Question

Vitol Energy is considering a project in the Volta Basin that is expected to generate US$15 million at the end of each year for

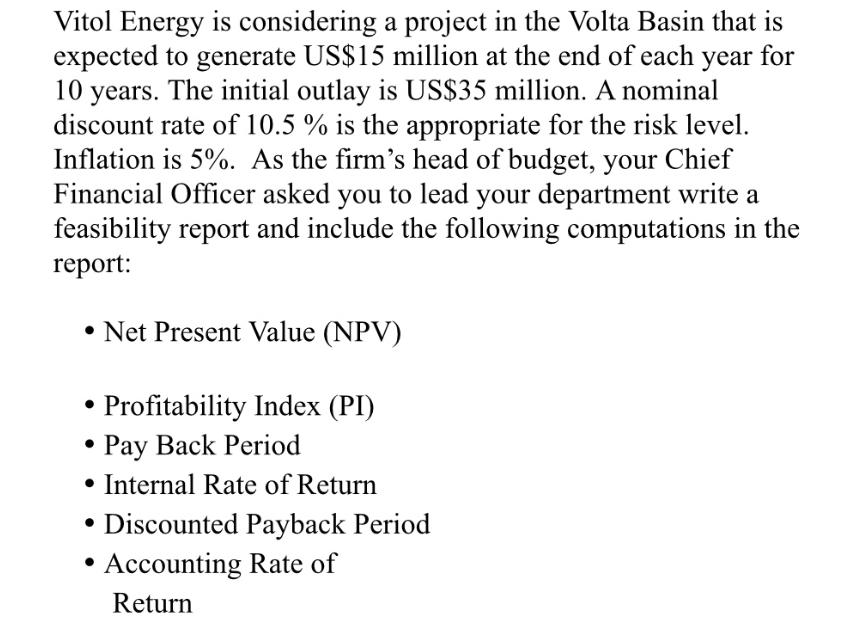

Vitol Energy is considering a project in the Volta Basin that is expected to generate US$15 million at the end of each year for 10 years. The initial outlay is US$35 million. A nominal discount rate of 10.5 % is the appropriate for the risk level. Inflation is 5%. As the firm's head of budget, your Chief Financial Officer asked you to lead your department write a feasibility report and include the following computations in the report: Net Present Value (NPV) Profitability Index (PI) Pay Back Period Internal Rate of Return Discounted Payback Period Accounting Rate of Return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To begin the feasibility report for the project in the Volta Basin we will calculate the various fin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Mathematical Applications for the Management Life and Social Sciences

Authors: Ronald J. Harshbarger, James J. Reynolds

11th edition

9781337032247, 9781305465183, 1305108043, 1337032247, 1305465180, 978-1305108042

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App