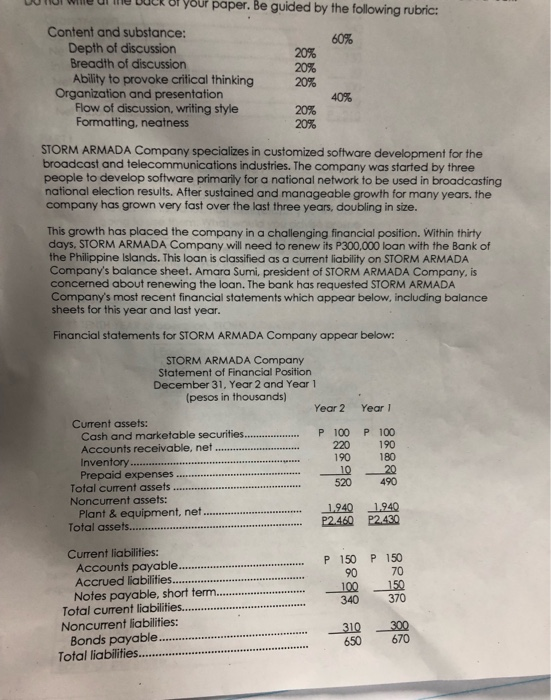

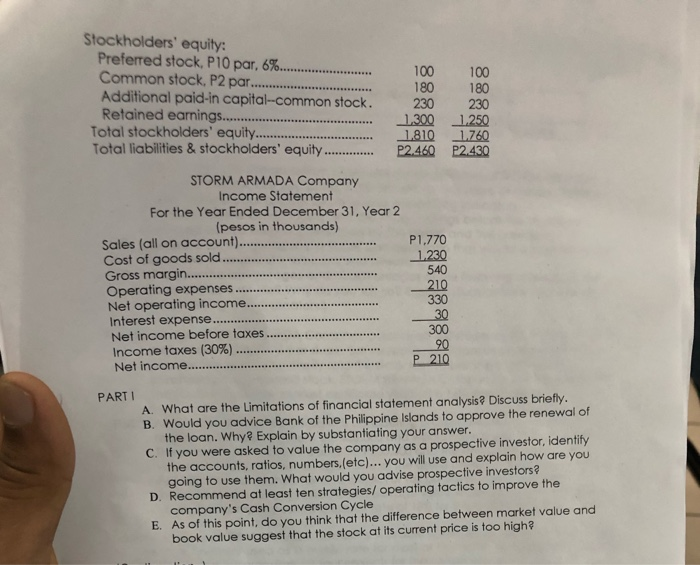

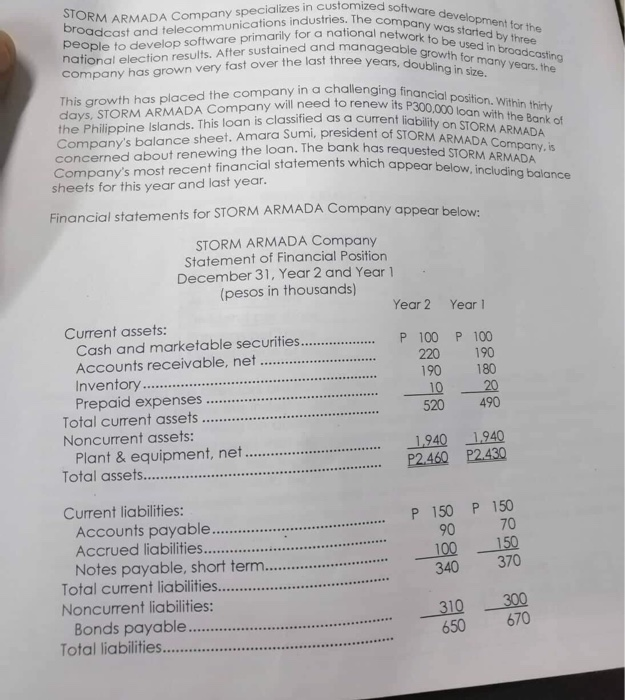

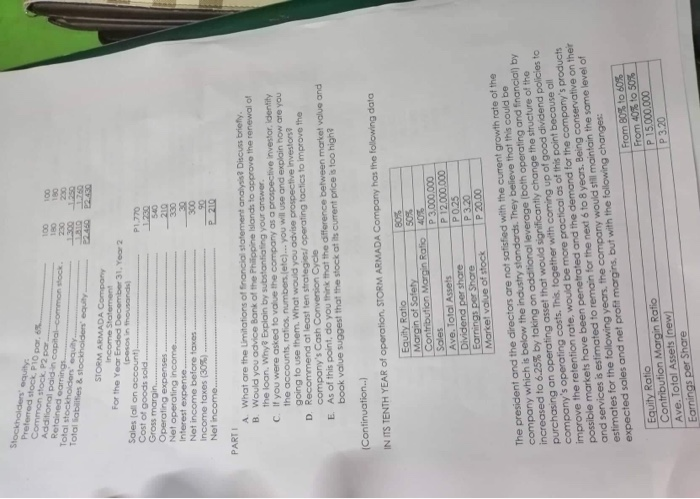

W u Weu e of your paper. Be guided by the following rubric: Content and substance: 60% Depth of discussion 20% Breadth of discussion 20% Ability to provoke critical thinking 20% Organization and presentation 40% Flow of discussion, writing style 20% Formatting, neatness 20% STORM ARMADA Company specializes in customized software development for the broadcast and telecommunications industries. The company was started by three people to develop software primarily for a national network to be used in broadcasting national election results. After sustained and manageable growth for many years, the company has grown very fast over the last three years, doubling in size. This growth has placed the company in a challenging financial position. Within thirty days, STORM ARMADA Company will need to renew its P300,000 loan with the Bank of the Philippine Islands. This loan is classified as a current liability on STORM ARMADA Company's balance sheet. Amara Sumi, president of STORM ARMADA Company, is concerned about renewing the loan. The bank has requested STORM ARMADA Company's most recent financial statements which appear below, including balance sheets for this year and last year. Financial statements for STORM ARMADA Company appear below: Year P 100 STORM ARMADA Company Statement of Financial Position December 31, Year 2 and Year 1 (pesos in thousands) Year 2 Current assets: Cash and marketable securities... .. P 100 Accounts receivable, net...... Inventory.. Prepaid expenses .............. Total current assets ..... Noncurrent assets: Plant & equipment, net ...... Total assets... 190 180 490 1.940 P2.430 70 150 370 Current liabilities: Accounts payable......... Accrued liabilities...... Notes payable, short term..... Total current liabilities...... Noncurrent liabilities: Bonds payable......... Total liabilities.......... 180 100 180 230 1.250 1.760 22.430 Stockholders' equity: Preferred stock, P10 par, 6%... Common stock, P2 par........ 100 Additional paid-in capital-common stock. 230 Retained earnings......... 1.300 Total stockholders' equity.... 1.810 Total liabilities & stockholders' equity... P2.460 STORM ARMADA Company Income Statement For the Year Ended December 31, Year 2 (pesos in thousands) Sales (all on account......... P1.770 Cost of goods sold. 1,230 Gross margin............ Operating expenses.... .... Net operating income........... Interest expense.... ........ Net income before taxes ......... Income taxes (30%) .............. Net income....... 9898989 PARTI A What are the Limitations of financial statement analysis & Discuss briefly. B. Would you advice Bank of the Philippine Islands to approve t the loan. Why? Explain by substantiating your answer. C. If you were asked to value the company as a prospective investor, identify the accounts, ratios, numbers,(etc)... you will use and explain how are you going to use them. What would you advise prospective investors D. Recommend at least ten strategies/ operating tactics to improve the company's Cash Conversion Cycle E. As of this point, do you think that the difference between market value and book value suggest that the stock at its current price is too high STORM ARMADA Company specializes in customized softu oroadcast and telecommunications industries. The com people to develop software primarily for a national netu national election results. After sustained and manageabi Company has grown very fast over the last three yeare zed software development for the The company was started by three a national network to be used in broadcasting nanageable growth