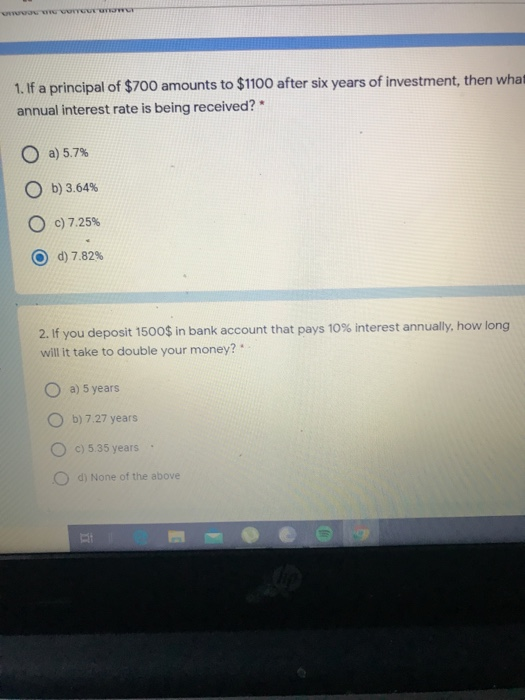

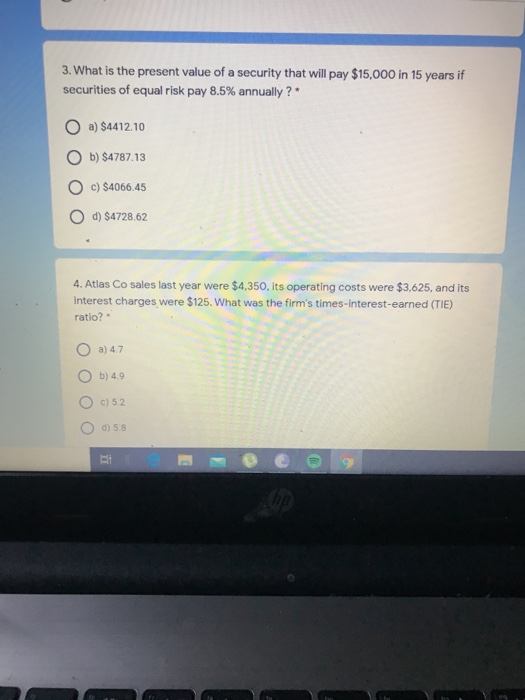

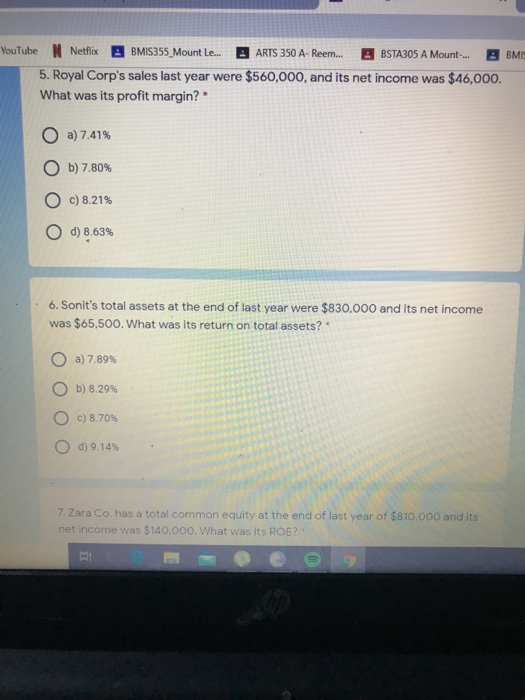

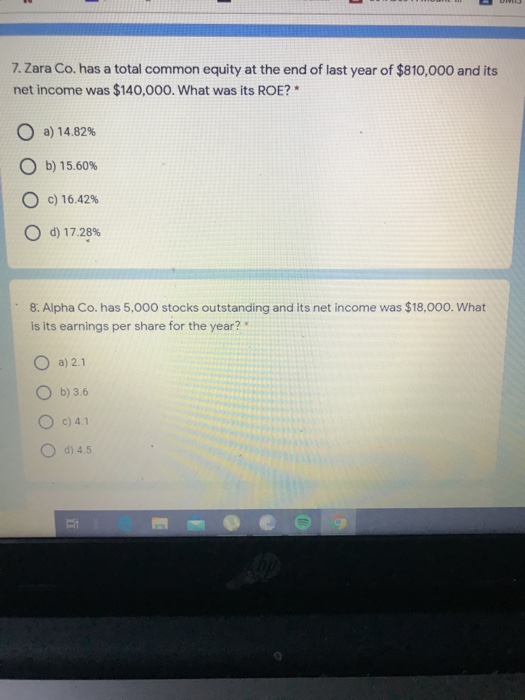

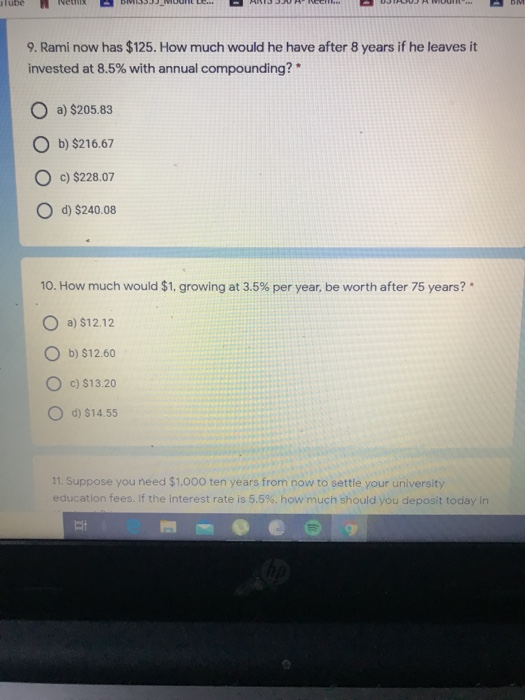

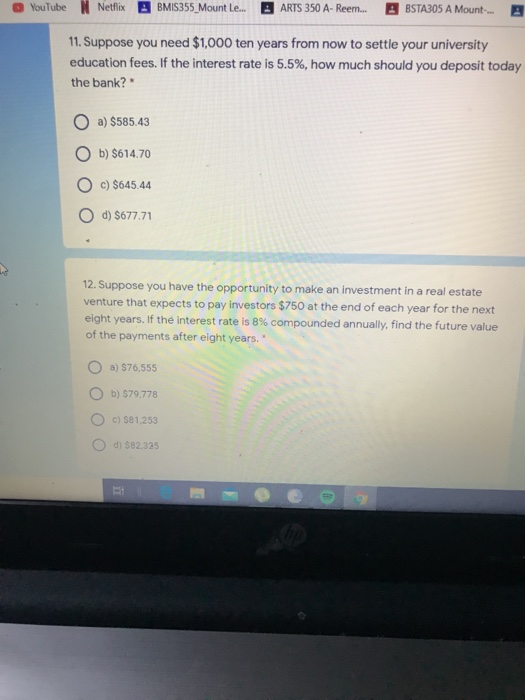

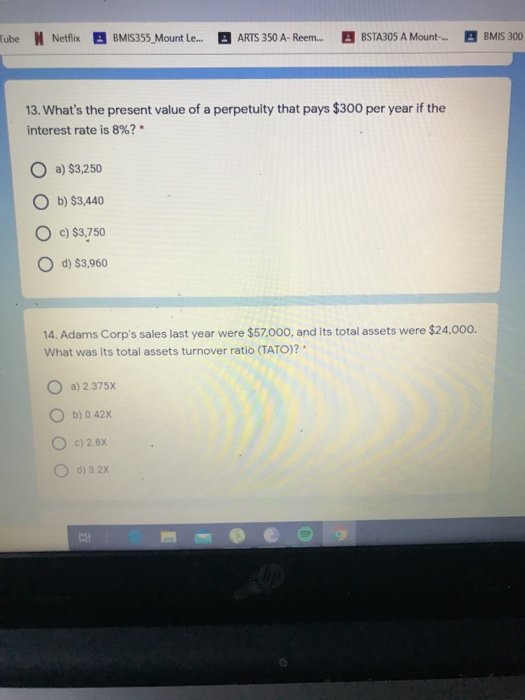

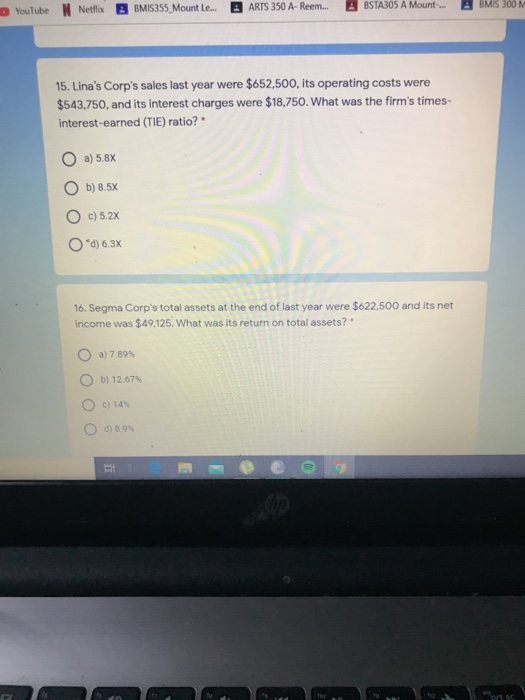

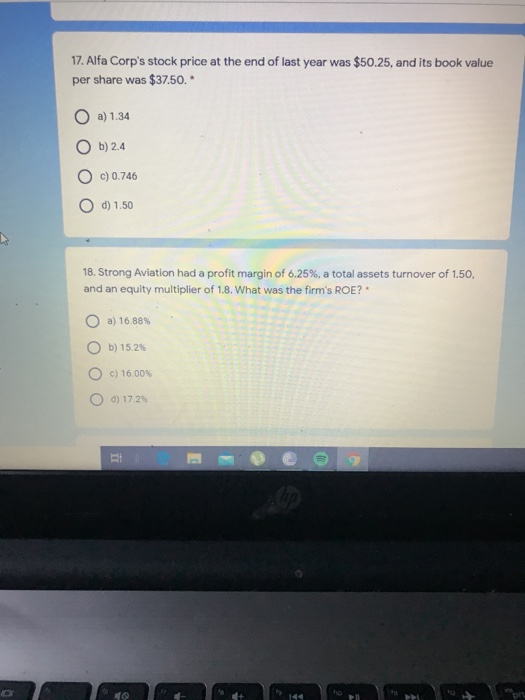

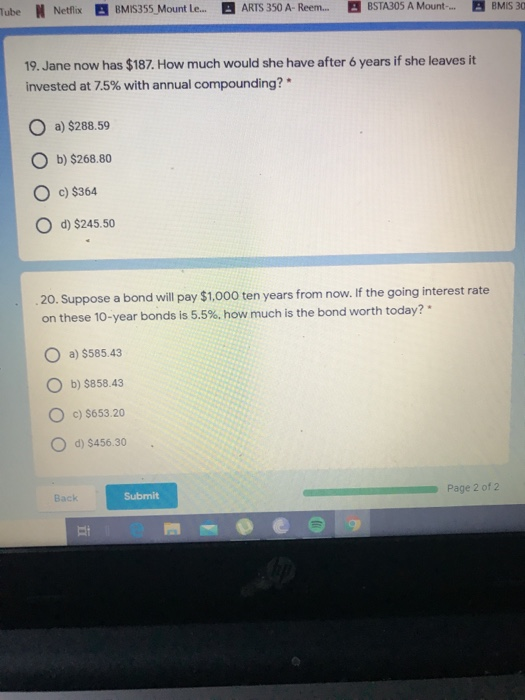

W OTURUM 1. If a principal of $700 amounts to $1100 after six years of investment, then what annual interest rate is being received? a) 5.7% Ob) 3.64% O c) 7.25% d) 7.82% 2. If you deposit 1500$ in bank account that pays 10% interest annually, how long will it take to double your money? O a) 5 years O b) 7.27 years c) 5.35 years d) None of the above 3. What is the present value of a security that will pay $15,000 in 15 years if securities of equal risk pay 8.5% annually ? a) $4412.10 b) $4787.13 O c) $4066.45 d) $4728.62 4. Atlas Co sales last year were $4,350, its operating costs were $3.625, and its interest charges were $125. What was the firm's times-interest-earned (TIE) ratio? O a) 47 o 6) 4.9 OC)52 O 058 YouTube N Netflix BMS355_Mount Le... BARTS 350 