Answered step by step

Verified Expert Solution

Question

1 Approved Answer

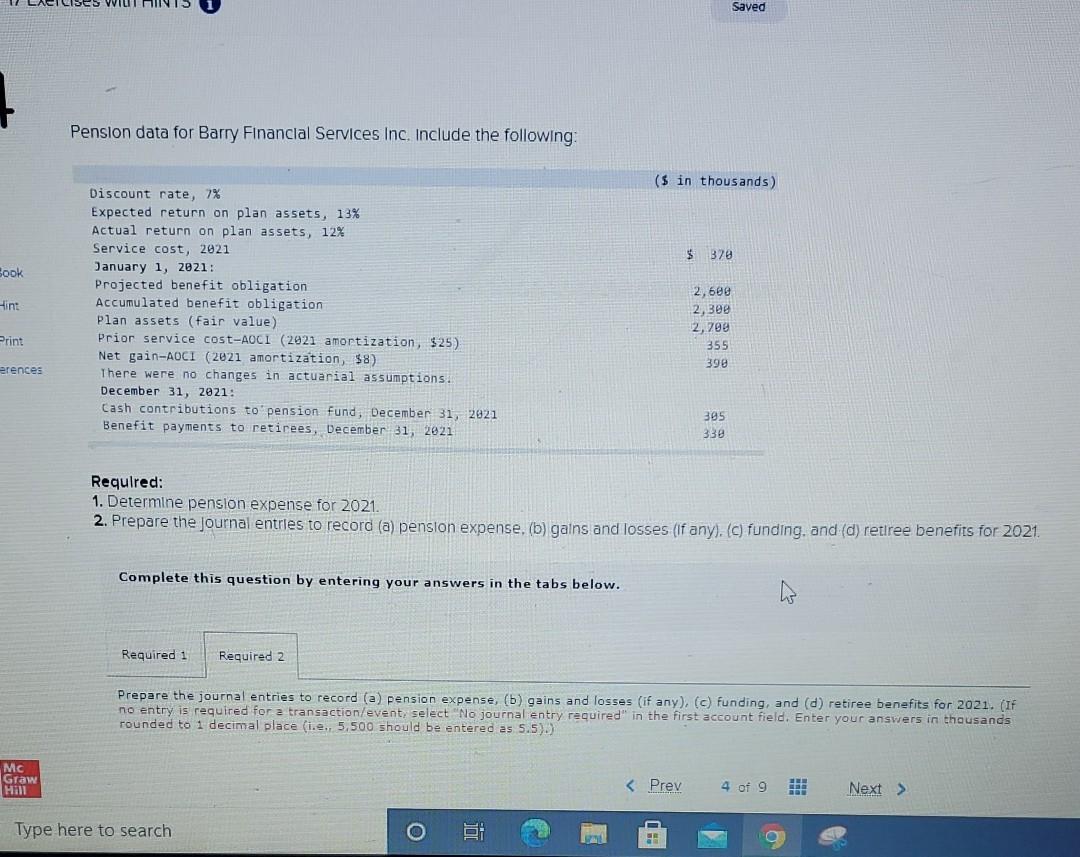

VILI NIINIS Saved Pension data for Barry Financial Services Inc. Include the following: ($ in thousands) $ 320 Sook Hint Discount rate, 7% Expected return