for many years, the vree years, doubling in size. This growth has placed the company in a challengine days, STORM ARMADA Company will need to renew its par the Philippine Islands. This loan is classified as a current li Company's balance sheet. Amara Sumi, president of STORM concerned about renewing the loan. The bank has reques Company's most recent financial statements which appearbe sheets for this year and last year. hallenging financial position. Within thirty o renew its P300,000 loan with the Bank of as a current liability on STORM ARMADA president of STORM ARMADA Company, is e bank has requested STORM ARMADA tatements which appear below, including balance Financial statements for STORM ARMADA Company appear below: Year 1 P STORM ARMADA Company Statement of Financial Position December 31, Year 2 and Year 1 (pesos in thousands) Year 2 Current assets: Cash and marketable securities..... P 100 Accounts receivable, net............. 220 190 Inventory..... Prepaid expenses .... 10 520 Total current assets. Noncurrent assets: Plant & equipment, net..... Total assets... 100 190 180 20 490 P 150 P 150 90 70 Current liabilities: Accounts payable..... Accrued liabilities..... Notes payable, short term.. Total current liabilities.. ......... Noncurrent liabilities: Bonds payable.............. Total liabilities............. Stockholders' equity Preferred stock. PIO por Common stock 2 DOT Additional paid in cool como Retained earnings Total stockholders' say Total lobes & stockholders' equity 1.300 1750 22460 22.430 STORM ARMADA Company Income Statement For the Year Ended December 31. Yor2 (posos in thousands Sales loll on account) P1.770 Cost of goods sold... 17 Gross margin- Operating expenses.. 219 Net operating income.. Interest expense. Net income before taxes 300 Income taxes (305) 2210 Not income PART! A What are the limitations of financial statement analysis Discuss briefly. B. Would you advice Bank of the Philippine Islands to approve the renewal of the loan, Why Explain by substantiating your answer C. If you were asked to value the company as a prospective investor. Identity the accounts, ratios, numbers.etc).-- you will use and explain how are you going to use them. What would you advise prospective investors D. Recommend at least ten strategies Operating tactics to improve the company's Cash Conversion Cycle E. As of this point, do you think that the difference between market value and book value suggest that the stock at its current price is too high (Continuation..) IN ITS TENTH YEAR of operation, STORM ARMADA Company has the following data 807 P 3.000.000 P 12.000.000 P 3.20 Equity Ratio Margin of Safety Contribution Margin Ratio 405 Sales Ave. Total Assets Dividend per share PO 25 Earnings per Shore Market value of stock P 20.00 The president and the directors are not satisfied with the current growth rate of the company which is below the industry standards. They believe that this could be increased to 6.25% by taking on additional leverage (both operating and financial) by purchasing an operating asset that would significantly change the structure of the company's operating costs. This together with coming up of good dividend policies to improve the retention rate, would be more practical as of this point because all possible markets have been penetrated and the demand for the company's products and services is estimated to remain for the next 6 to 8 years. Being conservative on the estimates for the following years. The company would still maintain the same level of expected soles and net profit margins, but with the following changes: Equity Ratio From 80% to 60% Contribution Margin Ratio From 40 to 50% Ave. Total Assets (new) P 15.000.000 Earnings per Share P 3.20