Answered step by step

Verified Expert Solution

Question

1 Approved Answer

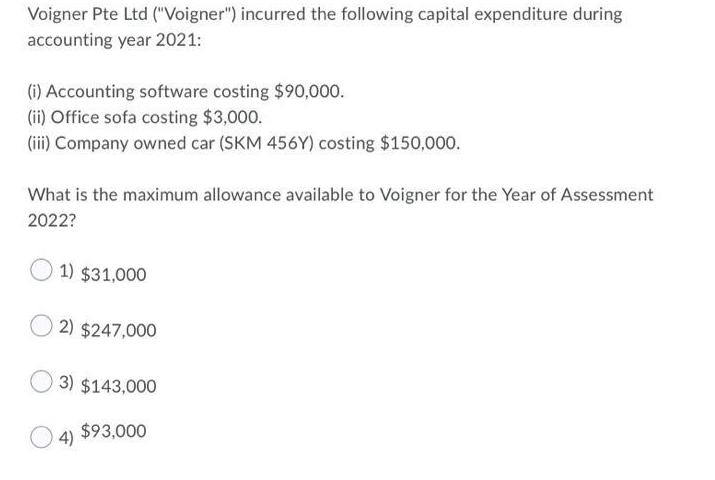

Voigner Pte Ltd (Voigner) incurred the following capital expenditure during accounting year 2021: (i) Accounting software costing $90,000. (ii) Office sofa costing $3,000. (iii)

