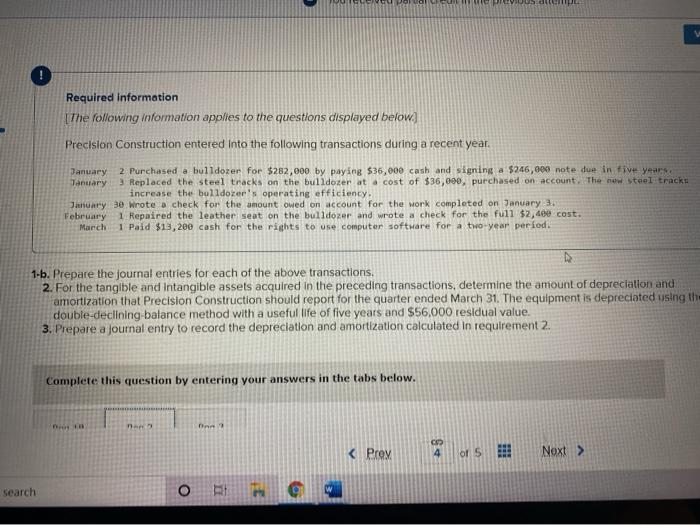

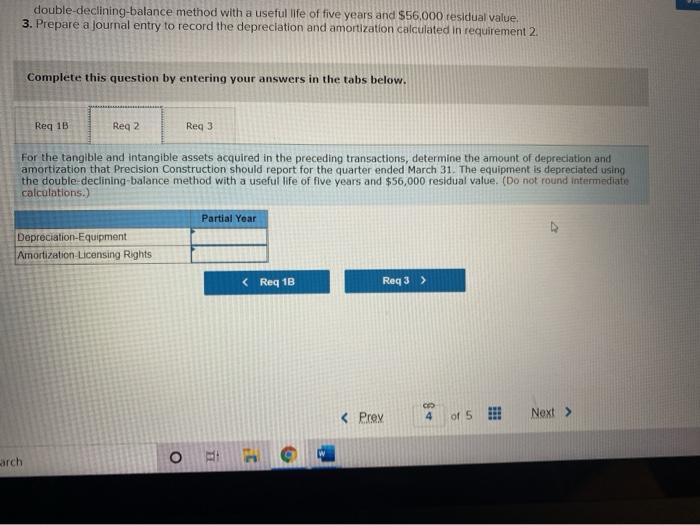

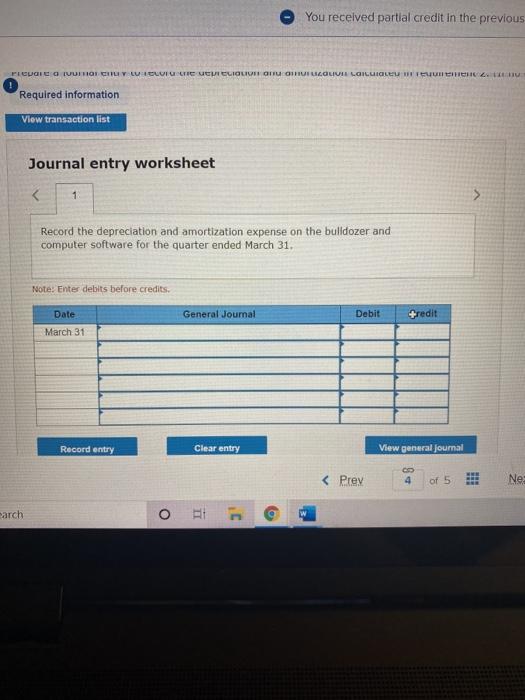

VO Required information [The following information applies to the questions displayed below.) Precision Construction entered into the following transactions during a recent year January 2 Purchased a bulldozer for $282,000 by paying $36,000 cash and signing a $246,000 note due in five years Tanuary 3 Replaced the steel tracks on the bulldozer at a cost of $36,000, purchased on account. The new steel tracks increase the bulldozer's operating efficiency. January 3e wrote a check for the amount owed on account for the work completed on January 3. February 1 Repaired the leather seat on the bulldozer and wrote a check for the full $2,400 cost. March 1 Paid $13,200 cash for the rights to use computer software for a two-year period. 1-b. Prepare the journal entries for each of the above transactions, 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Precision Construction should report for the quarter ended March 31. The equipment is depreciated using th- double-declining balance method with a useful life of five years and $56,000 residual value. 3. Prepare a journal entry to record the depreciation and amortization calculated in requirement 2. Complete this question by entering your answers in the tabs below. BAR Search O TH w double-declining balance method with a useful life of five years and $56.000 residual value. 3. Prepare a journal entry to record the depreciation and amortization calculated in requirement 2. Complete this question by entering your answers in the tabs below. Req 1B Reg 2 Reg 3 For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Precision Construction should report for the quarter ended March 31. The equipment is depreciated using the double-declining balance method with a useful life of five years and $56,000 residual value. (Do not round Intermediate calculations.) Partial Yoar Depreciation Equipment Amortization Licensing Rights arch O You received partial credit in the previous FLEUCIO IUFTO CHILLY LUCUVETIC LEVI CLIQLIVE ON OLULOUVILOILLEUTEUILHER Required information View transaction list Journal entry worksheet Record the depreciation and amortization expense on the bulldozer and computer software for the quarter ended March 31. Note: Enter debits before credits Date General Journal Debit +redit March 31 Record entry Clear entry View general Journal