A-Reem. EBSTA305 A Mount BBM 5. Royal Corp's sales last year were $560,000, and its net income was $46,000. What was its profit margin? * a) 7.41% O b) 7.80% O c) 8.21% O ) 8.63% 6. Sonit's total assets at the end of last year were $830,000 and its net income was $65,500. What was its return on total assets? O a) 7.89% Ob) 8.29% OC)8.70% d) 9.14% 7. Zara Co. has a total common equity at the end of last year of $810,000 and its net income was $140,000. What was its ROE? 7. Zara Co. has a total common equity at the end of last year of $810,000 and its net income was $140,000. What was its ROE?* a) 14.82% Ob) 15.60% O c) 16.42% d) 17.28% 8. Alpha Co. has 5.000 stocks outstanding and its net income was $18,000. What is its earnings per share for the year? O a) 2.1 Ob) 3.6 O c) 41 O d) 45 lube News BIJJ MUUN LE. ARIJ JANell.. UJIAJUJA UUNIL - DM 9. Rami now has $125. How much would he have after 8 years if he leaves it invested at 8.5% with annual compounding? O a) $205.83 b) $216.67 O O c) $228.07 d) $240.08 10. How much would $1. growing at 3.5% per year, be worth after 75 years? a) $12.12 b) $12.60 O OC) $13.20 d) $14.55 11. Suppose you need $1.000 ten years from now