Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VPI, Inc. purchased a piece of office equipment on April 1 for $550,000. They use straight-line depreciation and estimated that the asset has a

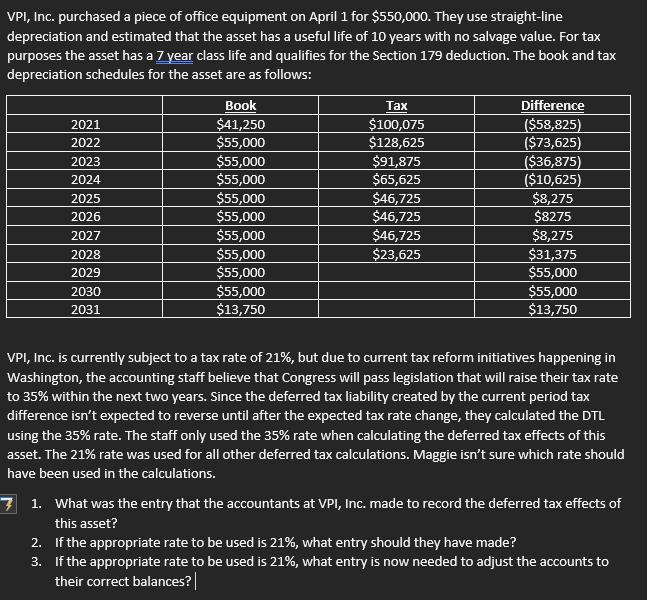

VPI, Inc. purchased a piece of office equipment on April 1 for $550,000. They use straight-line depreciation and estimated that the asset has a useful life of 10 years with no salvage value. For tax purposes the asset has a 7 year class life and qualifies for the Section 179 deduction. The book and tax depreciation schedules for the asset are as follows: 2021 2022 2023 2024 2. 3. 2025 2026 2027 2028 2029 2030 2031 Book $41,250 $55,000 $55,000 $55,000 $55,000 $55,000 $55,000 $55,000 $55,000 $55,000 $13,750 Tax $100,075 $128,625 $91,875 $65,625 $46,725 $46,725 $46,725 $23,625 Difference ($58,825) ($73,625) ($36,875) ($10,625) $8,275 $8275 $8,275 $31,375 $55,000 $55,000 $13,750 VPI, Inc. is currently subject to a tax rate of 21%, but due to current tax reform initiatives happening in Washington, the accounting staff believe that Congress will pass legislation that will raise their tax rate to 35% within the next two years. Since the deferred tax liability created by the current period tax difference isn't expected to reverse until after the expected tax rate change, they calculated the DTL using the 35% rate. The staff only used the 35% rate when calculating the deferred tax effects of this asset. The 21% rate was used for all other deferred tax calculations. Maggie isn't sure which rate should have been used in the calculations. 7 1. What was the entry that the accountants at VPI, Inc. made to record the deferred tax effects of this asset? If the appropriate rate to be used is 21%, what entry should they have made? If the appropriate rate to be used is 21%, what entry is now needed to adjust the accounts to their correct balances? |

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started