Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VOLMAX Fund is offering 5 mututal funds to the public. Volfgang, VOLMAX'S CIO, will sell to investors a risky portfolio WOLFX, which is made

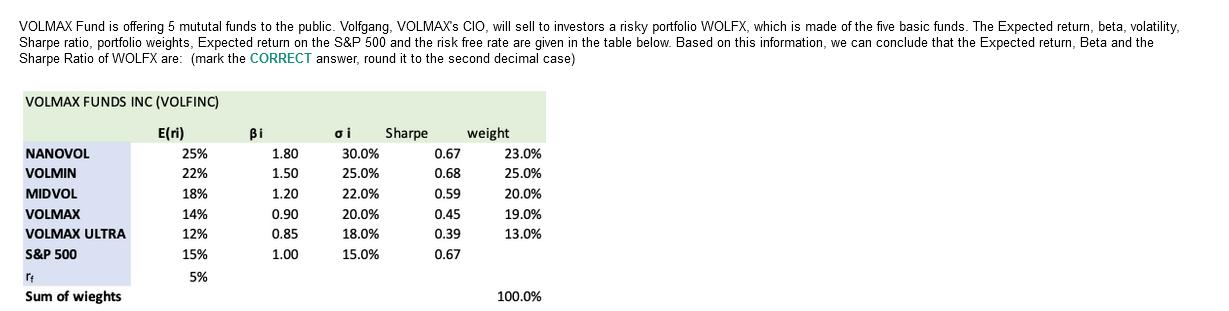

VOLMAX Fund is offering 5 mututal funds to the public. Volfgang, VOLMAX'S CIO, will sell to investors a risky portfolio WOLFX, which is made of the five basic funds. The Expected return, beta, volatility, Sharpe ratio, portfolio weights, Expected return on the S&P 500 and the risk free rate are given in the table below. Based on this information, we can conclude that the Expected return, Beta and the Sharpe Ratio of WOLFX are: (mark the CORRECT answer, round it to the second decimal case) VOLMAX FUNDS INC (VOLFINC) E(ri) Bi oi Sharpe weight NANOVOL 25% 1.80 30.0% 0.67 23.0% VOLMIN 22% 1.50 25.0% 0.68 25.0% MIDVOL 18% 1.20 22.0% 0.59 20.0% VOLMAX 14% 0.90 20.0% 0.45 19.0% VOLMAX ULTRA 12% 0.85 18.0% 0.39 13.0% S&P 500 15% 1.00 15.0% 0.67 5% Sum of wieghts 100.0%

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Solution Based on the information provided we can calculate the expected return beta and Sharpe rati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started