to settle your university education fees. If the interest rate is 5.5%. how much should you deposit today in YouTube Netflix BMIS355_Mount Le.. ARTS 350 A-Reem... BSTA305 A Mount. 11. Suppose you need $1,000 ten years from now to settle your university education fees. If the interest rate is 5.5%, how much should you deposit today the bank? O a) $585.43 Ob) $614.70 Oc) $645.44 d) $677.71 12. Suppose you have the opportunity to make an investment in a real estate venture that expects to pay investors $750 at the end of each year for the next eight years. If the interest rate is 8% compounded annually, find the future value of the payments after eight years. O a) $76,555 Ob) $79,778 OC) 581,253 d) $82,325 ube Netflix B BMIS355_Mount Le... B ARTS 350 A-Reem... BSTA305 A Mount BMIS 300 13. What's the present value of a perpetuity that pays $300 per year if the interest rate is 8%?* a) $3,250 O b) $3,440 O c) $3,750 d) $3,960 14. Adams Corp's sales last year were $57,000, and its total assets were $24,000. What was its total assets turnover ratio (TATO)? a) 2.375X Ob) 0.42% O c)2.8 1)3 2X YouTube N Netflix B BMIS355_Mount le... B ARTS 350 A-Reem. ESTA305 A Mount BMS 300 