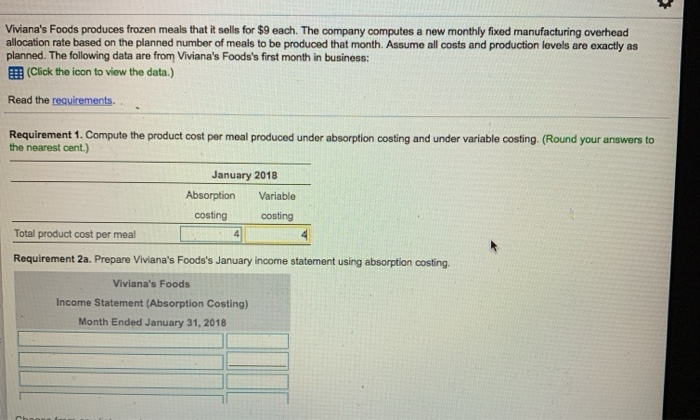

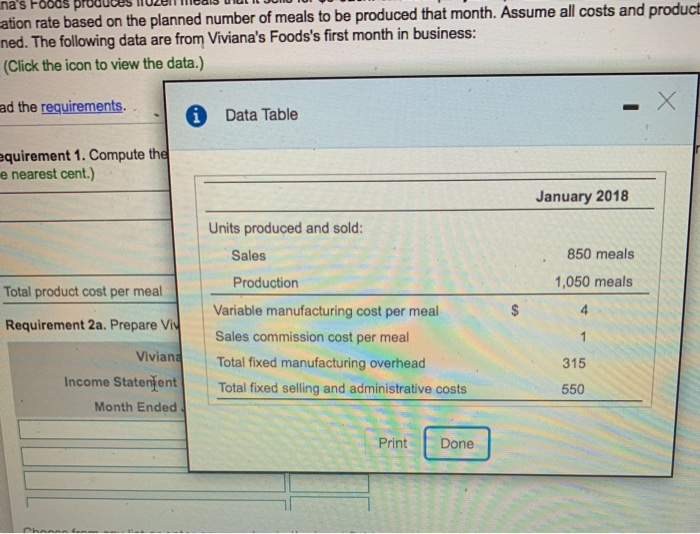

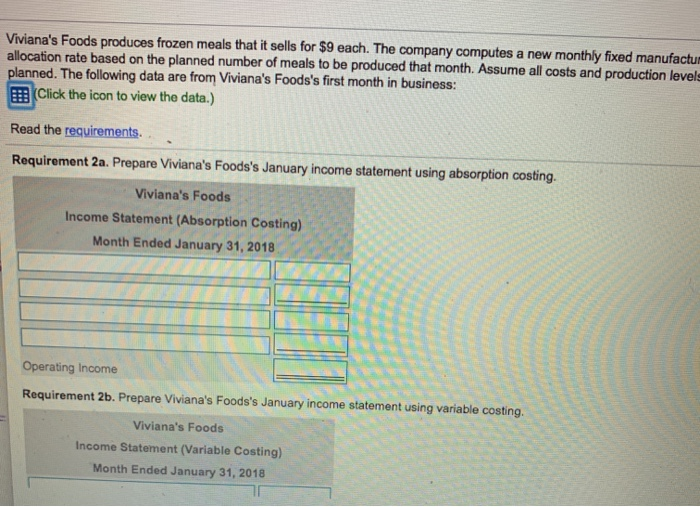

Viviana's Foods produces frozen meals that it sells for $9 each. The company computes a new monthly fixed manufacturing overhead allocation rate based on the planned number of meals to be produced that month. Assume all costs and production levels are exactly as planned. The following data are from Viviana's Foods's first month in business: (Click the icon to view the data.) Read the requirements. Requirement 1. Compute the product cost per meal produced under absorption costing and under variable costing. (Round your answers to the nearest cent.) January 2018 Absorption Variable costing costing Total product cost per meal 4 Requirement 2a. Prepare Viviana's Foods's January income statement using absorption costing. Viviana's Foods Income Statement (Absorption Costing) Month Ended January 31, 2018 na's Foods ation rate based on the planned number of meals to be produced that month. Assume all costs and product ned. The following data are from Viviana's Foods's first month in business: (Click the icon to view the data.) ad the requirements. i Data Table equirement 1. Compute the e nearest cent.) January 2018 Units produced and sold: 850 meals Sales Production 1,050 meals Total product cost per meal Variable manufacturing cost per meal 4 Requirement 2a. Prepare Vi Sales commission cost per meal 1 Viviana Total fixed manufacturing overhead 315 Income Statenjent Total fixed selling and administrative costs 550 Month Ended Print Done Viviana's Foods produces frozen meals that it sells for $9 each. The company computes a new monthly fixed manufactum allocation rate based on the planned number of meals to be produced that month. Assume all costs and production levels planned. The following data are from Viviana's Foods's first month in business: (Click the icon to view the data.) Read the requirements Requirement 2a. Prepare Viviana's Foods's January income statement using absorption costing. Viviana's Foods Income Statement (Absorption Costing) Month Ended January 31, 2018 Operating Income Requirement 2b. Prepare Viviana's Foods's January income statement using variable costing. Viviana's Foods Income Statement (Variable Costing) Month Ended January 31, 2018 Viviana's Foods produces frozen meals that it sells for $9 each. The company computes a new monthly fixed mana allocation rate based on the planned number of meals to be produced that month. Assume all costs and production planned. The following data are from Viviana's Foods's first month in business: (Click the icon to view the data.) Read the requirements. Requirement 2a. Prepare Viviana's Foods's January income statement using absorption costing. Viviana's Foods Income Statement (Absorption Costing) Month Ended January 31, 2018 Contribution Margin Cost of Goods Sold Fixed Costs Gross Profit Net Sales Revenue anuary income statement using variable costing. Selling and Administrative Costs Variable Costs Income Statement (Variable Costing) Month Ended January 31, 2018 Viviana's Foods produces frozen meals that it sells for $9 each. The company computes a new monthly fixed manufacturing overhe allocation rate based on the planned number of meals to be produced that month. Assume all costs and production levels are exac planned. The following data are from Viviana's Foods's first month in business: (Click the icon to view the data.) Read the requirements. Operating Income Requirement 2b. Prepare Viviana's Foods's January income statement using variable costing. Viviana's Foods Income Statement (Variable Costing) 5 Month Ended January 31, 2018 Contribution Margin Cost of Goods Sold Fixed Costs Gross Profit Net Sales Revenue under absorption costing or variable costing in January? Selling and Administrative Costs Variable Costs variable costing operating income. ome Viviana's Foods produces frozen meals that it sells for $9 each. The company computes allocation rate based on the planned number of meals to be produced that month. Assume all costs and production planned. The following data are from Viviana's Foods's first month in business (Click the icon to view the data.) ew monthly fixed manut a ne Read the requirements Operating Income Requirement 2b. Prepare Viviana's Foods's January income statement using variable costing. Viviana's Foods Income Statement (Variable Costing) Month Ended January 31, 2018 equals Operating Income exceeds Requirement 3. 1s operating income higher unde is less than or variable costing in January? In January, absorption costing operating income variable costing operating income