Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Volata Company began operations on January 1, 2019. In the second quarter of 2020, it adopted the FIFO method of inventory valuation. In the

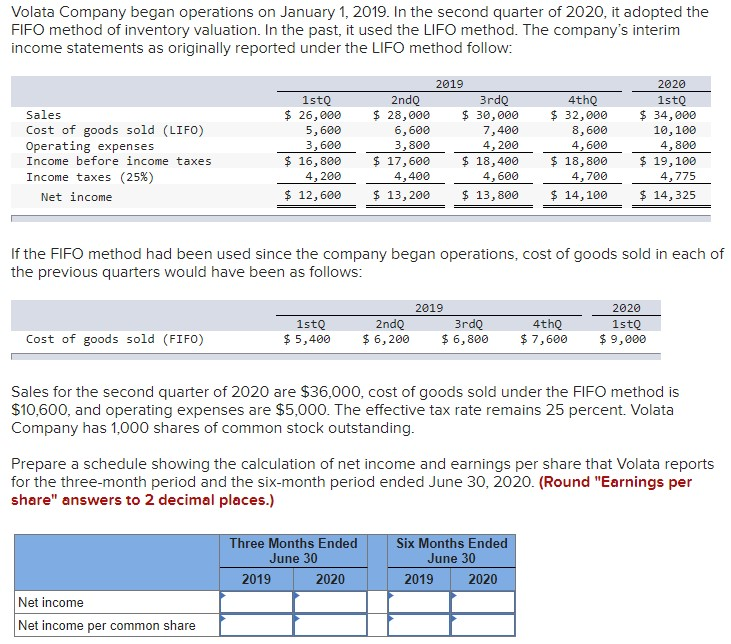

Volata Company began operations on January 1, 2019. In the second quarter of 2020, it adopted the FIFO method of inventory valuation. In the past, it used the LIFO method. The company's interim income statements as originally reported under the LIFO method follow: Sales Cost of goods sold (LIFO). Operating expenses Income before income taxes Income taxes (25%) Net income 2019 1stQ $ 26,000 5,600 3,600 $ 16,800 4,200 2ndQ $ 28,000 6,600 3,800 $ 17,600 4,400 3rdQ $ 30,000 7,400 4,200 4thQ $ 32,000 $ 18,400 4,600 8,600 4,600 $ 18,800 4,700 $ 12,600 $ 13,200 $ 13,800 $ 14,100 2020 1stQ $ 34,000 10,100 4,800 $ 19,100 4,775 $ 14,325 If the FIFO method had been used since the company began operations, cost of goods sold in each of the previous quarters would have been as follows: 2019 2020 1stQ 2ndQ 3rdQ 4thQ 1stQ Cost of goods sold (FIFO) $ 5,400 $ 6,200 $ 6,800 $7,600 $ 9,000 Sales for the second quarter of 2020 are $36,000, cost of goods sold under the FIFO method is $10,600, and operating expenses are $5,000. The effective tax rate remains 25 percent. Volata Company has 1,000 shares of common stock outstanding. Prepare a schedule showing the calculation of net income and earnings per share that Volata reports for the three-month period and the six-month period ended June 30, 2020. (Round "Earnings per share" answers to 2 decimal places.) Net income Net income per common share Three Months Ended June 30 Six Months Ended June 30 2019 2020 2019 2020

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net income and earnings per share for the threemonth period ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started