Question

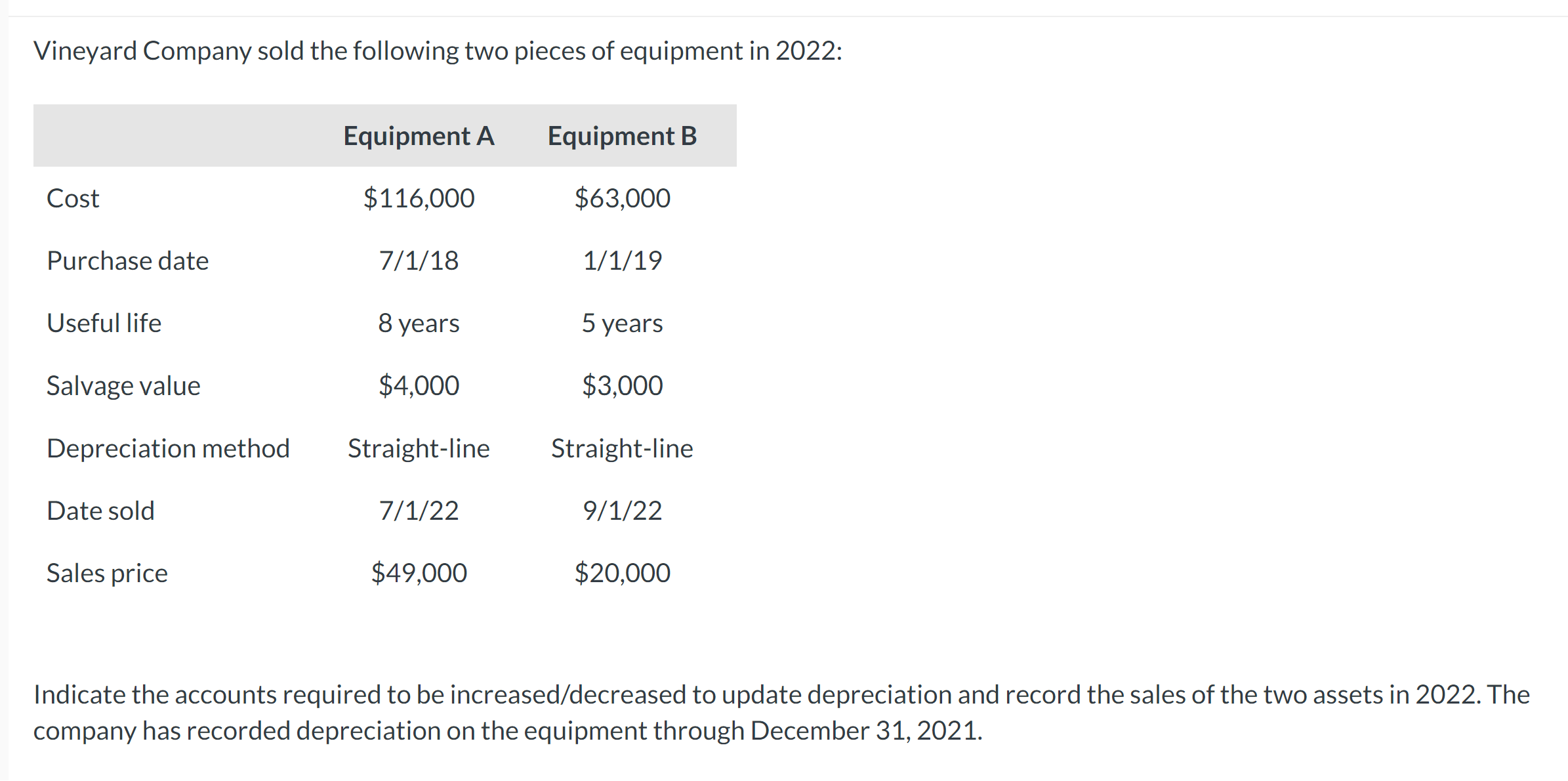

Vineyard Company sold the following two pieces of equipment in 2022: Equipment A Equipment B Cost $116,000 $63,000 Purchase date 7/1/18 1/1/19 Useful life

Vineyard Company sold the following two pieces of equipment in 2022: Equipment A Equipment B Cost $116,000 $63,000 Purchase date 7/1/18 1/1/19 Useful life 8 years 5 years Salvage value $4,000 $3,000 Depreciation method Straight-line Straight-line Date sold 7/1/22 9/1/22 Sales price $49,000 $20,000 Indicate the accounts required to be increased/decreased to update depreciation and record the sales of the two assets in 2022. The company has recorded depreciation on the equipment through December 31, 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the complete journal entries to update depreciation and record the sales of the t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Pearsons Federal Taxation 2023 Comprehensive

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

36th Edition

9780137840656

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App