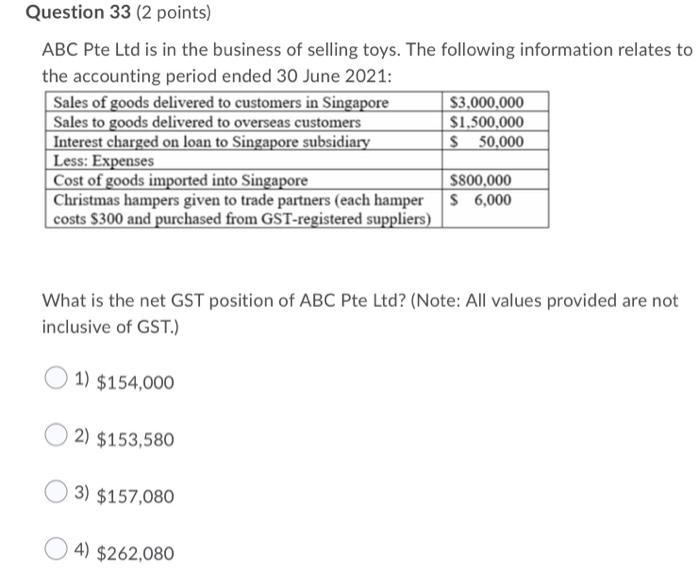

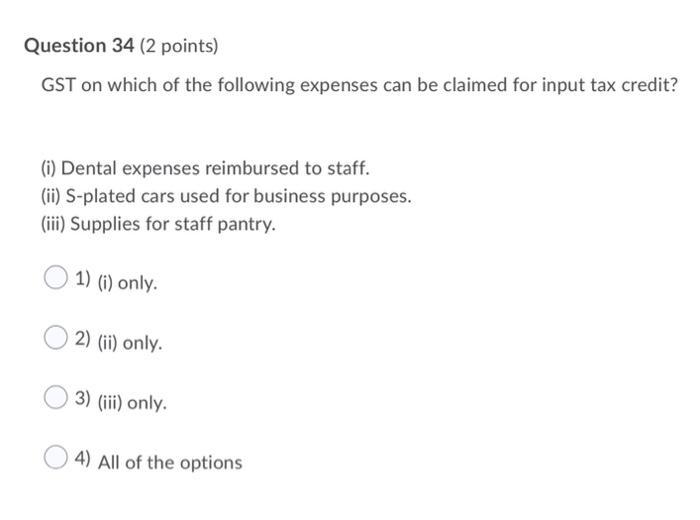

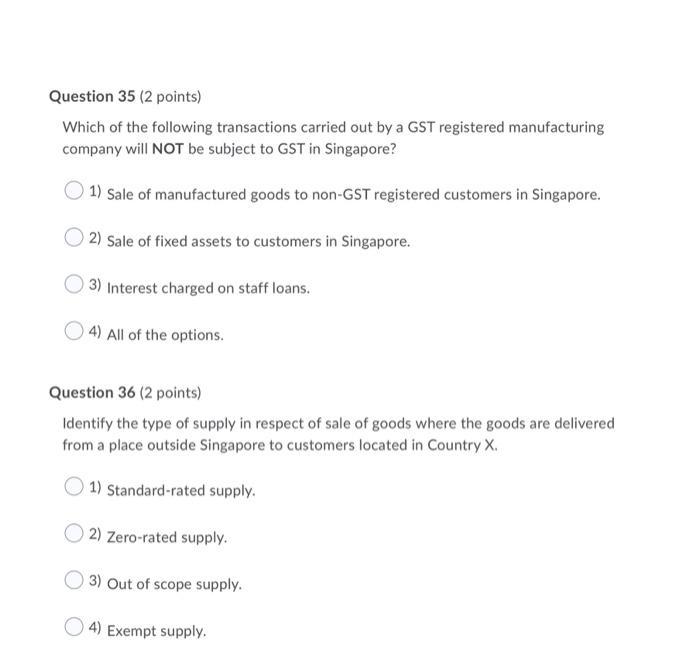

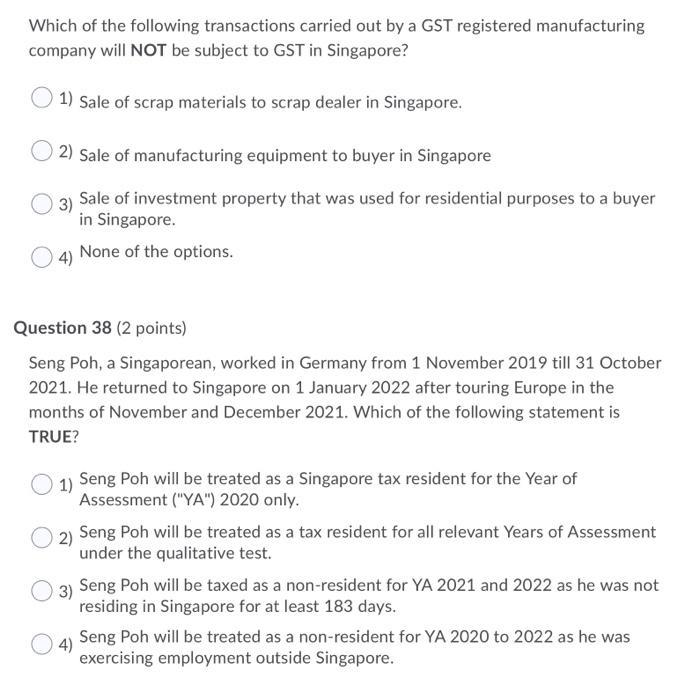

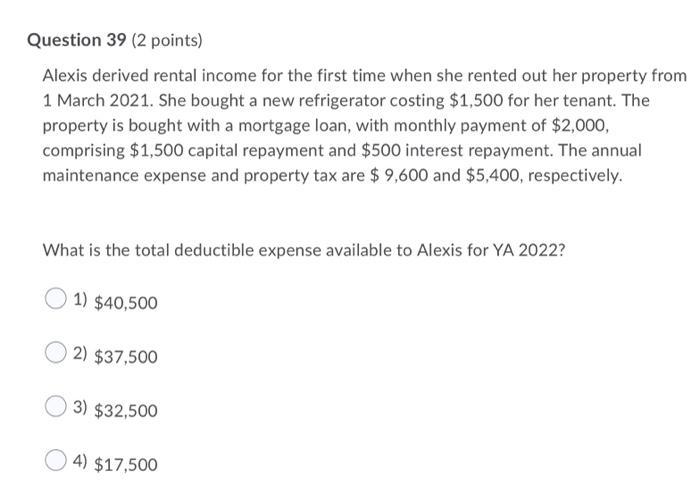

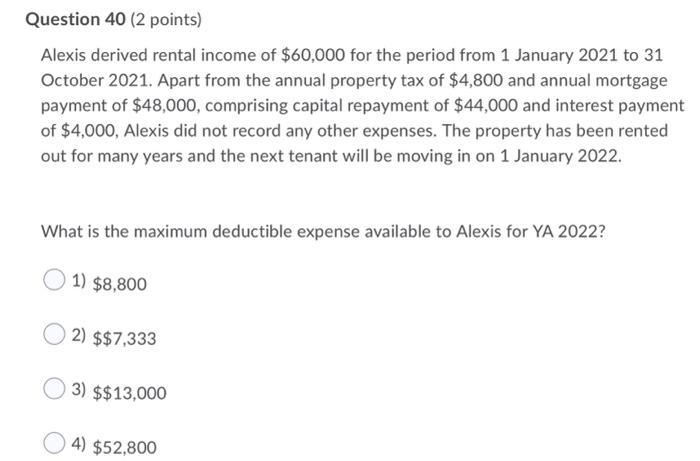

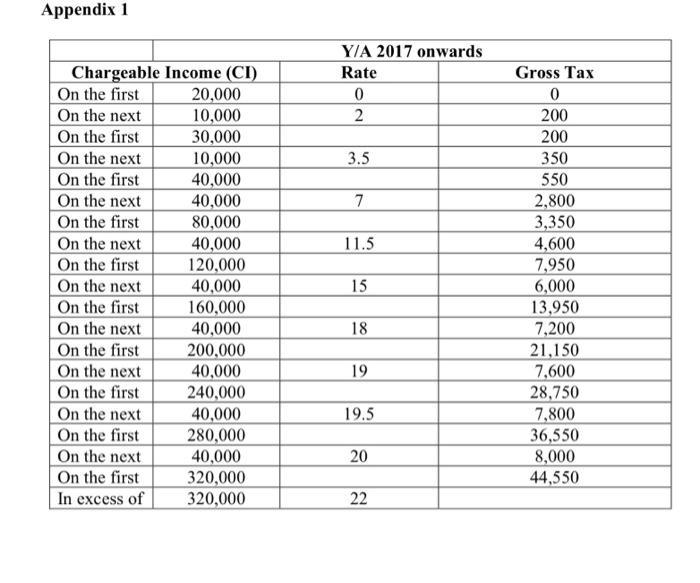

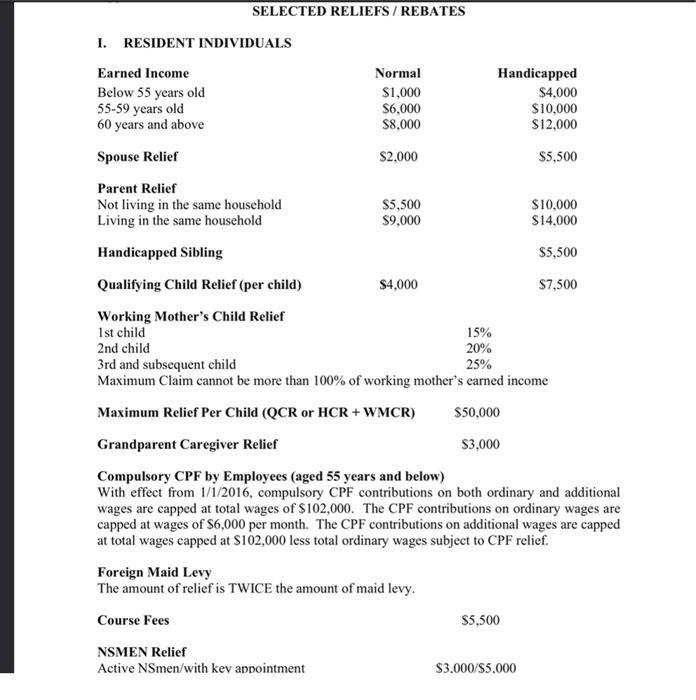

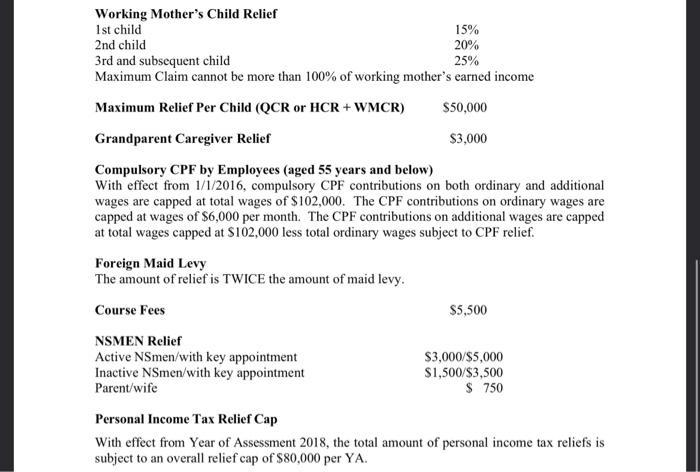

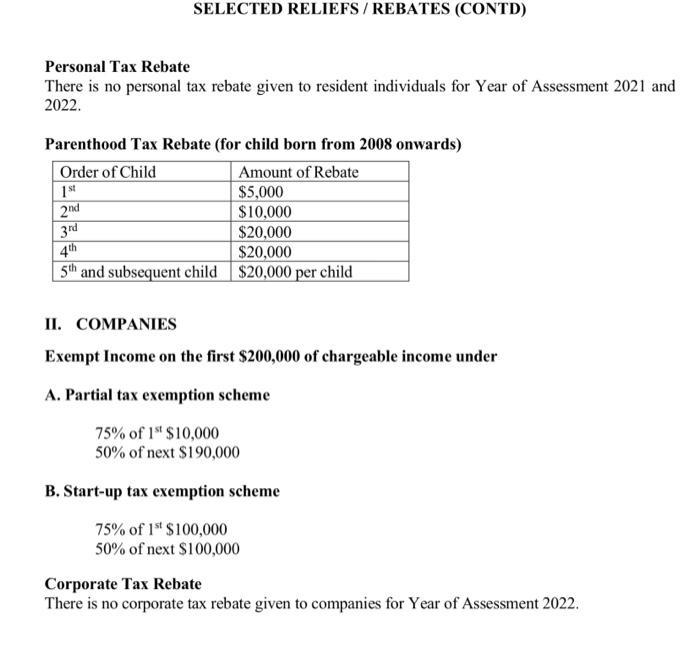

Voigner Pte Ltd ("Voigner") incurred the following capital expenditure during accounting year 2021: (i) Accounting software costing $90,000. (ii) Office sofa costing $3,000. (iii) Company owned car (SKM 456Y) costing $150,000. What is the maximum allowance available to Voigner for the Year of Assessment 2022? 1) $31,000 2) $247,000 3) $143,000 $93,000 4) Question 33 (2 points) ABC Pte Ltd is in the business of selling toys. The following information relates to the accounting period ended 30 June 2021: Sales of goods delivered to customers in Singapore Sales to goods delivered to overseas customers Interest charged on loan to Singapore subsidiary Less: Expenses Cost of goods imported into Singapore Christmas hampers given to trade partners (each hamper costs $300 and purchased from GST-registered suppliers) 1) $154,000 What is the net GST position of ABC Pte Ltd? (Note: All values provided are not inclusive of GST.) 2) $153,580 3) $157,080 $3,000,000 $1,500,000 $50,000 4) $262,080 $800,000 $ 6,000 Question 34 (2 points) GST on which of the following expenses can be claimed for input tax credit? (i) Dental expenses reimbursed to staff. (ii) S-plated cars used for business purposes. (iii) Supplies for staff pantry. 1) (i) only. 2) (ii) only. 3) (iii) only. 4) All of the options Question 35 (2 points) Which of the following transactions carried out by a GST registered manufacturing company will NOT be subject to GST in Singapore? 1) Sale of manufactured goods to non-GST registered customers in Singapore. 2) Sale of fixed assets to customers in Singapore. 