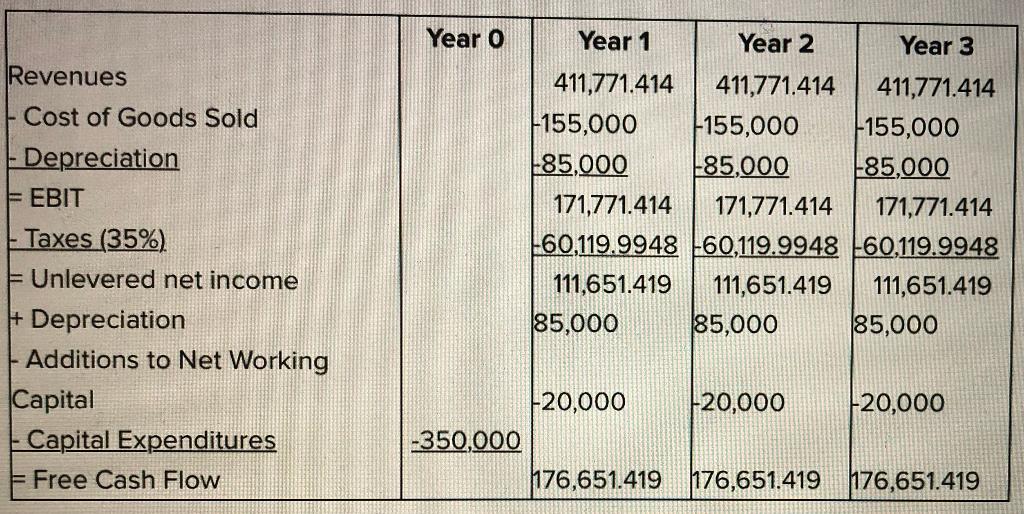

Visby Rides, a limousine hire company, is considering buying some new luxury cars. After extensive research, they come up with the below estimates of free

Revenues - Cost of Goods Sold - Depreciation = EBIT -Taxes (35%) = Unlevered net income + Depreciation - Additions to Net Working Capital - Capital Expenditures F= Free Cash Flow Year O -350,000 Year 1 411,771.414 Year 2 411,771.414 -155,000 -155,000 85,000 -85,000 -20,000 171,771.414 171,771.414 171,771.414 -60,119.9948 -60,119.9948 60,119.9948 111,651.419 111,651.419 111,651.419 85,000 85,000 85,000 -20,000 Year 3 411,771.414 176,651.419 176,651.419 -155,000 85,000 -20,000 176,651.419

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the opportunity cost of capital at which the net present value NPV of the proj...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started