Answered step by step

Verified Expert Solution

Question

1 Approved Answer

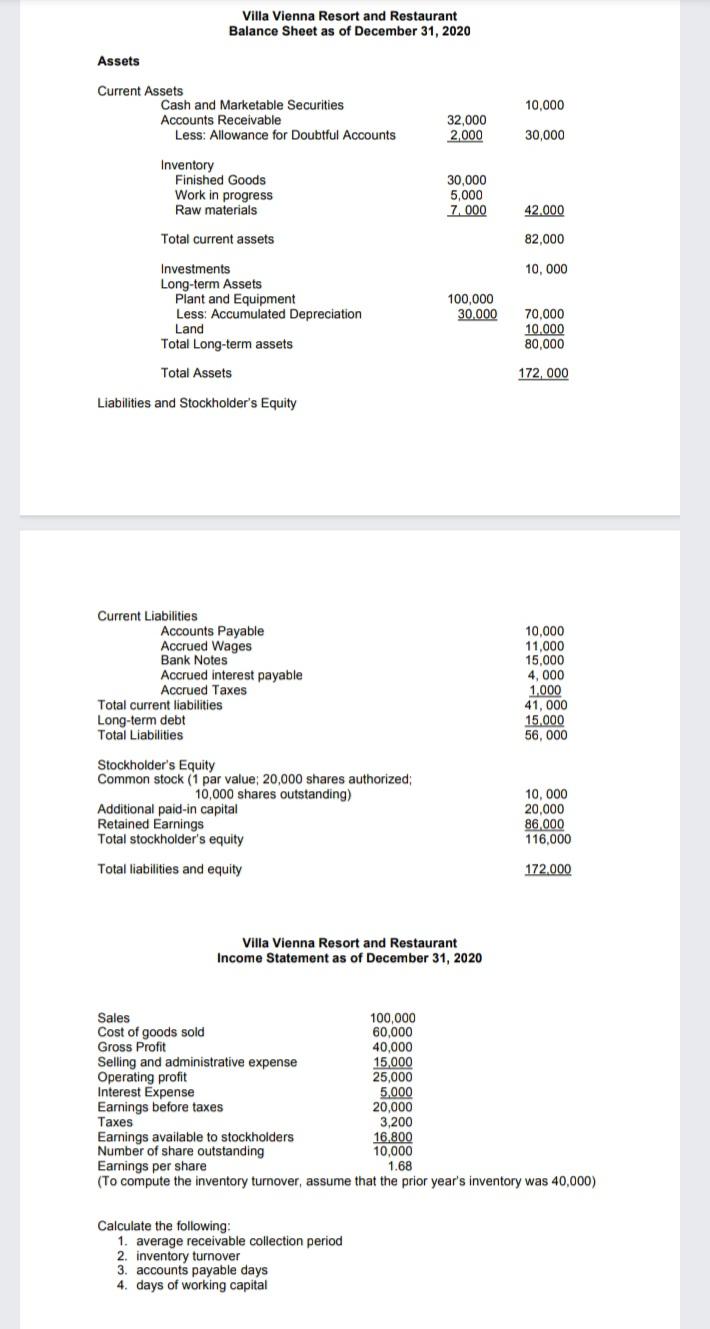

Villa Vienna Resort and Restaurant Balance Sheet as of December 31, 2020 Assets Current Assets Cash and Marketable Securities 10,000 32,000 2,000 Accounts Receivable

Villa Vienna Resort and Restaurant Balance Sheet as of December 31, 2020 Assets Current Assets Cash and Marketable Securities 10,000 32,000 2,000 Accounts Receivable Less: Allowance for Doubtful Accounts 30,000 Inventory Finished Goods Work in progress Raw materials 30,000 5,000 7. 000 42.000 Total current assets 82,000 Investments 10, 000 Long-term Assets Plant and Equipment Less: Accumulated Depreciation 100,000 30.000 70.000 10.000 80,000 Land Total Long-term assets Total Assets 172, 000 Liabilities and Stockholder's Equity Current Liabilities Accounts Payable Accrued Wages Bank Notes Accrued interest payable Accrued Taxes 10,000 11,000 15,000 4, 000 1,000 41, 000 15.000 56, 000 Total current liabilities Long-term debt Total Liabilities Stockholder's Equity Common stock (1 par value; 20,000 shares authorized; 10,000 shares outstanding) Additional paid-in capital Retained Earnings Total stockholder's equity 10, 000 20,000 86.000 116,000 Total liabilities and equity 172.000 Villa Vienna Resort and Restaurant Income Statement as of December 31, 2020 Sales Cost of goods sold Gross Profit Selling and administrative expense Operating profit Interest Expense Earnings before taxes es Earnings available to stockholders Number of share outstanding Earnings per share (To compute the inventory turnover, assume that the prior year's inventory was 40,000) 100,000 60,000 40,000 15,000 25,000 5,000 20,000 3,200 16.800 10,000 1.68 Calculate the following: 1. average receivable collection period 2. inventory turnover 3. accounts payable days 4. days of working capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution 1 Average Receivable Collection Period Average Receivable Collection Period indicates the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started