Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vodacom RM Notes 2019 Reviewed Revenue 3 44 389 Direct expenses (16 161) Staff Expenses (3 289) Publicity exoenses (902) Other operating expenses (5 860)

| Vodacom | ||

| RM | Notes | 2019 Reviewed |

| Revenue | 3 | 44 389 |

| Direct expenses | (16 161) | |

| Staff Expenses | (3 289) | |

| Publicity exoenses | (902) | |

| Other operating expenses | (5 860) | |

| Broad-based black econimic empowerment charge | ||

| Depreceiation and amortisation | (6 967) | |

| Impairment losses | ||

| Net profit associate and joint venture | 1 673 | |

| Operating Profit | 12 883 | |

| Finance income | 456 | |

| Finance costs | (2 196) | |

| Net gain/(loss) on remeasurement and disposal of - | ||

| financial instruments | 140 | |

| Profit before tax | 11 283 | |

| Taxation | (3 084) | |

| Net profit | 8 199 | |

| Attributable to: | ||

| Equity shareholders | 7 838 | |

| Non-controlling interests | 365 | |

| 8 199 | ||

| Cents | Notes | 2019 Reviewed |

| Basic earnings per share | 4 | 461 |

| Diluted earnings per share | 4 | 454 |

| RM | 2019 Reviewed | |

| Net profit | 8 199 | |

| Other comprehensive income | 2090 | |

| Foreign currency transation differences, net of tax | 16 | |

| Total comprehensive income | 10 305 | |

| Attribute to: | ||

| Equity shareholders | 9 746 | |

| Non-controlling intrests | 559 | |

| 10 305 |

Calculate the following ratios and show workings

Operating Profit percentage

Net profit percentage

return on asset

Return on total equity

Total asset turnover

Total debt/equity ratio

Total debt/total asset

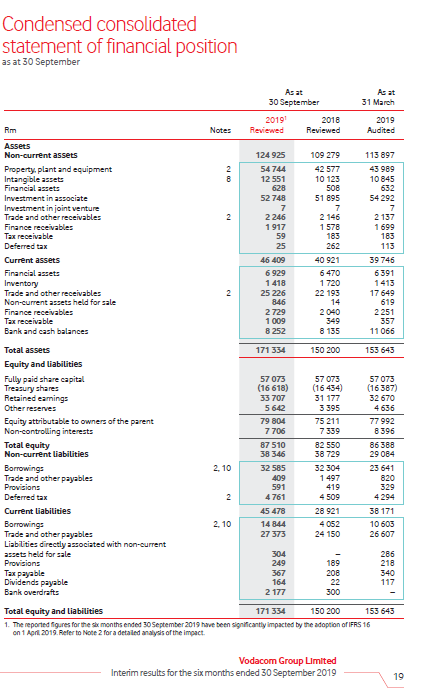

Condensed consolidated statement of financial position as at 30 September 31 March As at 30 September 2019 2018 Reviewed 2019 Audited 124 925 54 744 12 551 109 279 42 577 10 123 113 897 43989 10 845 508 632 52 748 51 895 54292 2 246 1917 2146 1 578 183 Non-current assets Property, plant and equipment Intangible assets Francal assets Investment in associate Investment in joint venture Trade and other receivables Finance receivables Tax receivable Deferred tax Current assets Financial assets Inventory Trade and other receivables Non-current assets held for sale Finance receivables Tax receivable Bank and cash balances 46 409 6929 1418 25 226 40 921 6470 1720 22 193 2137 1699 183 113 39746 6391 1413 17 649 619 2 251 2040 2 729 1009 8 252 8 135 11 066 171 334 150 200 153 643 57073 (16387) Total assets Equity and liabilities Fully paid share capital Treasury shares Retained earnings Other reserves Equity attributable to owners of the parent Non-controlling interests Total equity Non-current liabilities Borowings Trade and other payables Provisions Deferred tax Current liabilities Borowings Trade and other payables Liabilities directly associated with non-current 57 075 (16 618) 33 707 5642 79 804 7706 87 510 38 345 32 585 57 073 (16 434) 31 177 3 395 75 211 7399 82 550 32 670 4636 77 992 8396 86 388 29084 23 641 820 329 4294 591 4761 45478 14 844 32 304 1 497 419 4 509 28 921 4052 24 150 38 171 10 603 26 607 27 375 Provisions Tax payable Dividends payable Bank overdra 367 164 2 177 Total equity and liabilities 171 354 150 200 153 543 1 The reporte r s for the month ended September 2019 have been significantly impacted by the adoption of IFRS 16 on 1 Art2019 Refer to Note 2 fora detailed analysis of the impact Vodacom Group Limited Interim results for the six months ended 30 September 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started