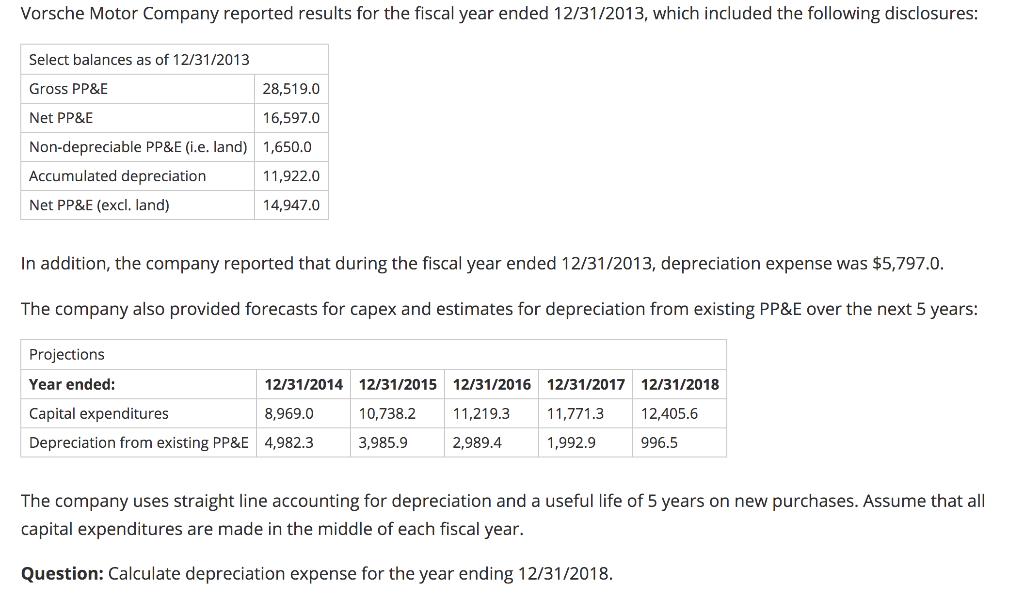

Vorsche Motor Company reported results for the fiscal year ended 12/31/2013, which included the following disclosures: Select balances as of 12/31/2013 Gross PP&E 28,519.0

Vorsche Motor Company reported results for the fiscal year ended 12/31/2013, which included the following disclosures: Select balances as of 12/31/2013 Gross PP&E 28,519.0 Net PP&E 16,597.0 Non-depreciable PP&E (i.e. land) 1,650.0 Accumulated depreciation 11,922.0 Net PP&E (excl. land) 14,947.0 In addition, the company reported that during the fiscal year ended 12/31/2013, depreciation expense was $5,797.0. The company also provided forecasts for capex and estimates for depreciation from existing PP&E over the next 5 years: Projections Year ended: 12/31/2014 12/31/2015 12/31/2016 12/31/2017 12/31/2018 Capital expenditures 8,969.0 10,738.2 11,219.3 11,771.3 12,405.6 Depreciation from existing PP&E 4,982.3 3,985.9 2,989.4 1,992.9 996.5 The company uses straight line accounting for depreciation and a useful life of 5 years on new purchases. Assume that all capital expenditures are made in the middle of each fiscal year. Question: Calculate depreciation expense for the year ending 12/31/2018.

Step by Step Solution

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the depreciation expense for the year ending 12312018 we need to consider the following ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started