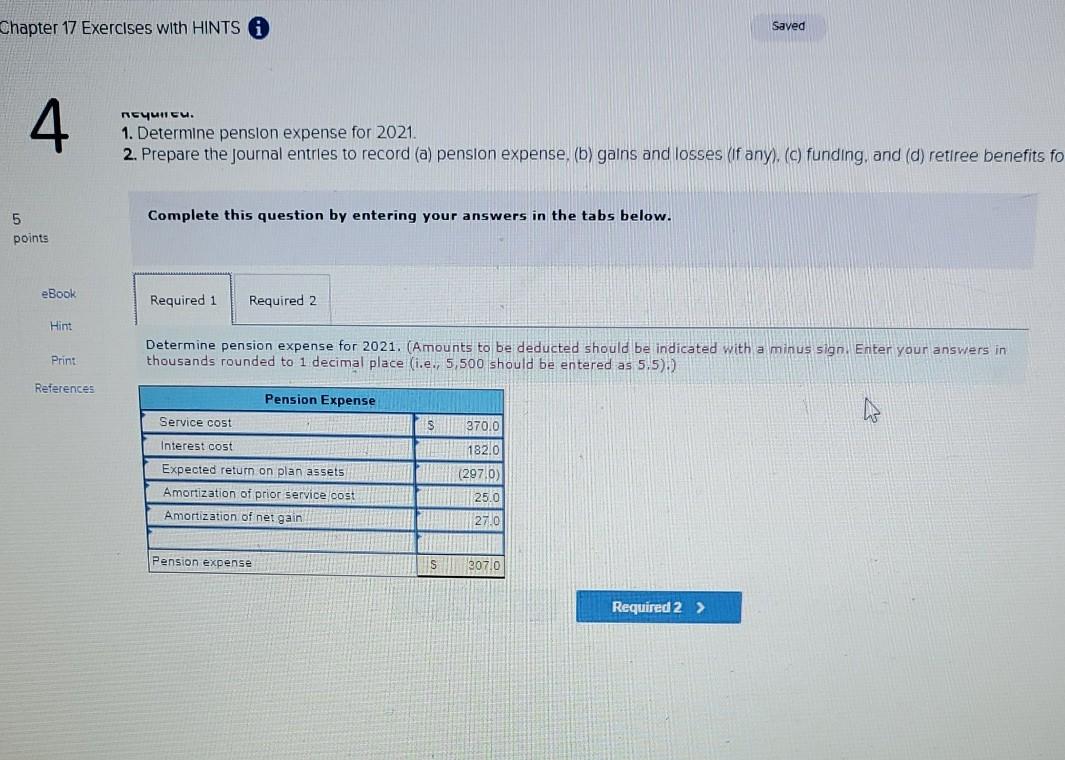

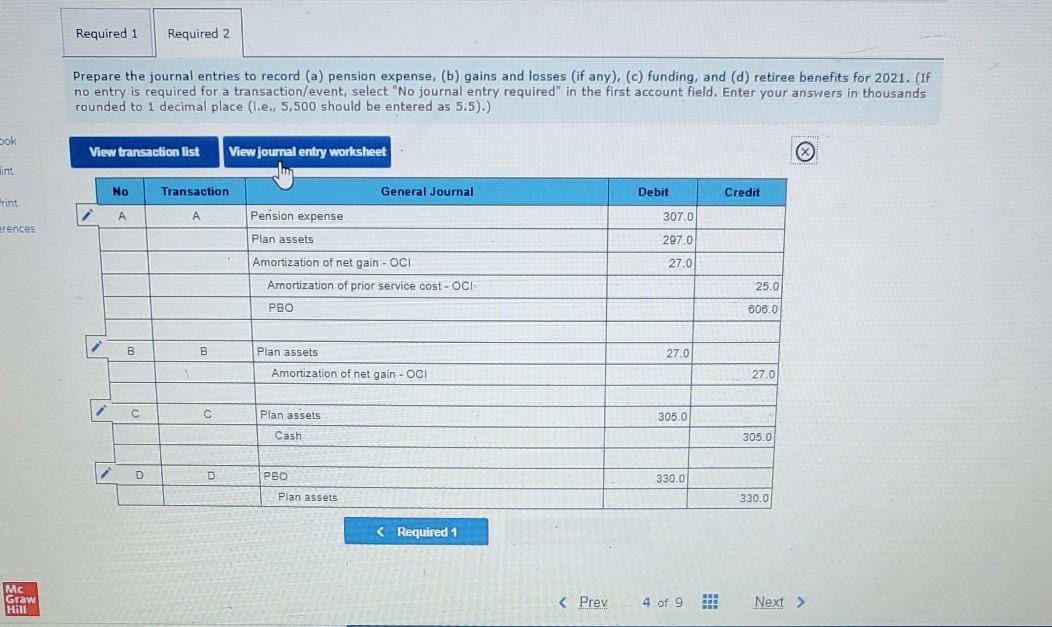

VILI NIINIS Saved Pension data for Barry Financial Services Inc. Include the following: ($ in thousands) $ 320 Sook Hint Discount rate, 7% Expected return on plan assets, 13% Actual return on plan assets, 12% Service cost, 2021 January 1, 2021: Projected benefit obligation Accumulated benefit obligation Plan assets (fair value) Prior service cost-AOCI (2021 amortization, $25) Net gain-AOCI (2021 amortization, $8) There were no changes in actuarial assumptions. December 31, 2021: Cash contributions to pension fund, December 31, 2021 Benefit payments to retirees, December 31, 2021 2,600 2,300 2,70 355 398 Print erences 385 330 Required: 1. Determine pension expense for 2021. 2. Prepare the journal entries to record (a) pension expense. (b) gains and losses (if any). (c) funding, and (d) retiree benefits for 2021 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entries to record (a) pension expense, (b) gains and losses (if any), (c) funding, and (d) retiree benefits for 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands rounded to 1 decimal place (i.e., 5,500 should be entered as 5.5)) MC Hill Gra Type here to search ji Chapter 17 Exercises with HINTS A Saved 4 . 1. Determine pension expense for 2021 2. Prepare the journal entries to record (a) pension expense, (b) galns and losses (if any). (c) funding, and (d) retiree benefits fo Complete this question by entering your answers in the tabs below. 5 points eBook Required 1 Required 2 Hint Determine pension expense for 2021. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands rounded to 1 decimal place (i.e., 5,500 should be entered as 5.5).) Print References Pension Expense Service cost S 370.0 Interest cost Expected return on plan assets 182.0 (297.0) 25.0 Amortization of prior service cost Amortization of net gain 27.0 Pension expense IS 30710 Required 2 > Required 1 Required 2 Prepare the journal entries to record (a) pension expense, (b) gains and losses (if any), (c) funding, and (d) retiree benefits for 2021. (IF no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in thousands rounded to 1 decimal place (ie, 5,500 should be entered as 5.5).) bok View transaction list View journal entry worksheet No General Journal Debit Credit rint Transaction A A Pension expense 307.0 rences Plan assets 297.0 27.0 Amortization of net gain - OCI Amortization of prior service cost - OCI PBO 25.0 806.0 B B Plan assets 27.0 Amortization of net gain - OCI 270 Plan assets 305.0 Cash 305.0 D D PBO 330.0 Plan assets 330.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started