3) Interest charged on staff loans. 4) All of the options. Question 36 (2 points) Identify the type of supply in respect of sale of goods where the goods are delivered from a place outside Singapore to customers located in Country X. 1) Standard-rated supply. 2) Zero-rated supply. 3) Out of scope supply. 4) Exempt supply. Which of the following transactions carried out by a GST registered manufacturing company will NOT be subject to GST in Singapore? 1) Sale of scrap materials to scrap dealer in Singapore. 2) Sale of manufacturing equipment to buyer in Singapore Sale of investment property that was used for residential purposes to a buyer in Singapore. None of the options. (4) Question 38 (2 points) Seng Poh, a Singaporean, worked in Germany from 1 November 2019 till 31 October 2021. He returned to Singapore on 1 January 2022 after touring Europe in the months of November and December 2021. Which of the following statement is TRUE? 1) Seng Poh will be treated as a Singapore tax resident for the Year of Assessment ("YA") 2020 only. 2) Seng Poh will be treated as a tax resident for all relevant Years of Assessment under the qualitative test. 3) Seng Poh will be taxed as a non-resident for YA 2021 and 2022 as he was not residing in Singapore for at least 183 days. 4) Seng Poh will be treated as a non-resident for YA 2020 to 2022 as he was exercising employment outside Singapore. Question 39 (2 points) Alexis derived rental income for the first time when she rented out her property from 1 March 2021. She bought a new refrigerator costing $1,500 for her tenant. The property is bought with a mortgage loan, with monthly payment of $2,000, comprising $1,500 capital repayment and $500 interest repayment. The annual maintenance expense and property tax are $ 9,600 and $5,400, respectively. What is the total deductible expense available to Alexis for YA 2022? 