Answered step by step

Verified Expert Solution

Question

1 Approved Answer

wacc =10% CAPITAL BUDGETING TECHNIQUES 1. Evaluate the implications of the company's capital budgeting decision for the two futures projects after the pandemic (covid-19). Project

wacc =10%

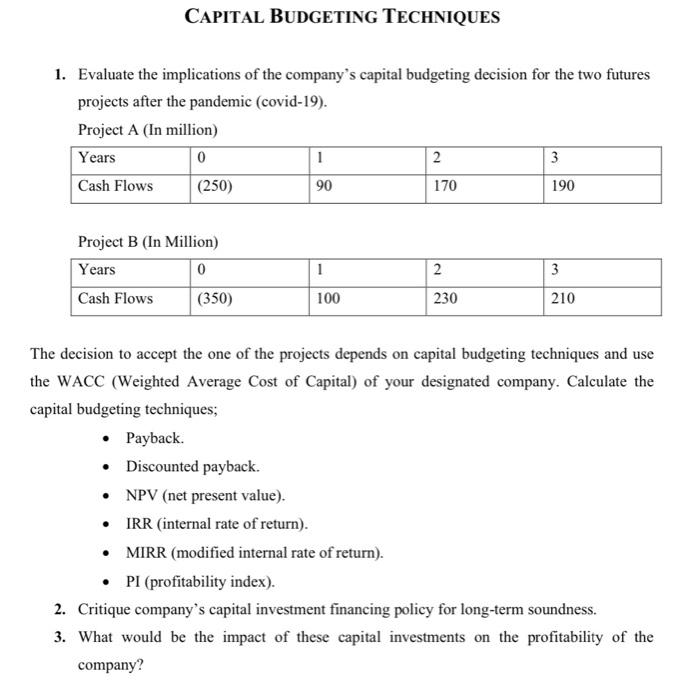

CAPITAL BUDGETING TECHNIQUES 1. Evaluate the implications of the company's capital budgeting decision for the two futures projects after the pandemic (covid-19). Project A (In million) Years 0 1 2 3 Cash Flows (250) 90 170 190 2 Project B (In Million) Years 0 Cash Flows (350) 1 2. 3 100 230 210 The decision to accept the one of the projects depends on capital budgeting techniques and use the WACC (Weighted Average Cost of Capital) of your designated company. Calculate the capital budgeting techniques; Payback. Discounted payback. NPV (net present value). IRR (internal rate of return). MIRR (modified internal rate of return). PI (profitability index). 2. Critique company's capital investment financing policy for long-term soundness. 3. What would be the impact of these capital investments on the profitability of the company Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started