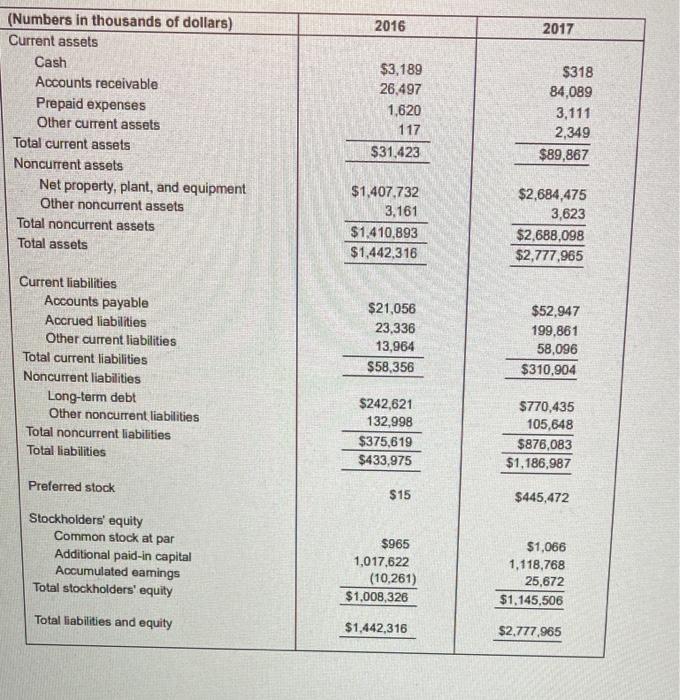

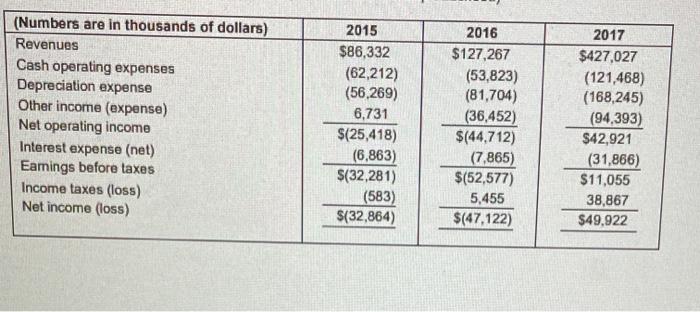

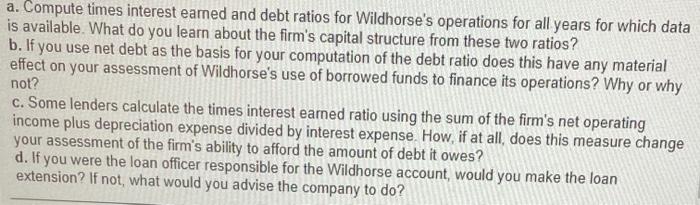

Vildhorse Resource Development of Houston, TX (WRD) is an independent oil and natural gas company focused on he acquisition, exploration, development and production of oil, natural gas, and NGL properties primarily in the Eagle Ford Shale and Austin Chalk in East Texas. In 2016, the company became a publicly traded firm by issuing 28,000,000 hares of its common stock at $14.00 per share. Although Wildhorse has traditionally limited its operations to two fields in Texas (Eagle Ford in south Texas and the Austin Chalk in central Texas) it is now engaged in a series of horizontal drilling investments in north central Louisiana The rapid rate of growth in scale of the firm's operations have led to dramatic increases in the firm's investments and appetite for investment capital as illustrated in the following balance sheets, and income statements, Wildhorse's management team has become increasingly concerned about the firm's ability to sustain the capital requirements of the firm's growing and profitable) drilling operations. So, they have decided to approach the firm's bank to try to increase the firm's borrowing capacity by $200 million. The CFO hopes that the bank will be sufficiently impressed by the firm's current level of profitability and growth prospects to grant them the increased credit . If the Wildhorse is not successful in getting the additional financing, they have considered two possible contingencies. First, they may have to sell off some of their producing properties that are now contributing to the firm's growing profits. Second, the management team has considered approaching a larger energy company with a proposal to merge or sell the firm. The idea would be that the larger firm could afford to fund Wildhorse's operations internally or by using an existing line of credit has wonder 2016 2017 (Numbers in thousands of dollars) Current assets Cash Accounts receivable Prepaid expenses Other current assets Total current assets Noncurrent assets Net property, plant, and equipment Other noncurrent assets Total noncurrent assets Total assets $3,189 26.497 1,620 117 $31,423 $318 84,089 3,111 2,349 $89,867 $1,407.732 3,161 $1.410,893 $1,442,316 $2,684,475 3,623 $2.688,098 $2,777,965 Current liabilities Accounts payable Accrued liabilities Other current liabilities Total current liabilities Noncurrent liabilities Long-term debt Other noncurrent liabilities Total noncurrent liabilities Total liabilities $21,056 23,336 13,964 $58,356 $52,947 199,861 58,096 $310.904 $242,621 132,998 $375,619 $433,975 $770,435 105,648 $876,083 $1,186,987 Preferred stock $15 $445,472 Stockholders' equity Common stock at par Additional paid-in capital Accumulated eamings Total stockholders' equity $965 1,017.622 (10,261) $1,008,326 $1,066 1.118,768 25,672 $1,145,506 Total liabilities and equity $1,442,316 $2.777.965 (Numbers are in thousands of dollars) Revenues Cash operating expenses Depreciation expense Other income (expense) Net operating income Interest expense (net) Eamings before taxes Income taxes (loss) Net income (loss) 2015 $86,332 (62,212) (56,269) 6,731 $(25,418) (6,863) $(32,281) (583) $(32,864) 2016 $127,267 (53,823) (81,704) (36,452) $(44,712) (7.865) $(52,577) 5,455 $(47,122) 2017 $427,027 (121,468) (168,245) (94,393) $42,921 (31,866) $11,055 38,867 $49,922 a. Compute times interest earned and debt ratios for Wildhorse's operations for all years for which data is available. What do you learn about the firm's capital structure from these two ratios? b. If you use net debt as the basis for your computation of the debt ratio does this have any material effect on your assessment of Wildhorse's use of borrowed funds to finance its operations? Why or why not? c. Some lenders calculate the times interest earned ratio using the sum of the firm's net operating income plus depreciation expense divided by interest expense. How, if at all, does this measure change your assessment of the firm's ability to afford the amount of debt it owes? d. If you were the loan officer responsible for the Wildhorse account, would you make the loan extension? If not, what would you advise the company to do