Answered step by step

Verified Expert Solution

Question

1 Approved Answer

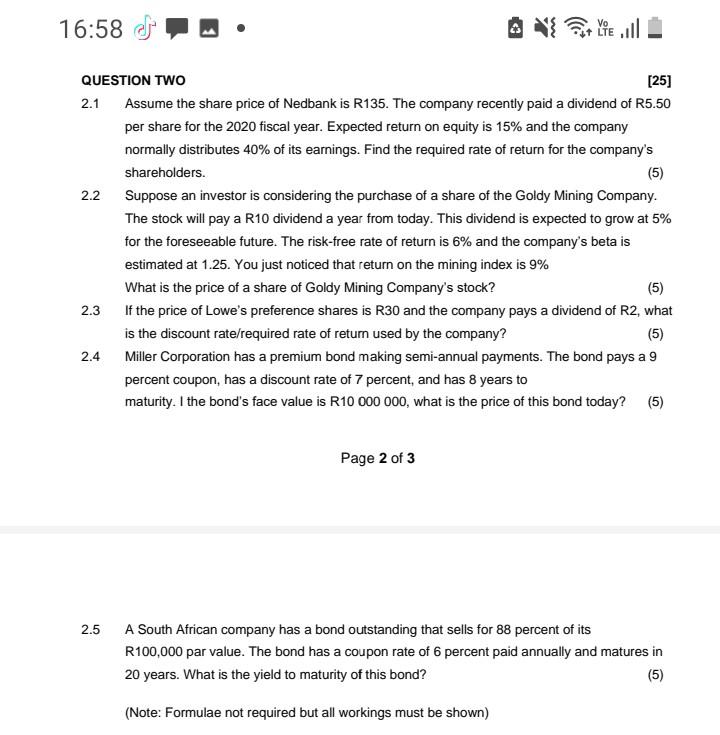

Vo QUESTION TWO [25] 2.1 Assume the share price of Nedbank is R135. The company recently paid a dividend of R5.50 per share for the

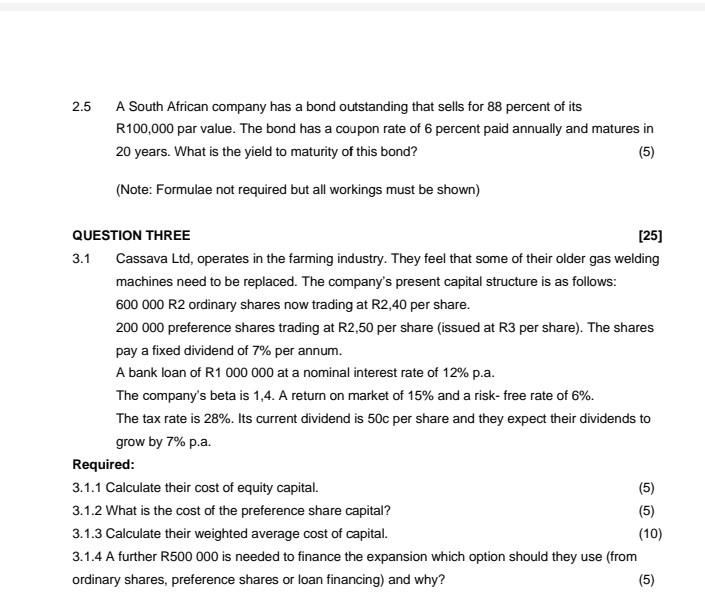

Vo QUESTION TWO [25] 2.1 Assume the share price of Nedbank is R135. The company recently paid a dividend of R5.50 per share for the 2020 fiscal year. Expected return on equity is 15% and the company normally distributes 40% of its earnings. Find the required rate of return for the company's shareholders. (5) 2.2 Suppose an investor is considering the purchase of a share of the Goldy Mining Company. The stock will pay a R10 dividend a year from today. This dividend is expected to grow at 5% for the foreseeable future. The risk-free rate of return is 6% and the company's beta is estimated at 1.25. You just noticed that return on the mining index is 9% What is the price of a share of Goldy Mining Company's stock? (5) 2.3 If the price of Lowe's preference shares is R30 and the company pays a dividend of R2, what is the discount rate/required rate of return used by the company? (5) 2.4 Miller Corporation has a premium bond making semi-annual payments. The bond pays a 9 percent coupon, has a discount rate of 7 percent, and has 8 years to maturity. I the bond's face value is R10 000 000, what is the price of this bond today? (5) Page 2 of 3 2.5 A South African company has a bond outstanding that sells for 88 percent of its R100,000 par value. The bond has a coupon rate of 6 percent paid annually and matures in 20 years. What is the yield to maturity of this bond? (5) (Note: Formulae not required but all workings must be shown) 16:58 2.5 A South African company has a bond outstanding that sells for 88 percent of its R100,000 par value. The bond has a coupon rate of 6 percent paid annually and matures in 20 years. What is the yield to maturity of this bond? (5) (Note: Formulae not required but all workings must be shown) QUESTION THREE [25] 3.1 Cassava Ltd, operates in the farming industry. They feel that some of their older gas welding machines need to be replaced. The company's present capital structure is as follows: 600 000 R2 ordinary shares now trading at R2,40 per share. 200 000 preference shares trading at R2,50 per share (issued at R3 per share). The shares pay a fixed dividend of 7% per annum. A bank loan of R1 000 000 at a nominal interest rate of 12% p.a. The company's beta is 1,4. A return on market of 15% and a risk-free rate of 6%. The tax rate is 28%. Its current dividend is 50c per share and they expect their dividends to grow by 7% p.a. Required: 3.1.1 Calculate their cost of equity capital. (5) 3.1.2 What is the cost of the preference share capital? (5) 3.1.3 Calculate their weighted average cost of capital. (10) 3.1.4 A further R500 000 is needed to finance the expansion which option should they use (from ordinary shares, preference shares or loan financing) and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started