Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WACC is the Weighted Average Cost Of Capital APV is Adjusted Present Value Solutions given by professor a) r* = .1057 b) APV = 73.9986

WACC is the Weighted Average Cost Of Capital

APV is Adjusted Present Value

Solutions given by professor

a) r* = .1057

b) APV = 73.9986

c) APV = 73.9986 , r = .1158

What are the steps by steps solution to this problem? Thank you

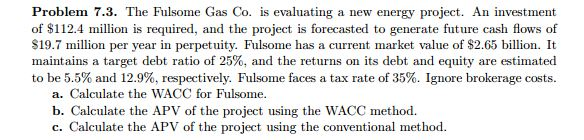

Problem 7.3. The Fulsome Gas Co. is evaluating a new energy project. An investment of $112.4 million is required, and the project is forecasted to generate future cash flows of $19.7 million per year in perpetuity. Fulsome has a current market value of $2.65 billion. It maintains a target debt ratio of 25%, and the returns on its debt and equity are estimated to be 5.5% and 12.9%, respectively. Fulsome faces a tax rate of 35%. Ignore brokerage costs. a. Calculate the WACC for Fulsome. b. Calculate the APV of the project using method. Calculate the APV of the project using the conventional methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started