Answered step by step

Verified Expert Solution

Question

1 Approved Answer

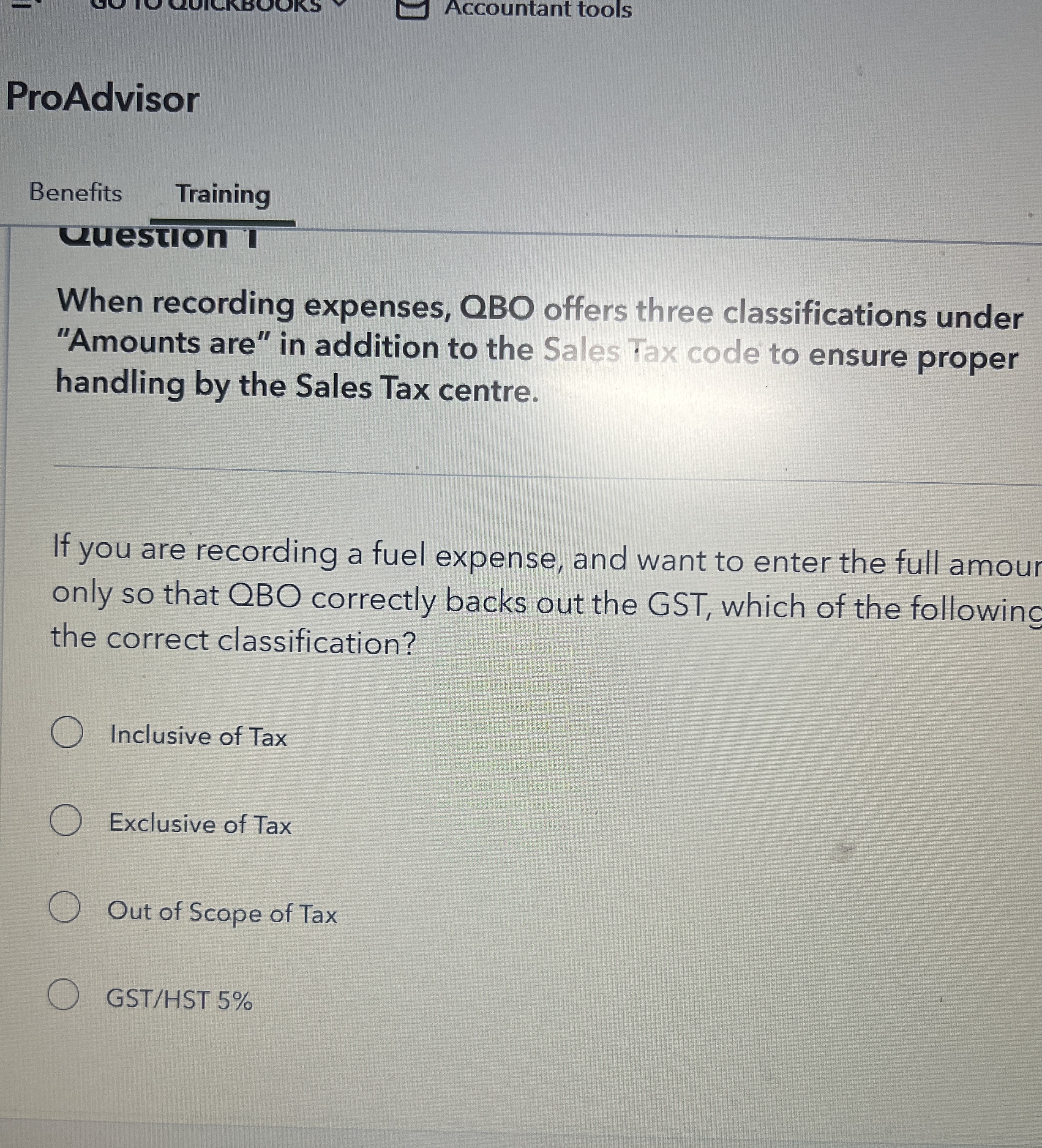

vuestion I When recording expenses, QBO offers three classifications under Amounts are in addition to the Sales Tax code to ensure proper handling by the

vuestion I

When recording expenses, QBO offers three classifications under

"Amounts are" in addition to the Sales Tax code to ensure proper

handling by the Sales Tax centre.

If you are recording a fuel expense, and want to enter the full amour

only so that QBO correctly backs out the GST which of the following

the correct classification?

Inclusive of Tax

Exclusive of Tax

Out of Scope of Tax

GSTHST

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started