Answered step by step

Verified Expert Solution

Question

1 Approved Answer

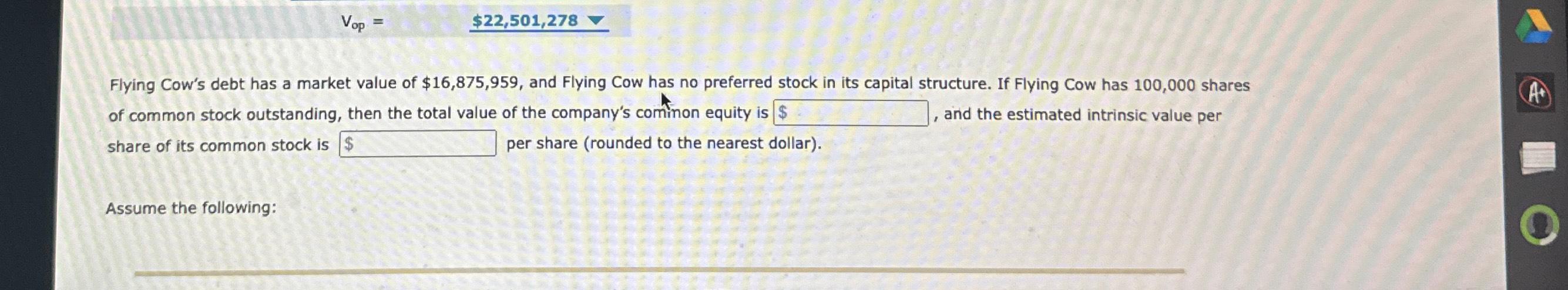

V_(op)=,$22,501,278grad Flying Cow's debt has a market value of $16,875,959 , and Flying Cow has no preferred stock in its capital structure. If Flying

V_(op)=,$22,501,278grad\ Flying Cow's debt has a market value of

$16,875,959, and Flying Cow has no preferred stock in its capital structure. If Flying Cow has 100,000 shares of common stock outstanding, then the total value of the company's common equity is

$, and the estimated intrinsic value per share of its common stock is per share (rounded to the nearest dollar).\ Assume the following:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started