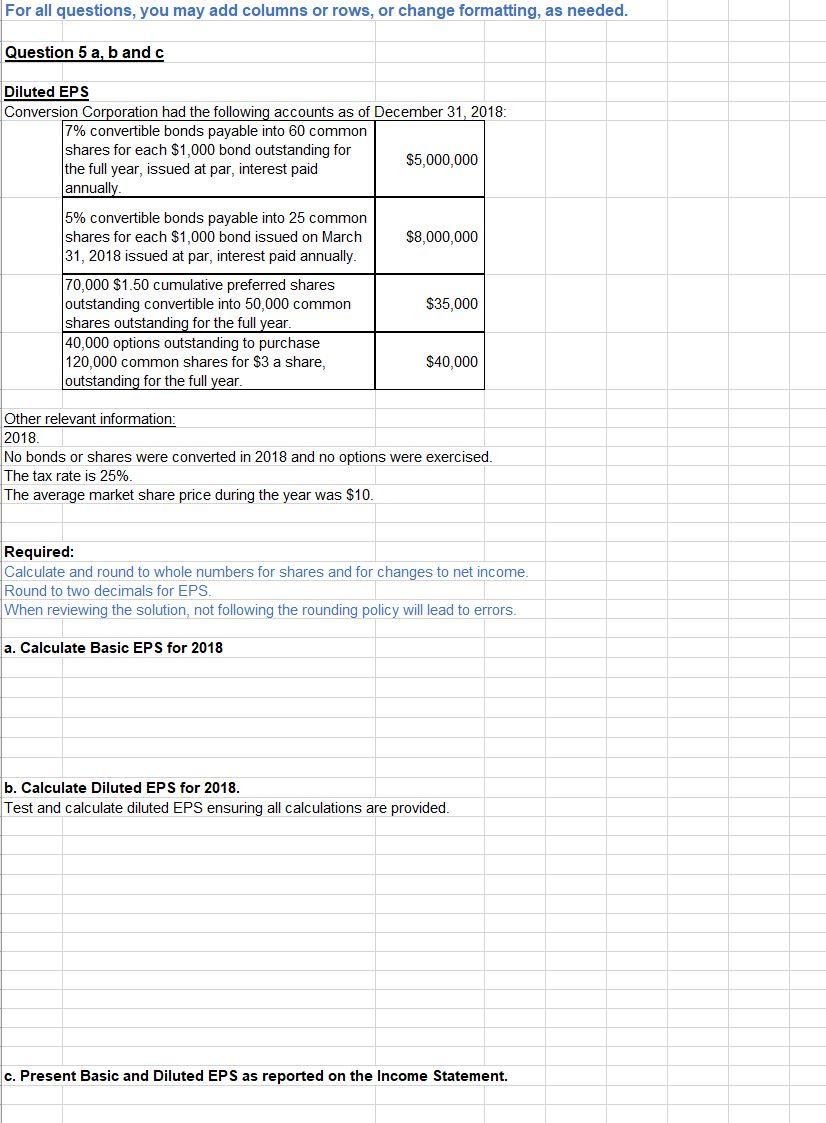

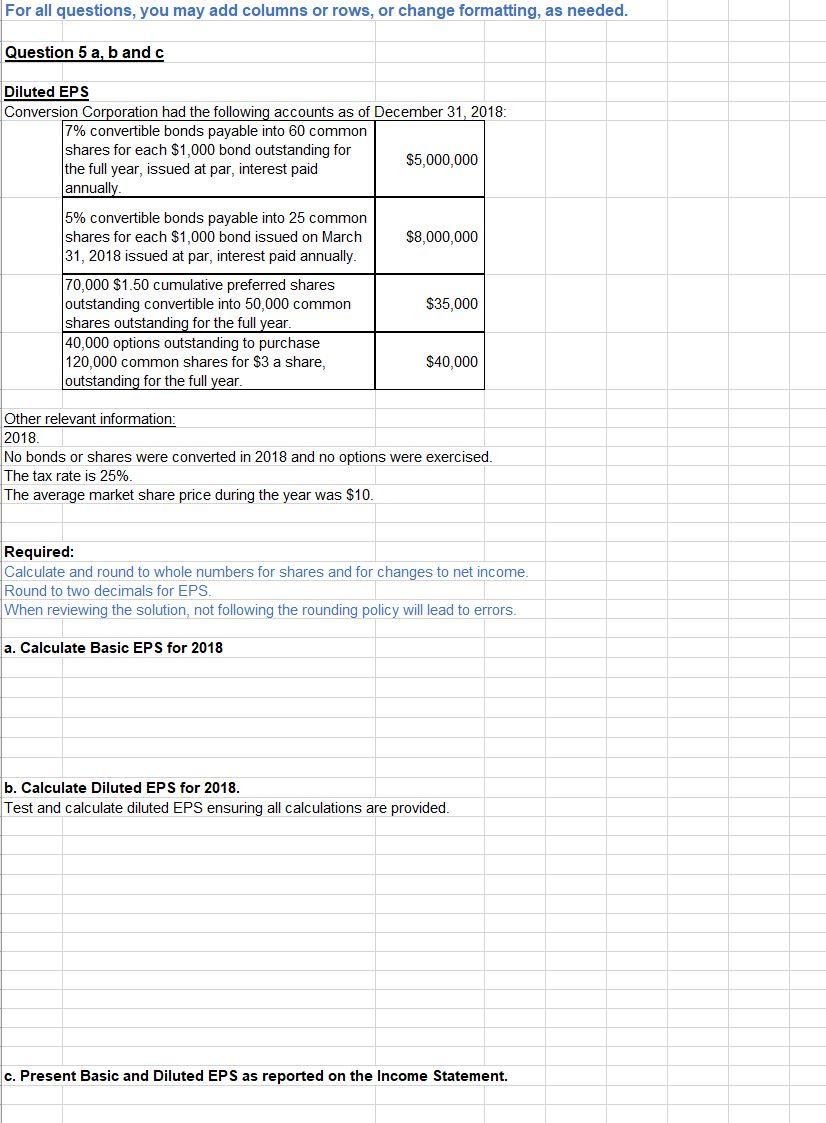

vNet earnings for the year were $1,317,500. Common shares outstanding are 500,000 with no changes to common share ownership in 2018.

vNet earnings for the year were $1,317,500. Common shares outstanding are 500,000 with no changes to common share ownership in 2018.

For all questions, you may add columns or rows, or change formatting, as needed. Question 5 a, b and c Diluted EPS Conversion Corporation had the following accounts as of December 31, 2018: 7% convertible bonds payable into 60 common shares for each $1,000 bond outstanding for $5,000,000 the full year, issued at par, interest paid annually. $8,000,000 5% convertible bonds payable into 25 common shares for each $1,000 bond issued on March 31, 2018 issued at par, interest paid annually. 70,000 $1.50 cumulative preferred shares Outstanding convertible into 50,000 common shares outstanding for the full year. 40,000 options outstanding to purchase 120,000 common shares for $3 a share, outstanding for the full year. $35,000 $40,000 Other relevant information: 2018 No bonds or shares were converted in 2018 and no options were exercised The tax rate is 25%. The average market share price during the year was $10. Required: Calculate and round to whole numbers for shares and for changes to net income. Round to two decimals for EPS. When reviewing the solution, not following the rounding policy will lead to errors. a. Calculate Basic EPS for 2018 b. Calculate Diluted EPS for 2018. Test and calculate diluted EPS ensuring all calculations are provided. c. Present Basic and Diluted