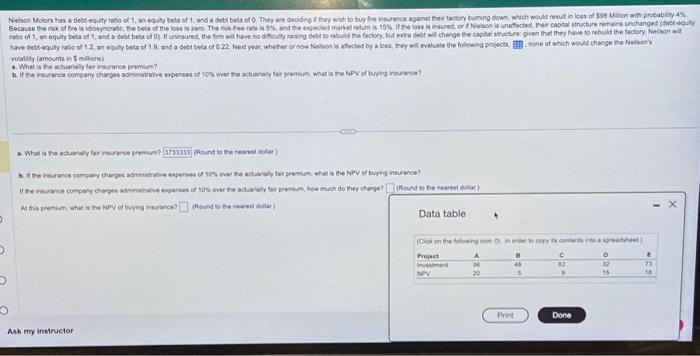

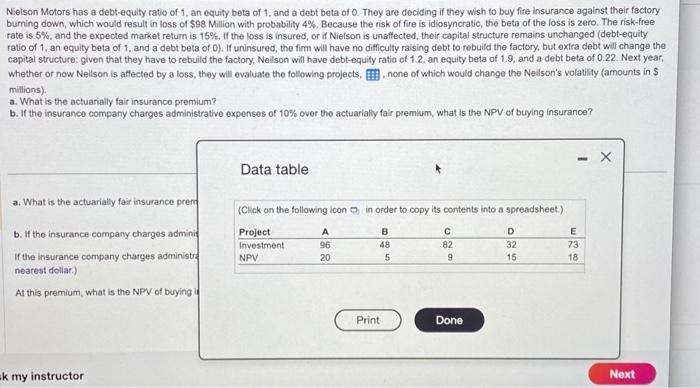

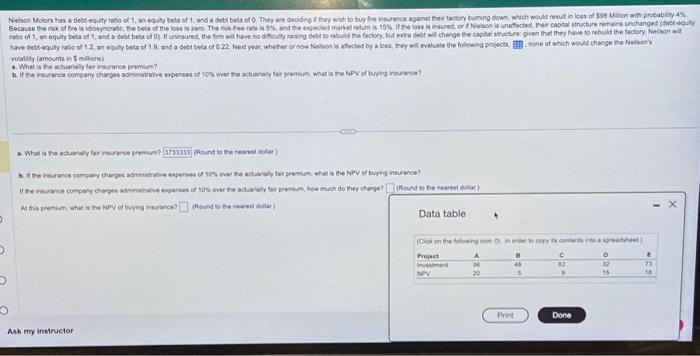

voinity (anourtsin 5 elitons) a. What a t the ocharialy terinsuance prention? 2. What is the atianaly for mornce premin? (Poind to the newast doter) Data table Nielson Motors has a debt-equity ratio of 1 , an equity beta of 1 , and a debt beta of 0 . They are deciding if they wish to buy fire insurance against their factory buming down, which would result in loss of $98 Million with probability 4%. Because the risk of fire is idiosyncratic, the beta of the loss is zero. The risk-free rate is 5%, and the expected market retum is 15%. If the loss is insured, or if Nielson is unaffected, their capital structure remains unchanged (debt-equity ratio of 1 , an equity beta of 1 , and a debt beta of 0). If uninsured, the firm will have no difficulty raising debt to rebuld the factory, but extra debt will change the capital structure: given that they have to rebuild the factory. Neilson will have debt-equity ratio of 1.2, an equity beta of 1.9 , and a debt beta of 0.22 . Next year, whether or now Neilson is allected by a loss, they will evaluate the following projects, , none of which would change the Neilsor's volatility (amounts in $ millions). a. What is the actuarially fair insurance premlum? b. If the insurance company charges administrative expenses of 10% over the actuarially fair premium, what is the NPV of buying insurance? Data table a. What is the actuarially fair insurance prem (Click on the following icon D in order to copy its contents into a spreadsheet.) b. If the insurance company charges adminit If the insurance company charges administrs nearest dollar.) At this premium, what is the NPV of buying if k my instructor voinity (anourtsin 5 elitons) a. What a t the ocharialy terinsuance prention? 2. What is the atianaly for mornce premin? (Poind to the newast doter) Data table Nielson Motors has a debt-equity ratio of 1 , an equity beta of 1 , and a debt beta of 0 . They are deciding if they wish to buy fire insurance against their factory buming down, which would result in loss of $98 Million with probability 4%. Because the risk of fire is idiosyncratic, the beta of the loss is zero. The risk-free rate is 5%, and the expected market retum is 15%. If the loss is insured, or if Nielson is unaffected, their capital structure remains unchanged (debt-equity ratio of 1 , an equity beta of 1 , and a debt beta of 0). If uninsured, the firm will have no difficulty raising debt to rebuld the factory, but extra debt will change the capital structure: given that they have to rebuild the factory. Neilson will have debt-equity ratio of 1.2, an equity beta of 1.9 , and a debt beta of 0.22 . Next year, whether or now Neilson is allected by a loss, they will evaluate the following projects, , none of which would change the Neilsor's volatility (amounts in $ millions). a. What is the actuarially fair insurance premlum? b. If the insurance company charges administrative expenses of 10% over the actuarially fair premium, what is the NPV of buying insurance? Data table a. What is the actuarially fair insurance prem (Click on the following icon D in order to copy its contents into a spreadsheet.) b. If the insurance company charges adminit If the insurance company charges administrs nearest dollar.) At this premium, what is the NPV of buying if k my instructor