Answered step by step

Verified Expert Solution

Question

1 Approved Answer

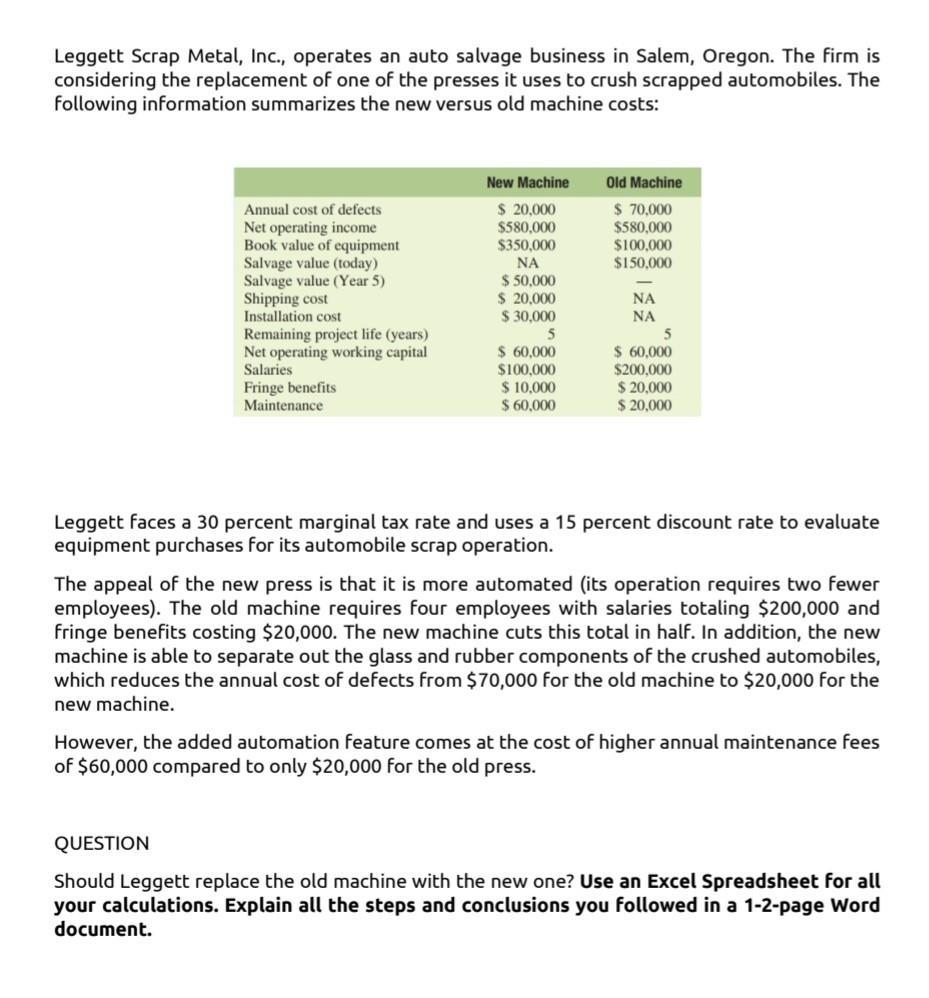

Leggett Scrap Metal, Inc., operates an auto salvage business in Salem, Oregon. The firm is considering the replacement of one of the presses it

Leggett Scrap Metal, Inc., operates an auto salvage business in Salem, Oregon. The firm is considering the replacement of one of the presses it uses to crush scrapped automobiles. The following information summarizes the new versus old machine costs: Annual cost of defects Net operating income Book value of equipment Salvage value (today) Salvage value (Year 5) Shipping cost Installation cost Remaining project life (years) Net operating working capital Salaries Fringe benefits Maintenance New Machine $ 20,000 $580,000 $350,000 NA $ 50,000 $ 20,000 $ 30,000 5 $ 60,000 $100,000 $ 10,000 $ 60,000 Old Machine $ 70,000 $580,000 $100,000 $150,000 5 $ 60,000 $200,000 $ 20,000 $ 20,000 Leggett faces a 30 percent marginal tax rate and uses a 15 percent discount rate to evaluate equipment purchases for its automobile scrap operation. The appeal of the new press is that it is more automated (its operation requires two fewer employees). The old machine requires four employees with salaries totaling $200,000 and fringe benefits costing $20,000. The new machine cuts this total in half. In addition, the new machine is able to separate out the glass and rubber components of the crushed automobiles, which reduces the annual cost of defects from $70,000 for the old machine to $20,000 for the new machine. However, the added automation feature comes at the cost of higher annual maintenance fees of $60,000 compared to only $20,000 for the old press. QUESTION Should Leggett replace the old machine with the new one? Use an Excel Spreadsheet for all your calculations. Explain all the steps and conclusions you followed in a 1-2-page Word document.

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solution Add Add Less Less Less Add Add Add 11183735 Statement Showing NPV of Replaceme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e1afd76dad_181498.pdf

180 KBs PDF File

635e1afd76dad_181498.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started