Answered step by step

Verified Expert Solution

Question

1 Approved Answer

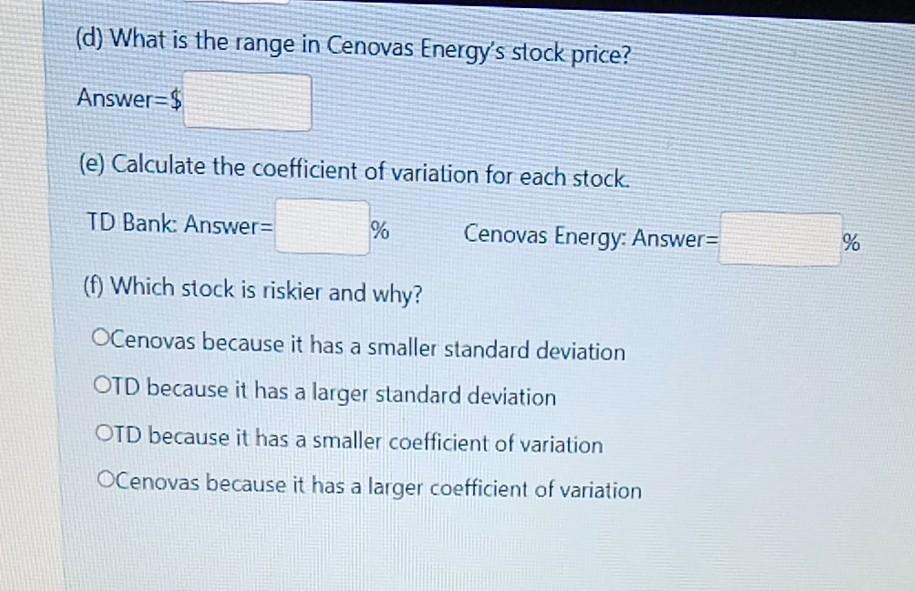

V={{Standard Deviation)/(Mean)}*100% You are thinking about investing money in the stock market and have narrowed choices to one of two stocks: TD Bank or

![fsonV={(Standard Deviation)/(Mean)]*100%You are thinking about investing money in the stock market and have narrowedyour](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/01/61efd483361f5_1643107457245.jpg)

V={{Standard Deviation)/(Mean)}*100% You are thinking about investing money in the stock market and have narrowed choices to one of two stocks: TD Bank or Cenovas Energy. For TD Bank you have the following statistics. your on Mean monthly closing price: $75. 00 Sample staridard deviation: $6.00 The monthly closing stock prices of Cenovas Energy for the last eight months is shown below Closirng Stock Price: ($) 14.00 14.50 11.00 13.00 13./5 11.00 875 1000 (a) Calculate the mean stock price of Cenovas Energy Answer-$ (b) Calculate the standard deviation for the sample prices of Cenovas Energy. Answer $ () What is thhe median stock price for Cenovas Energy? Answer3%$ (d) What is the range in Cenovas Energy's stock price? Answer=$ (e) Calculate the coefficient of variation for each stock. TD Bank: Answer%3D % Cenovas Energy: Answer= % () Which stock is riskier and why? OCenovas because it has a smaller standard deviation OTD because it has a larger standard deviation OTD because it has a smaller coefficient of variation OCenovas because it has a larger coefficient of variation

Step by Step Solution

★★★★★

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Solution Griven Fou TD Bank Mean manthly vilosing puice 7500 O Sample 6 00 Fou ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started