EPS as reported on the Income Statement. For all questions, you may add columns or rows, or change formatting, as needed. Question 5 a, b and c Diluted EPS Conversion Corporation had the following accounts as of December 31, 2018: 7% convertible bonds payable into 60 common shares for each $1,000 bond outstanding for $5,000,000 the full year, issued at par, interest paid annually. $8,000,000 5% convertible bonds payable into 25 common shares for each $1,000 bond issued on March 31, 2018 issued at par, interest paid annually. 70,000 $1.50 cumulative preferred shares Outstanding convertible into 50,000 common shares outstanding for the full year. 40,000 options outstanding to purchase 120,000 common shares for $3 a share, outstanding for the full year. $35,000 $40,000 Other relevant information: 2018 No bonds or shares were converted in 2018 and no options were exercised The tax rate is 25%. The average market share price during the year was $10. Required: Calculate and round to whole numbers for shares and for changes to net income. Round to two decimals for EPS. When reviewing the solution, not following the rounding policy will lead to errors. a. Calculate Basic EPS for 2018 b. Calculate Diluted EPS for 2018. Test and calculate diluted EPS ensuring all calculations are provided. c. Present Basic and Diluted EPS as reported on the Income Statement

vNet earnings for the year were $1,317,500. Common shares outstanding are 500,000 with no changes to common share ownership in 2018.

vNet earnings for the year were $1,317,500. Common shares outstanding are 500,000 with no changes to common share ownership in 2018.