Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VPS Ltd paid a fully-franked dividend of $0.14 per share on 15 November 2021. On the record date you owned 1000 VPS shares. VPS

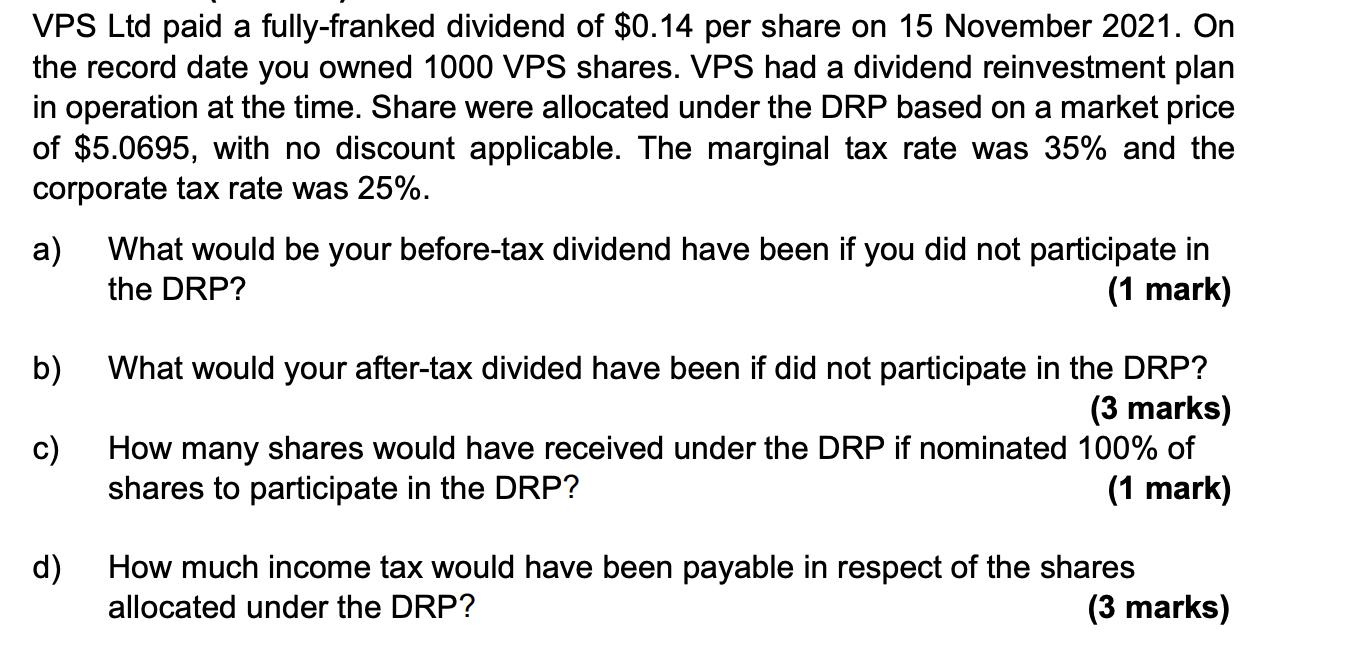

VPS Ltd paid a fully-franked dividend of $0.14 per share on 15 November 2021. On the record date you owned 1000 VPS shares. VPS had a dividend reinvestment plan in operation at the time. Share were allocated under the DRP based on a market price of $5.0695, with no discount applicable. The marginal tax rate was 35% and the corporate tax rate was 25%. a) What would be your before-tax dividend have been if you did not participate in the DRP? (1 mark) b) c) d) What would your after-tax divided have been if did not participate in the DRP? (3 marks) How many shares would have received under the DRP if nominated 100% of shares to participate in the DRP? (1 mark) How much income tax would have been payable in respect of the shares allocated under the DRP? (3 marks)

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Your beforetax dividend if you did not participate in the DRP would be calculated as Beforetax div...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started