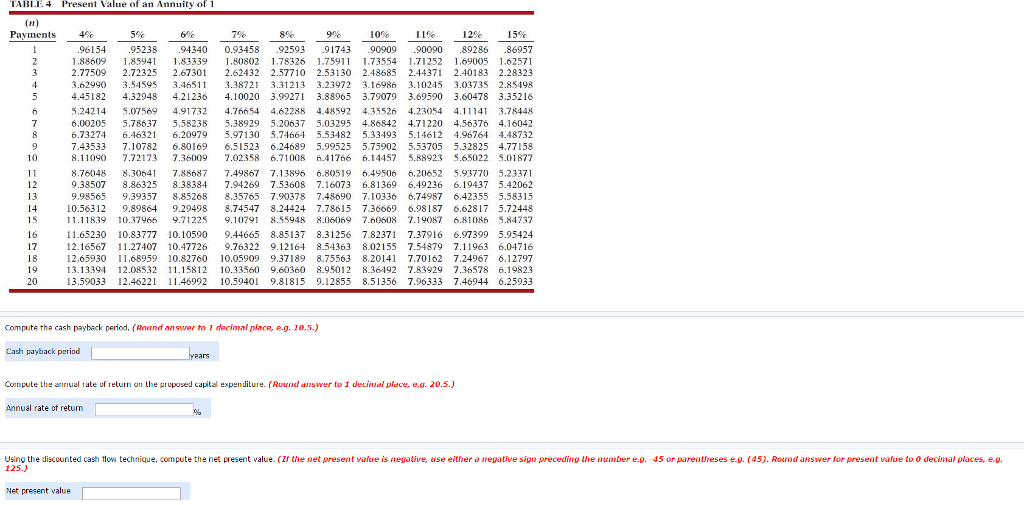

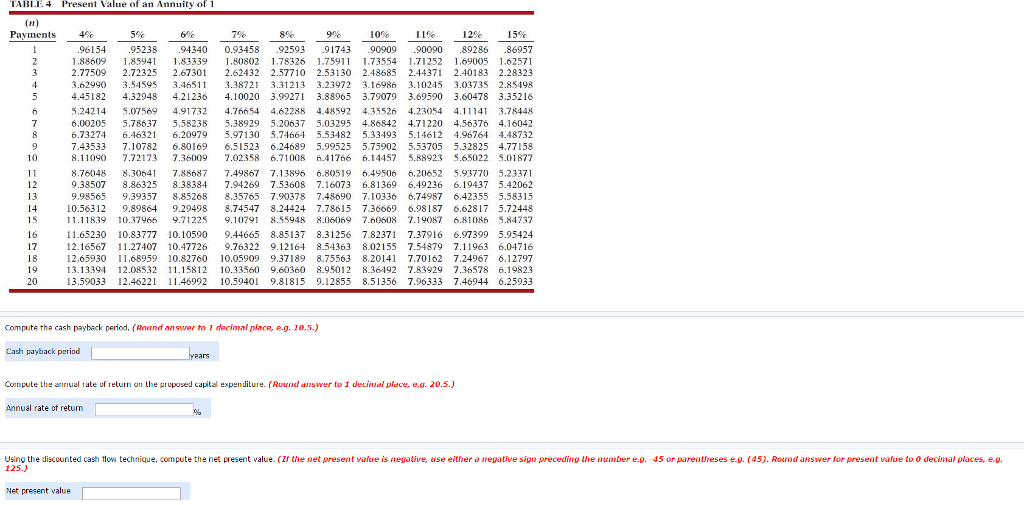

Vilas Company is considering a capital investment of $190,900 in additional productive facilities. The new machinery is expected to have a useful life of 5 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $15,400 and $49,140, respectively. Vilas has a 12% cost of capital rate, which is the required rate of return on the investment. (Refer the below table)

PLEASE USE ZOOM ON BROWSER IF YOU ARE UNABLE TO SEE GRAPH. THANK YOU.

Prese Val e of an A y of Payments 96154 95238 94340 0.93458 92593 91743 90909 90090 89286 86957 88609 8594 83339 80802 78326 759 73554 252 69005 6257 2.77509 2.72325 2.6730 2.62432 2.57710 2.53130 2.48685 2.4437 2.40183 2.28323 3.62990 3.54595 3.465 3.3872 3.31213. 3.23972 3.16986 3.10245 3.037356 2.85498 4.45182 4.32948 4.21236 3.38965 3.79079 3.69590 3.60478 3.35216 4.10020 3.9927 5.24214 07569 4.91732 4.76054 4,62288 4.48592 4.35526 4.23054 4,11141 3.78448 6,00205 5.78637 5,58238 5.38929 5.20637 5.03295 4.86842 4,71220 4,56376 4,16042 6.73274 6.4632 6.20979 5.97130 5.74604 5.53482 5.33193 5.14612 4.96764 4.48732 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.7715 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14157 5.88923 5.65022 5.01877 6.80519 6.49506 6.20652 5,93770 5.2337 8,76048 8,3064 7,88687 7,49867 7,13896 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 9,98565 9.39357 8,85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 0.56312 9.89864. 9.29498 74547 8.24424 7.78613 7.36669 6.98187 6.62817 5.72448 11.11839 10.37966 9.71225 79 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 65230 0.83777 10.10590 44665 8.85137 8.31256 7.8237 7.37916 6.97399 5.95424 2.16567 27407 0.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7. 963 6.04716 2.65930 68959 0.82760 0.05909 9.37189 8.75563 8.2014 7.70162 7.24967 6.12797 3.13394 2.08532 5812 0.33560 9.60360 8.95012 8.36192 7.83929 7.36578 6.19823 20 3.59033 2.4622 46992 0.5940. 9.81815 2855 8.51356 7.96333 7.46944 6.25933 Compute the h payback period. (Round answer to 1 decimal place, e.g. 10.5.) Cash payb of relu he oposed lal expe e. (Round Lo 1 decinal place, 20.5.) rate of Annu Using the discounted cash flow hnique, compute e net presen ue. (If the net present value is negative, use either a negative sign preceding the number eg. -45 or parentheses e g. (45). Round answer for present value to 0 decimal places, e.g. 125. Net present value