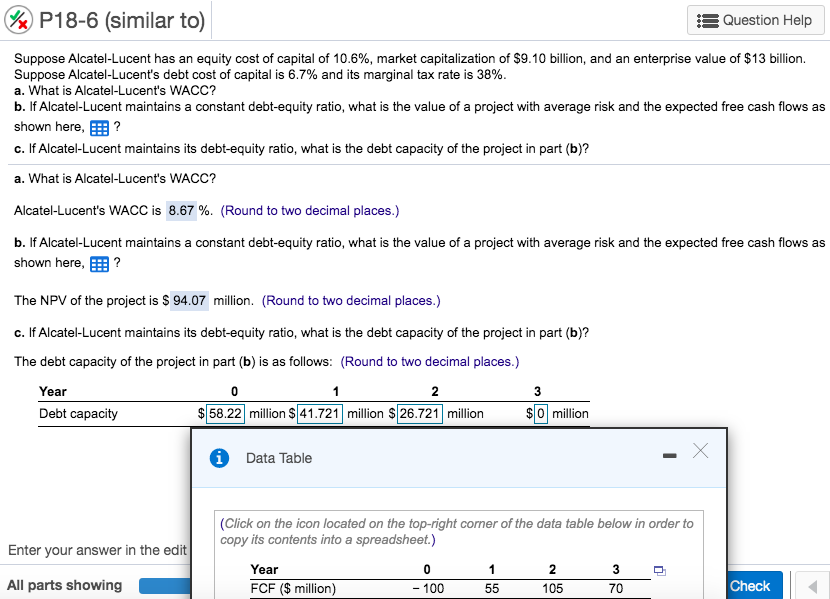

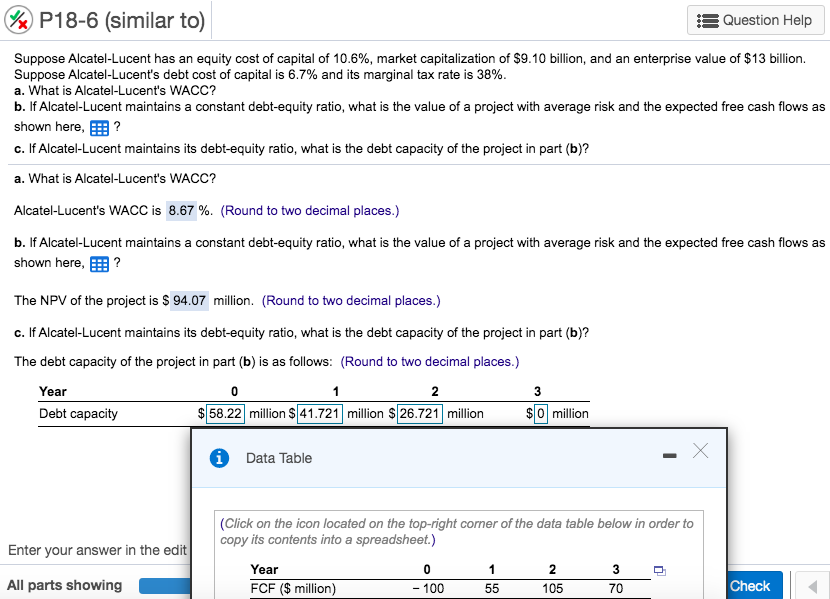

W P18-6 (similar to) 3 Question Help Suppose Alcatel-Lucent has an equity cost of capital of 10.6%, market capitalization of $9.10 billion, and an enterprise value of $13 billion. Suppose Alcatel-Lucent's debt cost of capital is 6.7% and its marginal tax rate is 38%. a. What is Alcatel-Lucent's WACC? b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, ? c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? a. What is Alcatel-Lucent's WACC? Alcatel-Lucent's WACC is 8.67 %. (Round to two decimal places.) b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, ?: ? The NPV of the project is $ 94.07 million. (Round to two decimal places.) c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? The debt capacity of the project in part (b) is as follows: (Round to two decimal places.) Year Debt capacity 2 $58.22 million $ 41.721 million $ 26.721 million 3 $0 million Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Enter your answer in the edit| All parts showing Year FCF ($ million) 1 55 2 105 3 0 - 100 7 Check W P18-6 (similar to) 3 Question Help Suppose Alcatel-Lucent has an equity cost of capital of 10.6%, market capitalization of $9.10 billion, and an enterprise value of $13 billion. Suppose Alcatel-Lucent's debt cost of capital is 6.7% and its marginal tax rate is 38%. a. What is Alcatel-Lucent's WACC? b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, ? c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? a. What is Alcatel-Lucent's WACC? Alcatel-Lucent's WACC is 8.67 %. (Round to two decimal places.) b. If Alcatel-Lucent maintains a constant debt-equity ratio, what is the value of a project with average risk and the expected free cash flows as shown here, ?: ? The NPV of the project is $ 94.07 million. (Round to two decimal places.) c. If Alcatel-Lucent maintains its debt-equity ratio, what is the debt capacity of the project in part (b)? The debt capacity of the project in part (b) is as follows: (Round to two decimal places.) Year Debt capacity 2 $58.22 million $ 41.721 million $ 26.721 million 3 $0 million Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Enter your answer in the edit| All parts showing Year FCF ($ million) 1 55 2 105 3 0 - 100 7 Check