1) $40,500 2) $37,500 3) $32,500 4) $17,500 Question 40 (2 points) Alexis derived rental income of $60,000 for the period from 1 January 2021 to 31 October 2021. Apart from the annual property tax of $4,800 and annual mortgage payment of $48,000, comprising capital repayment of $44,000 and interest payment of $4,000, Alexis did not record any other expenses. The property has been rented out for many years and the next tenant will be moving in on 1 January 2022. What is the maximum deductible expense available to Alexis for YA 2022? 1) $8,800 2) $$7,333 3) $$13,000 4) $52,800 Appendix 1 Chargeable Income (CI) On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first On the next On the first In excess of 20,000 10,000 30,000 10,000 40,000 40,000 80,000 40,000 120,000 40,000 160,000 40,000 200,000 40,000 240,000 40,000 280,000 40,000 320,000 320,000 Y/A 2017 onwards Rate 0 2 3.5 7 11.5 15 18 19 19.5 20 22 Gross Tax 0 200 200 350 550 2,800 3,350 4,600 7,950 6,000 13,950 7,200 21,150 7,600 28,750 7,800 36,550 8,000 44,550 SELECTED RELIEFS/REBATES I. RESIDENT INDIVIDUALS Earned Income Below 55 years old 55-59 years old 60 years and above Spouse Relief Normal $1,000 $6,000 $8,000 $2,000 Parent Relief Not living in the same household Living in the same household Handicapped Sibling Qualifying Child Relief (per child) Working Mother's Child Relief 1st child 15% 2nd child 20% 3rd and subsequent child 25% Maximum Claim cannot be more than 100% of working mother's earned income Maximum Relief Per Child (QCR or HCR + WMCR) $50,000 Grandparent Caregiver Relief $3,000 Compulsory CPF by Employees (aged 55 years and below) With effect from 1/1/2016, compulsory CPF contributions on both ordinary and additional wages are capped at total wages of $102,000. The CPF contributions on ordinary wages are capped at wages of $6,000 per month. The CPF contributions on additional wages are capped at total wages capped at $102,000 less total ordinary wages subject to CPF relief. $5,500 $9,000 $4,000 Handicapped $4,000 $10,000 $12,000 $5,500 Foreign Maid Levy The amount of relief is TWICE the amount of maid levy. Course Fees