15. Lina's Corp's sales last year were $652,500, its operating costs were $543,750, and its interest charges were $18,750. What was the firm's times- interest-earned (TIE) ratio? O a) 5.8% Ob) 8.5% O O c) 5.2% Od) 6.3% 16. Segma Corp's total assets at the end of last year were $622,500 and its net income was $49,125. What was its return on total assets? O a) 7.893 b) 12.678 Oc) 14% O 0) 8.99 17. Alfa Corp's stock price at the end of last year was $50.25, and its book value per share was $37.50. O a) 1.34 b) 2.4 C) 0.746 ) 1,50 18. Strong Aviation had a profit margin of 6.25%, a total assets turnover of 1.50. and an equity multiplier of 1.8. What was the firm's ROE? a) 16.88% b) 15.2% O O c) 16.00 O 0) 17:23 Tube N Netflix BBMIS355_Mount le... E ARTS 350 A-Reem... EBSTA305 A Mount- BMIS 30 19. Jane now has $187. How much would she have after 6 years if she leaves it invested at 7.5% with annual compounding? * a) $288.59 Ob) $268.80 O c) $364 O d) $245.50 20. Suppose a bond will pay $1,000 ten years from now. If the going interest rate on these 10-year bonds is 5.5%. how much is the bond worth today? * O a) $585.43 Ob) $858.43 OC) $653.20 O d) $456.30 Page 2 of 2 Back Submit