Question

W.. 104 2 2 0 19. blob. Req: Ans: 20. 6. 7. 8. On 31st March, 2017, the Cash Book of Mr. Nadeem shows Rs.

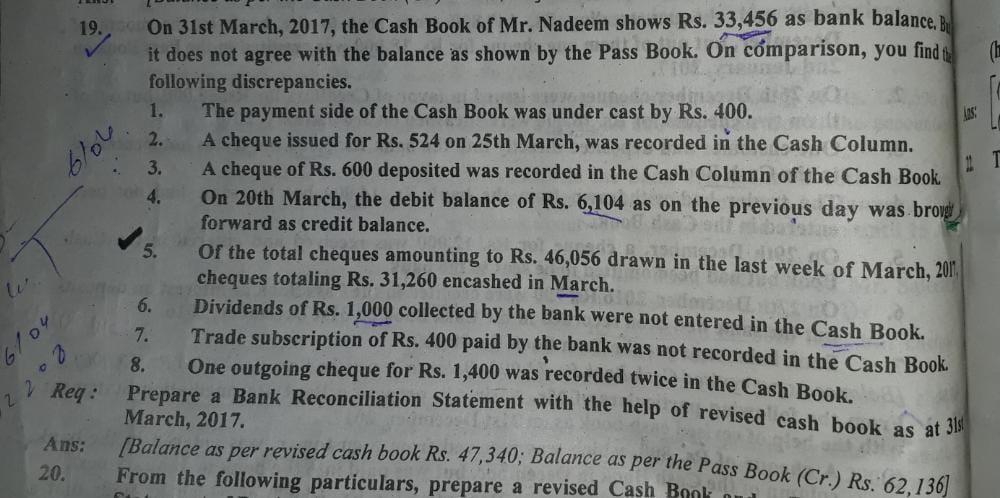

W.. 104 2 2 0 19. blob. Req: Ans: 20. 6. 7. 8. On 31st March, 2017, the Cash Book of Mr. Nadeem shows Rs. 33,456 as bank balance, it does not agree with the balance as shown by the Pass Book. On comparison, you find th following discrepancies. 1. 2. The payment side of the Cash Book was under cast by Rs. 400. 4. A cheque issued for Rs. 524 on 25th March, was recorded in the Cash Column. 3. A cheque of Rs. 600 deposited was recorded in the Cash Column of the Cash Book On 20th March, the debit balance of Rs. 6,104 as on the previous day was broug forward as credit balance. T 5. 7027 Of the total cheques amounting to Rs. 46,056 drawn in the last week of March, 201 cheques totaling Rs. 31,260 encashed in March. Dividends of Rs. 1,000 collected by the bank were not entered in the Cash Book. Trade subscription of Rs. 400 paid by the bank was not recorded in the Cash Book. One outgoing cheque for Rs. 1,400 was recorded twice in the Cash Book. Prepare a Bank Reconciliation Statement with the help of revised cash book as at 31s March, 2017. [Balance as per revised cash book Rs. 47,340; Balance as per the Pass Book (Cr.) Rs. 62,136] From the following particulars, prepare a revised Cash Book

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started