted cash gifts of $50,000,

Image caption

Image caption

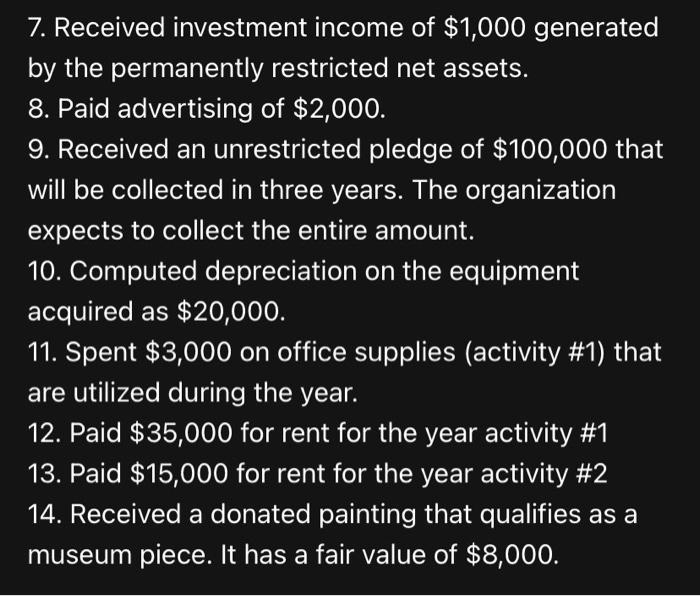

VII. During 2020, the organization has the following transactions: 1. Received unrestricted cash donations of $210,000. 2. Received restricted cash gifts of $50,000, used only for salaries of activity #2. 3. Paid wages of $80,000 with $20,000 of that amount coming from restricted funds (activities #2) 4. Bought equipment for $300,000 (FMV) with a long-term note signed for $250,000 and the remainder was donated by the seller. This equipment is 80% is used in Program #1 and 20% to Program #2. 5. Of this equipment, 80 percent is used in activity #1, 20 percent activity #2. 6. Received $100,000 from a donor that requests that the principal must never be used, but any income derive may be used at the organization's discretion. 7. Received investment income of $1,000 generated by the permanently restricted net assets. 8. Paid advertising of $2,000.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

PARTICULARS REVINUE AND OTHER SUPPORT Total Revine and other S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started