NSMEN Relief Active NSmen/with key appointment $5,500 $3.000/$5.000 $10,000 $14,000 $5,500 $7,500 Working Mother's Child Relief 1st child 15% 20% 25% 2nd child 3rd and subsequent child Maximum Claim cannot be more than 100% of working mother's earned income Maximum Relief Per Child (QCR or HCR + WMCR) $50,000 $3,000 Grandparent Caregiver Relief Compulsory CPF by Employees (aged 55 years and below) With effect from 1/1/2016, compulsory CPF contributions on both ordinary and additional wages are capped at total wages of $102,000. The CPF contributions on ordinary wages are capped at wages of $6,000 per month. The CPF contributions on additional wages are capped at total wages capped at $102,000 less total ordinary wages subject to CPF relief. Foreign Maid Levy The amount of relief is TWICE the amount of maid levy. Course Fees NSMEN Relief Active NSmen/with key appointment Inactive NSmen/with key appointment Parent/wife $5,500 $3,000/$5,000 $1,500/$3,500 $ 750 Personal Income Tax Relief Cap With effect from Year of Assessment 2018, the total amount of personal income tax reliefs is subject to an overall relief cap of $80,000 per YA. Personal Tax Rebate There is no personal tax rebate given to resident individuals for Year of Assessment 2021 and 2022. SELECTED RELIEFS/REBATES (CONTD) Parenthood Tax Rebate (for child born from 2008 onwards) Amount of Rebate $5,000 $10,000 Order of Child 1st 2nd 3rd $20,000 $20,000 5th and subsequent child $20,000 per child 4th II. COMPANIES Exempt Income on the first $200,000 of chargeable income under A. Partial tax exemption scheme 75% of 1st $10,000 50% of next $190,000 B. Start-up tax exemption scheme 75% of 1st $100,000 50% of next $100,000 Corporate Tax Rebate There is no corporate tax rebate given to companies for Year of Assessment 2022.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Part 1 Capital Allowances To calculate the maximum capital allowance available to Voigner ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started