Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VII. Mechanics of Moving to the Optimal - If the FESCO company actual debt ratio is different from its recommended debt ratio, how should they

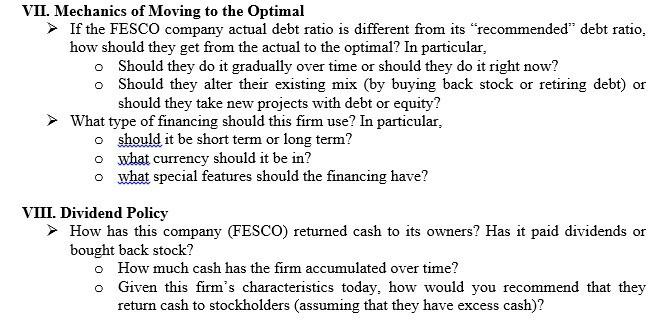

VII. Mechanics of Moving to the Optimal - If the FESCO company actual debt ratio is different from its "recommended" debt ratio, how should they get from the actual to the optimal? In particular, - Should they do it gradually over time or should they do it right now? - Should they alter their existing mix (by buying back stock or retiring debt) or should they take new projects with debt or equity? What type of financing should this firm use? In particular, should it be short term or long term? what currency should it be in? what special features should the financing have? VIII. Dividend Policy - How has this company (FESCO) returned cash to its owners? Has it paid dividends or bought back stock? - How much cash has the firm accumulated over time? Given this firm's characteristics today, how would you recommend that they return cash to stockholders (assuming that they have excess cash)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started