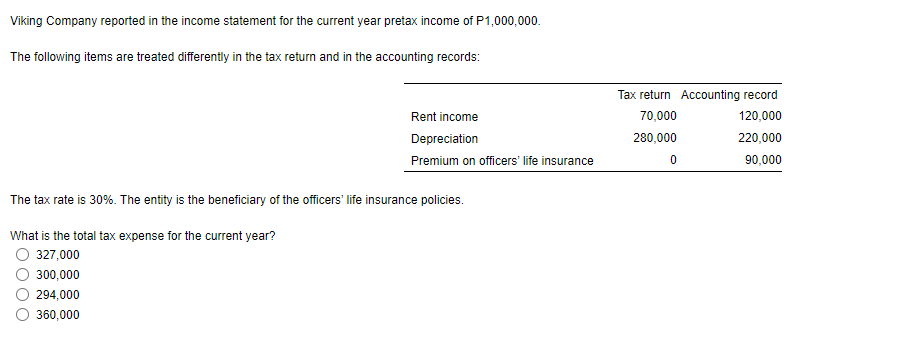

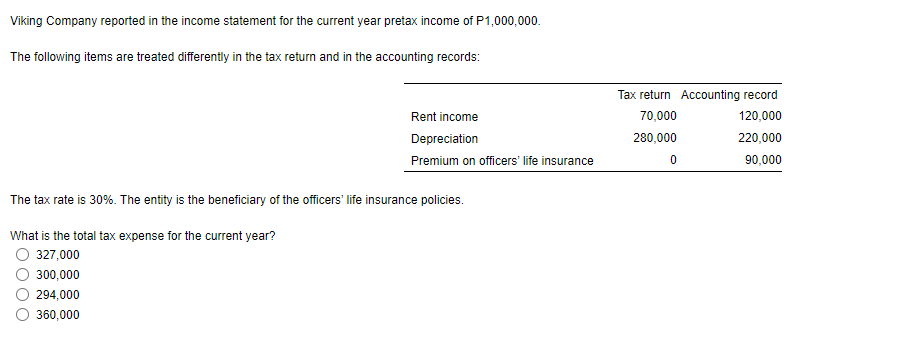

Viking Company reported in the income statement for the current year pretax income of P1,000,000 The following items are treated differently in the tax return and in the accounting records: Rent income Depreciation Premium on officers' life insurance Tax return Accounting record 70,000 120,000 280,000 220,000 0 90,000 The tax rate is 30%. The entity is the beneficiary of the officers' life insurance policies. What is the total tax expense for the current year? O 327,000 O 300,000 294,000 O 360,000 Pine Company reported pretax income of P800,000 for the current year. In the computation of income taxes, the following data were considered: 350,000 50,000 Nontaxable gain Depreciation deducted for tax purposes in excess of depreciation for book purposes Estimated tax payments during current year Enacted tax rate 70,000 30% What amount should be reported as current tax liability at year end? 120,000 50,000 135,000 65,000 Grim Company reported pretax accounting income of P200,000 and taxable income of P150,000 for the current year. 70,000 (20,000) Interest income on saving deposit (permanent difference) Premium expense on keyman life insurance and the company is the beneficiary Total 50,000 The income tax rate is 30%. What amount should be reported as current provision for income tax expense in the income statement for the current year? 50,000 45,000 60,000 Huskie Company reported in the income statement for the current year pretax income of P400.000 The following items are treated differently on the tax returns and on the book. Royalty income Depreciation expense Payment of a penalty Tax return Per Book 20,000 40,000 125,000 100,000 None 15,000 The enacted tax rate for current year is 30% and 25% for all future years. What amount should be reported as current portion of income tax expense in the income statement for the current year? 115,500 O 102,000 O 111,000 92,500 Tantrum Company began operations at the beginning of current year. At the end of the first year of operations, the entity reported P6,000,000 income before income tax in the income statement but only P5,100,000 taxable income in the tax return. Analysis of the P900,000 difference revealed that P500,000 was a permanent difference and P400,000 was a temporary difference tax liability difference related to a current asset. The enacted tax rate of the current year and future years is 30%. What is the total income tax expense to be reported in the income statement for the current year? O 1,800,000 1,950,000 O 1,530,000 O 1,650,000 Hilton Company reported pretax financial income of P6,200,000 for the current year. Included in other income was P200,000 of interest revenue from government bonds held by the entity (which is a permanent difference) The income statement also included depreciation expense of P500,000 for a machine costing P3,000,000. The income tax return reported P600,000 as depreciation on the machine. The enacted tax rate is 30% for the current year and future years. What is the current tax expense for the current year? O 1,770,000 O 1,860,000 O 1,800,000 O 1,830,000