Violet Silva is 57 years old, was born in Canada and has always been a resident of Canada. Having become fed up with Halifax

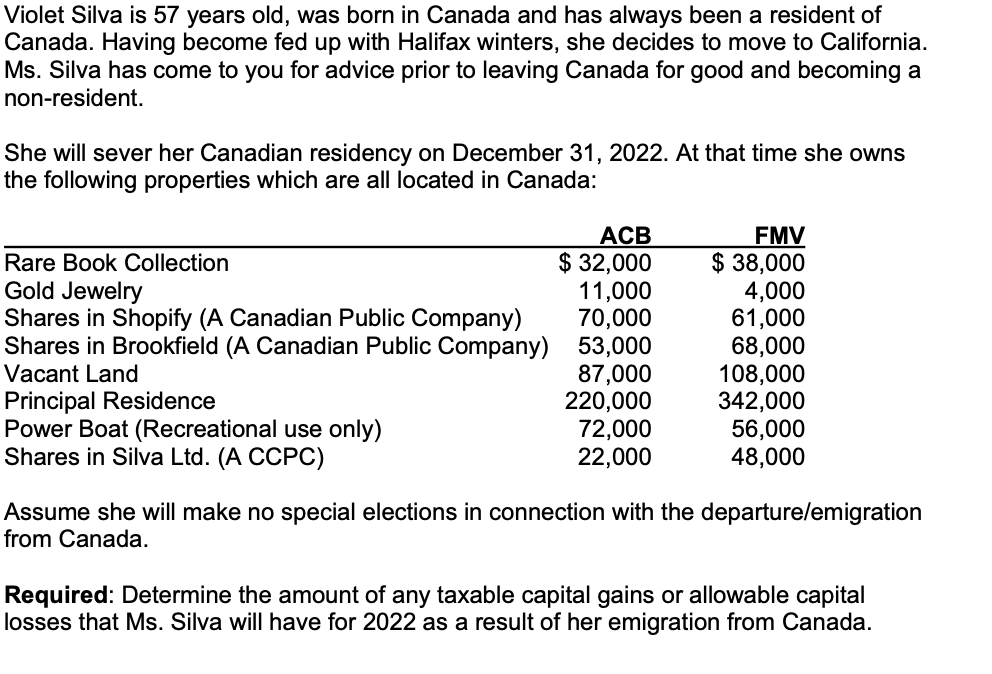

Violet Silva is 57 years old, was born in Canada and has always been a resident of Canada. Having become fed up with Halifax winters, she decides to move to California. Ms. Silva has come to you for advice prior to leaving Canada for good and becoming a non-resident. She will sever her Canadian residency on December 31, 2022. At that time she owns the following properties which are all located in Canada: Rare Book Collection Gold Jewelry Shares in Shopify (A Canadian Public Company) Shares in Brookfield (A Canadian Public Company) Vacant Land Principal Residence Power Boat (Recreational use only) Shares in Silva Ltd. (A CCPC) ACB $ 32,000 11,000 70,000 53,000 87,000 220,000 72,000 22,000 FMV $ 38,000 4,000 61,000 68,000 108,000 342,000 56,000 48,000 Assume she will make no special elections in connection with the departure/emigration from Canada. Required: Determine the amount of any taxable capital gains or allowable capital losses that Ms. Silva will have for 2022 as a result of her emigration from Canada.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine the taxable capital gains or allowable capital losses that Ms Violet Silva will have fo...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started