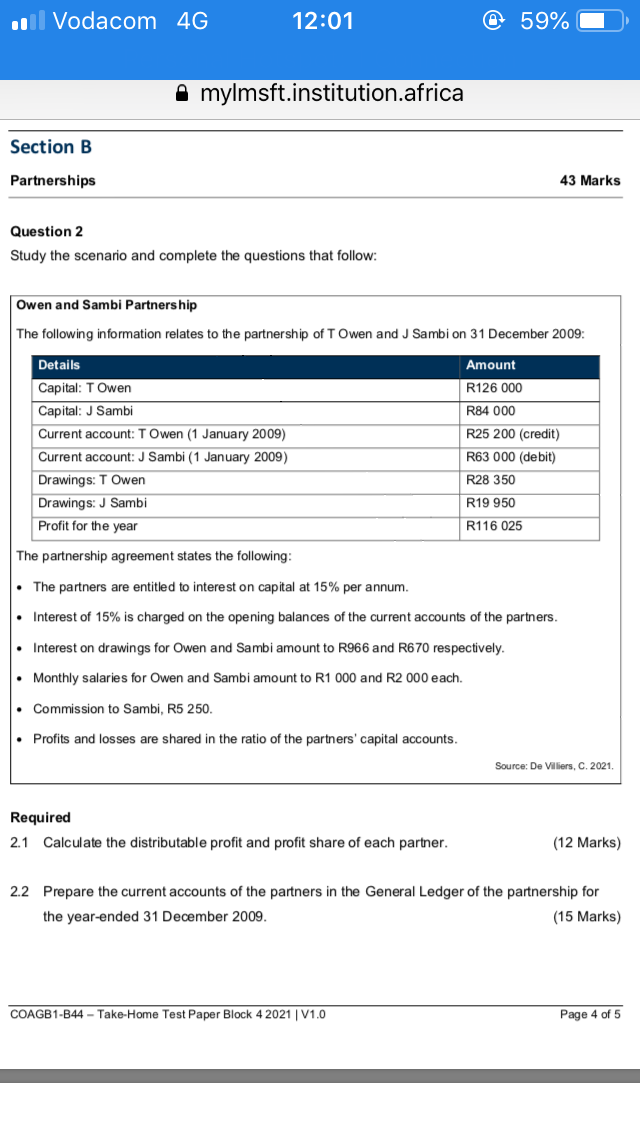

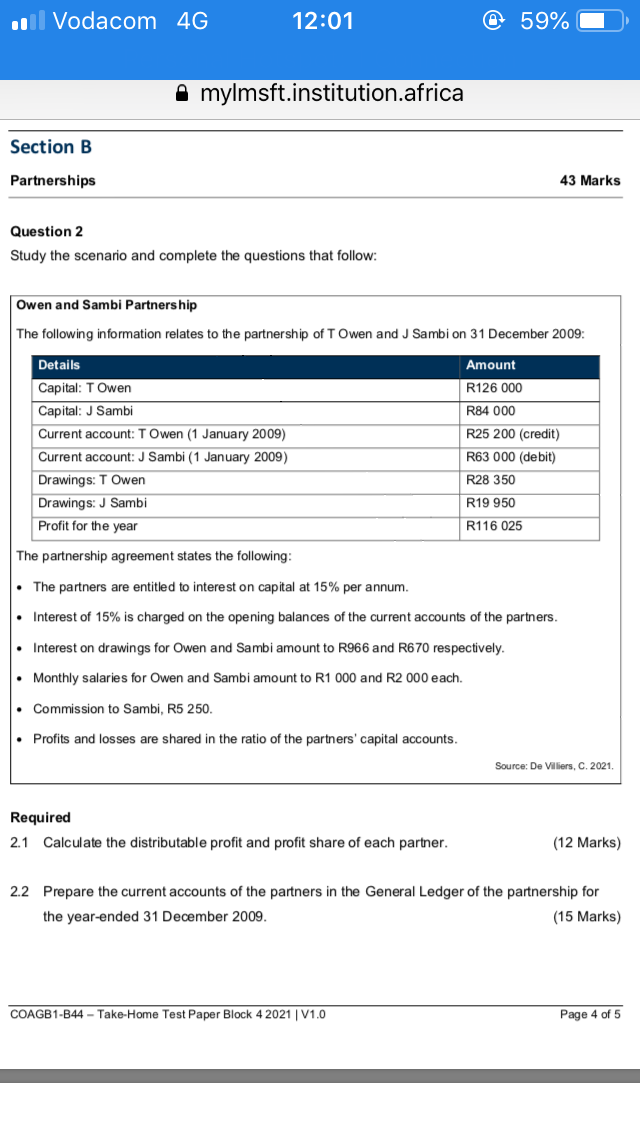

Vodacom 4G 12:01 @ 59% mylmsft.institution.africa Section B Partnerships 43 Marks Question 2 Study the scenario and complete the questions that follow: Owen and Sambi Partnership The following information relates to the partnership of T Owen and J Sambi on 31 December 2009: Amount R126 000 Details Capital: T Owen Capital: J Sambi Current account: T Owen (1 January 2009) Current account: J Sambi (1 January 2009) Drawings: T Owen Drawings: J Sambi Profit for the year R84 000 R25 200 (credit) R63 000 (debit) R28 350 R19 950 R116 025 The partnership agreement states the following: The partners are entitled to interest on capital at 15% per annum. Interest of 15% is charged on the opening balances of the current accounts of the partners. Interest on drawings for Owen and Sambi amount to R966 and R670 respectively. Monthly salaries for Owen and Sambi amount to R1 000 and R2 000 each. Commission to Sambi, R5 250. Profits and losses are shared in the ratio of the partners' capital accounts. Source: De Villiers, C. 2021 Required 2.1 Calculate the distributable profit and profit share of each partner. (12 Marks) 2.2 Prepare the current accounts of the partners in the General Ledger of the partnership for the year-ended 31 December 2009 (15 Marks) COAGB1-B44 - Take-Home Test Paper Block 4 2021 V1.0 Page 4 of 5 Vodacom 4G 12:01 @ 59% mylmsft.institution.africa Section B Partnerships 43 Marks Question 2 Study the scenario and complete the questions that follow: Owen and Sambi Partnership The following information relates to the partnership of T Owen and J Sambi on 31 December 2009: Amount R126 000 Details Capital: T Owen Capital: J Sambi Current account: T Owen (1 January 2009) Current account: J Sambi (1 January 2009) Drawings: T Owen Drawings: J Sambi Profit for the year R84 000 R25 200 (credit) R63 000 (debit) R28 350 R19 950 R116 025 The partnership agreement states the following: The partners are entitled to interest on capital at 15% per annum. Interest of 15% is charged on the opening balances of the current accounts of the partners. Interest on drawings for Owen and Sambi amount to R966 and R670 respectively. Monthly salaries for Owen and Sambi amount to R1 000 and R2 000 each. Commission to Sambi, R5 250. Profits and losses are shared in the ratio of the partners' capital accounts. Source: De Villiers, C. 2021 Required 2.1 Calculate the distributable profit and profit share of each partner. (12 Marks) 2.2 Prepare the current accounts of the partners in the General Ledger of the partnership for the year-ended 31 December 2009 (15 Marks) COAGB1-B44 - Take-Home Test Paper Block 4 2021 V1.0 Page 4 of 5