Answered step by step

Verified Expert Solution

Question

1 Approved Answer

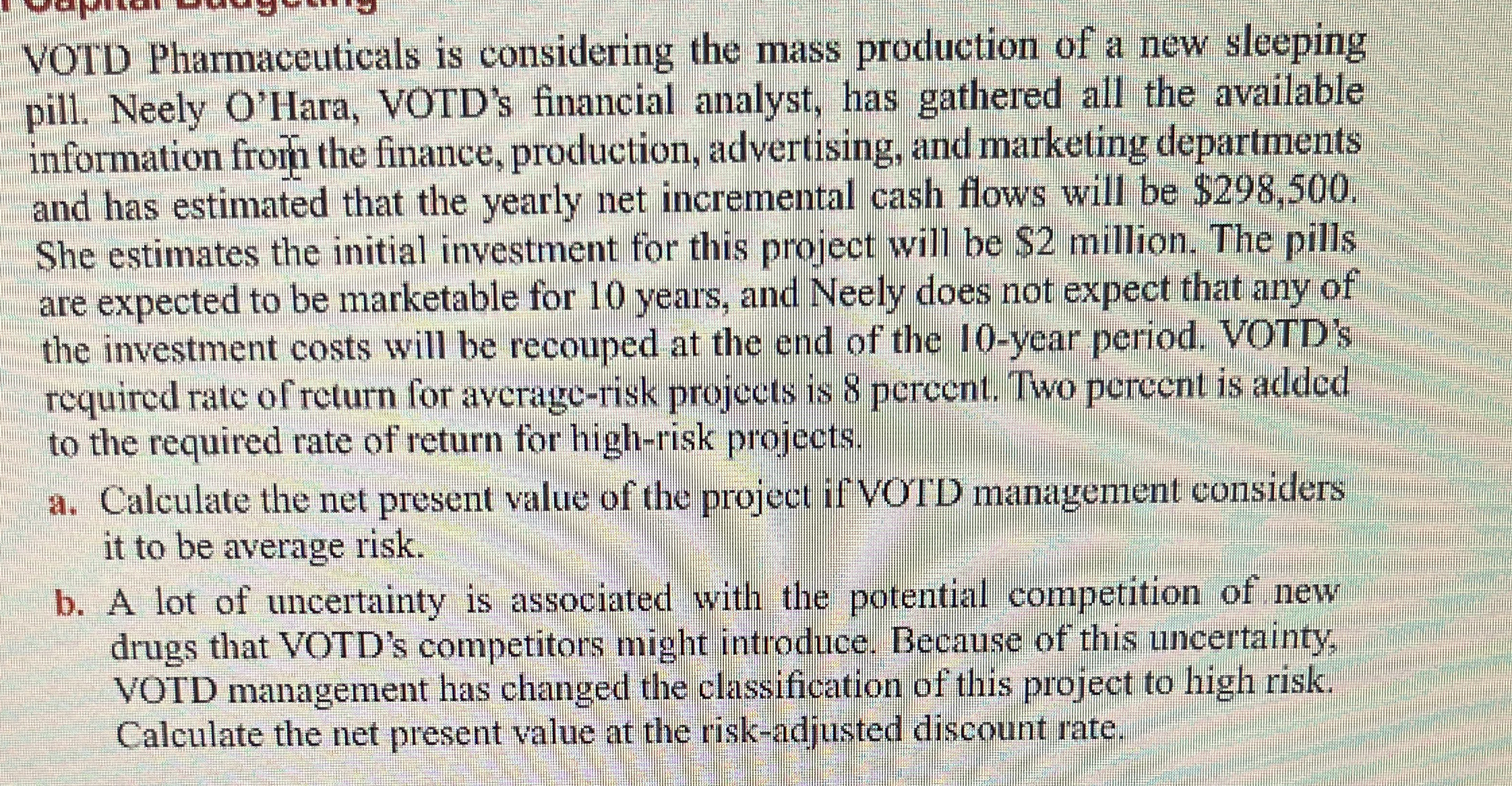

VOTD Pharmaceuticals is considering the mass production of a new sleeping pill. Neely O'Hara, VOTD's financial analyst, has gathered all the available information fron the

VOTD Pharmaceuticals is considering the mass production of a new sleeping

pill. Neely O'Hara, VOTD's financial analyst, has gathered all the available

information fron the finance, production, advertising, and marketing departments

and has estimated that the yearly net incremental cash flows will be $

She estimates the initial investment for this project will be $ million. The pills

are expected to be marketable for years, and Neely does not expect that any of

the investment costs will be recouped at the end of the year period. VOTD's

required rate of return for averagerisk projects is percent. Two pereent is added

to the required rate of return for highrisk projects.

a Calculate the net present value of the project if VOTD management considers

it to be average risk.

b A lot of uncertainty is associated with the potential competition of new

drugs that VOTD's competitors might introduce. Because of this uncertainty,

VOTD management has changed the classification of this project to high risk.

Calculate the net present value at the riskadjusted discount rate. Show all work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started