Answered step by step

Verified Expert Solution

Question

1 Approved Answer

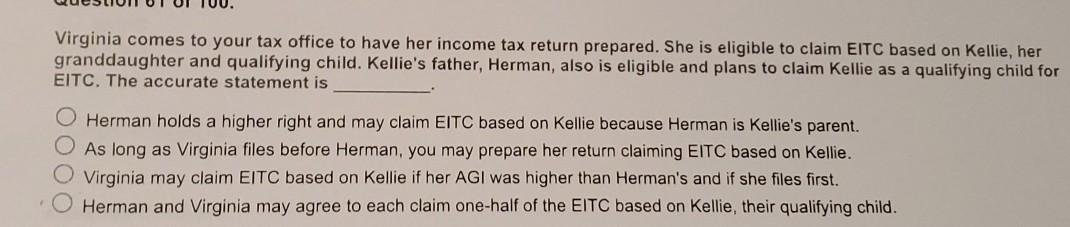

Virginia comes to your tax office to have her income tax return prepared. She is eligible to claim EITC based on Kellie, her granddaughter and

Virginia comes to your tax office to have her income tax return prepared. She is eligible to claim EITC based on Kellie, her granddaughter and qualifying child. Kellie's father, Herman, also is eligible and plans to claim Kellie as a qualifying child for EITC. The accurate statement is O Herman holds a higher right and may claim EITC based on Kellie because Herman is Kellie's parent. As long as Virginia files before Herman, you may prepare her return claiming EITC based on Kellie. O Virginia may claim EITC based on Kellie if her AGI was higher than Herman's and if she files first. Herman and Virginia may agree to each claim one-half of the EITC based on Kellie, their qualifying child

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started