Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vikki Rococo (age 22) graduated from college two months ago. She is currently living with her parents, Dave and Amy (ages 47 and 45),

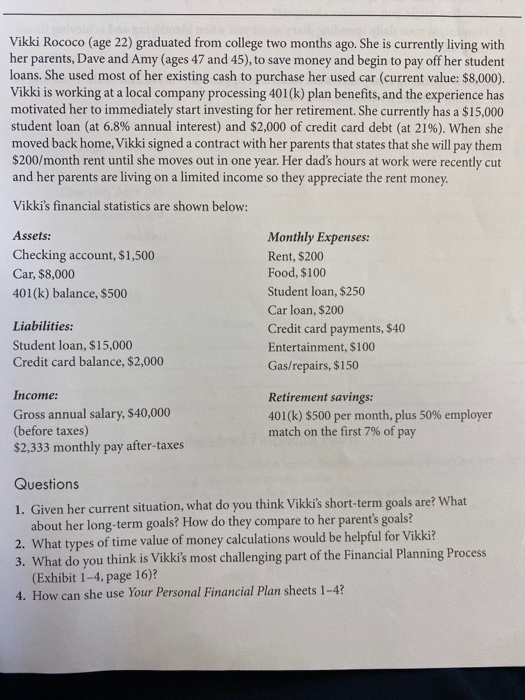

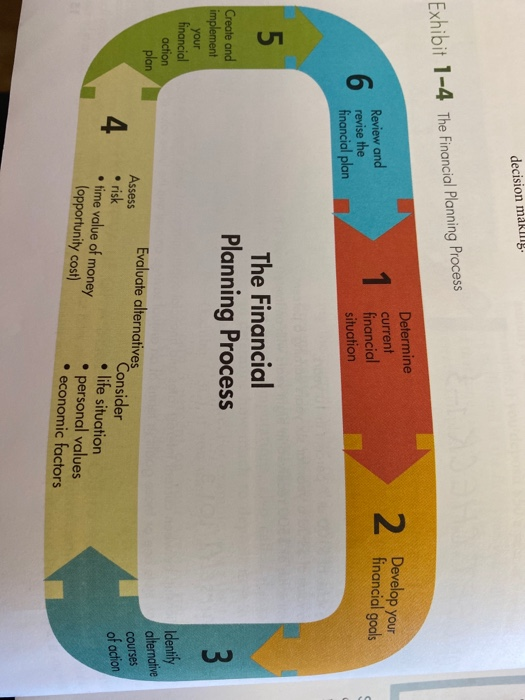

Vikki Rococo (age 22) graduated from college two months ago. She is currently living with her parents, Dave and Amy (ages 47 and 45), to save money and begin to pay off her student loans. She used most of her existing cash to purchase her used car (current value: $8,000). Vikki is working at a local company processing 401(k) plan benefits, and the experience has motivated her to immediately start investing for her retirement. She currently has a $15,000 student loan (at 6.8% annual interest) and $2,000 of credit card debt (at 21%). When she moved back home, Vikki signed a contract with her parents that states that she will pay them $200/month rent until she moves out in one year. Her dad's hours at work were recently cut and her parents are living on a limited income so they appreciate the rent money. Vikki's financial statistics are shown below: Assets: Checking account, $1,500 Car, $8,000 401(k) balance, $500 Liabilities: Student loan, $15,000 Credit card balance, $2,000 Income: Gross annual salary, $40,000 (before taxes) $2,333 monthly pay after-taxes Monthly Expenses: Rent, $200 Food, $100 Student loan, $250 Car loan, $200 Credit card payments, $40 Entertainment, $100 Gas/repairs, $150 Retirement savings: 401(k) $500 per month, plus 50% employer match on the first 7% of pay Questions 1. Given her current situation, what do you think Vikki's short-term goals are? What about her long-term goals? How do they compare to her parent's goals? 2. What types of time value of money calculations would be helpful for Vikki? 3. What do you think is Vikki's most challenging part of the Financial Planning Process (Exhibit 1-4, page 16)? 4. How can she use Your Personal Financial Plan sheets 1-4? Exhibit 1-4 The Financial Planning Process 5 Create and implement your financial action decision making. plan Review and 6 revise the financial plan 4 Assess risk 1 Determine current financial situation The Financial Planning Process Evaluate alternatives time value of money (opportunity cost) Consider life situation personal values economic factors 2 financial goals 3 Identify alternative courses of action

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Short term goals of Vikki include Save money Pay off her student loan of 15000 Pay off the credit card bills on time Long term goals of Vikki include Save enough money for retirement Vikki wants to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started