Vinita Ramaswamy recently acquired Wild Country Air. Wild Country has been in business for many years, and provides charter flights for remote fishing and camping enthusiasts.

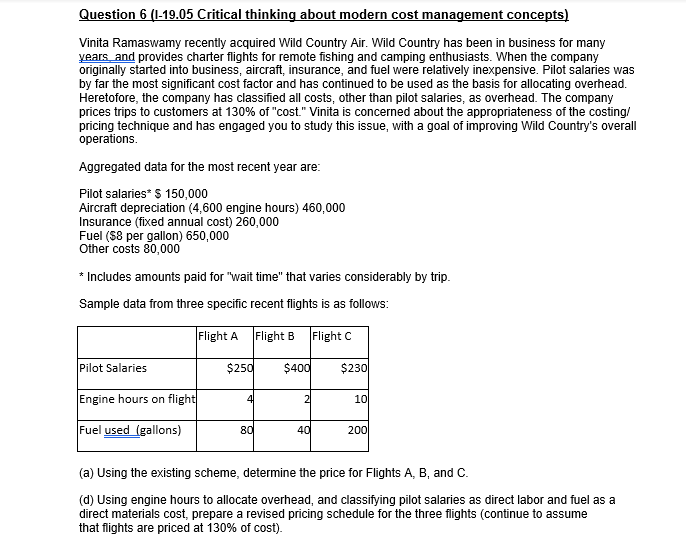

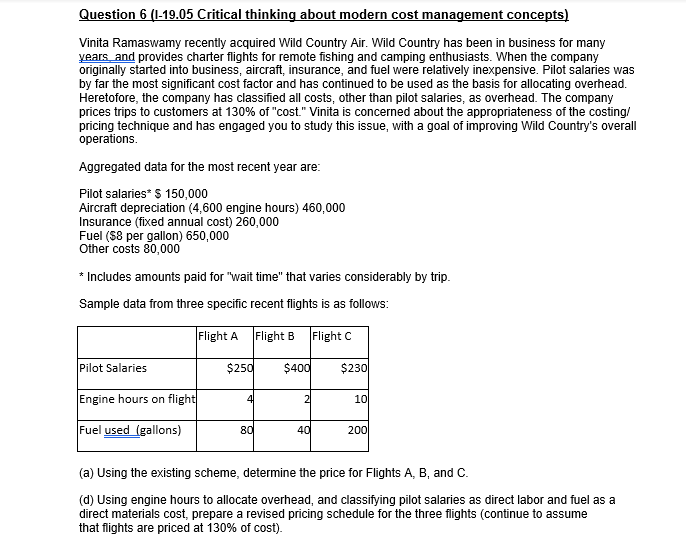

Question 6 (1-19.05 Critical thinking about modern cost management concepts) Vinita Ramaswamy recently acquired Wild Country Air. Wild Country has been in business for many years and provides charter flights for remote fishing and camping enthusiasts. When the company originally started into business, aircraft, insurance, and fuel were relatively inexpensive. Pilot salaries was by far the most significant cost factor and has continued to be used as the basis for allocating overhead. Heretofore, the company has classified all costs, other than pilot salaries, as overhead. The company prices trips to customers at 130% of "cost." Vinita is concerned about the appropriateness of the costing/ pricing technique and has engaged you to study this issue, with a goal of improving Wild Country's overall operations Aggregated data for the most recent year are: Pilot salaries* S 150,000 Aircraft depreciation (4,600 engine hours) 460,000 Insurance (fixed annual cost) 260,000 Fuel ($8 per gallon) 650,000 Other costs 80,000 Includes amounts paid for "wait time" that varies considerably by trip Sample data from three specific recent flights is as follows: Flight B Flight C Flight A Pilot Salaries $250 $230 $400 Engine hours on flight 2 10 4 Fuel used (gallons) 200 80 40 (a) Using the existing scheme, determine the price for Flights A, B, and C. (d) Using engine hours to allocate overhead, and classifying pilot salaries as direct labor and fuel as a direct materials cost, prepare a revised pricing schedule for the three flights (continue to assume that flights are priced at 130% of cost) Question 6 (1-19.05 Critical thinking about modern cost management concepts) Vinita Ramaswamy recently acquired Wild Country Air. Wild Country has been in business for many years and provides charter flights for remote fishing and camping enthusiasts. When the company originally started into business, aircraft, insurance, and fuel were relatively inexpensive. Pilot salaries was by far the most significant cost factor and has continued to be used as the basis for allocating overhead. Heretofore, the company has classified all costs, other than pilot salaries, as overhead. The company prices trips to customers at 130% of "cost." Vinita is concerned about the appropriateness of the costing/ pricing technique and has engaged you to study this issue, with a goal of improving Wild Country's overall operations Aggregated data for the most recent year are: Pilot salaries* S 150,000 Aircraft depreciation (4,600 engine hours) 460,000 Insurance (fixed annual cost) 260,000 Fuel ($8 per gallon) 650,000 Other costs 80,000 Includes amounts paid for "wait time" that varies considerably by trip Sample data from three specific recent flights is as follows: Flight B Flight C Flight A Pilot Salaries $250 $230 $400 Engine hours on flight 2 10 4 Fuel used (gallons) 200 80 40 (a) Using the existing scheme, determine the price for Flights A, B, and C. (d) Using engine hours to allocate overhead, and classifying pilot salaries as direct labor and fuel as a direct materials cost, prepare a revised pricing schedule for the three flights (continue to assume that flights are priced at 130% of cost)