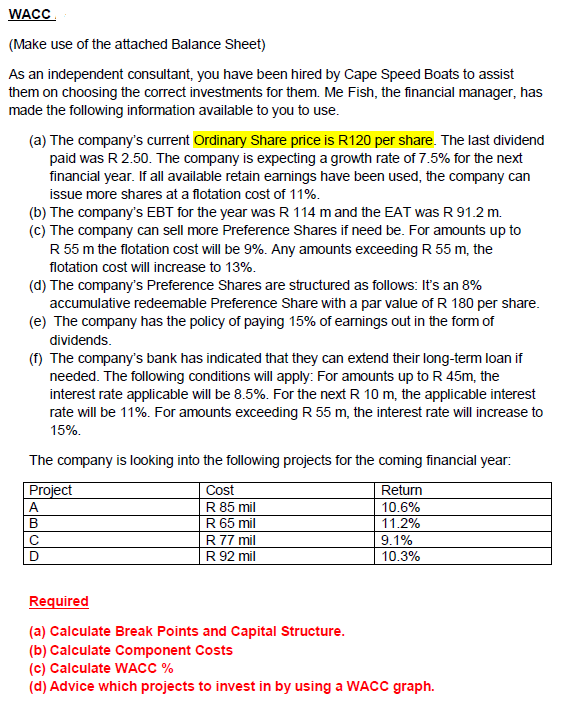

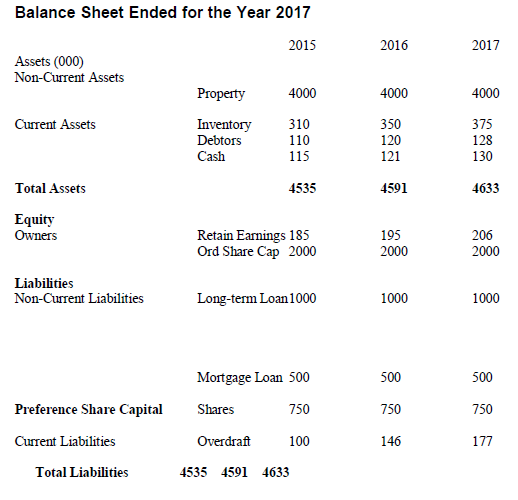

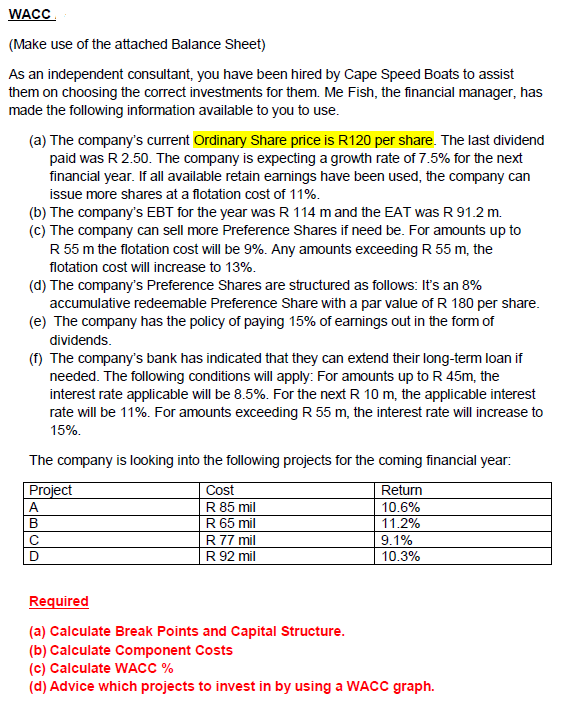

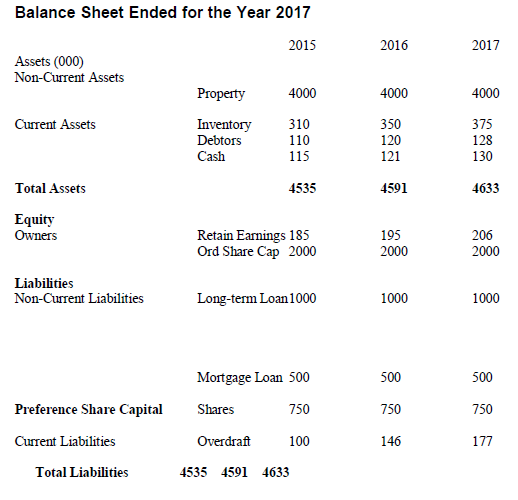

WACC (Make use of the attached Balance Sheet) As an independent consultant, you have been hired by Cape Speed Boats to assist them on choosing the correct investments for them. Me Fish, the financial manager, has made the following information available to you to use. (a) The company's current Ordinary Share price is R120 per share. The last dividend paid was R 2.50. The company is expecting a growth rate of 7.5% for the next financial year. If all available retain earnings have been used, the company can issue more shares at a flotation cost of 11%. (b) The company's EBT for the year was R 114 m and the EAT was R 912 m. (C) The company can sell more Preference Shares if need be. For amounts up to R 55 m the flotation cost will be 9%. Any amounts exceeding R 55 m, the flotation cost will increase to 13%. (d) The company's Preference Shares are structured as follows: It's an 8% accumulative redeemable Preference Share with a par value of R 180 per share. (e) The company has the policy of paying 15% of earnings out in the form of dividends. (1) The company's bank has indicated that they can extend their long-term loan if needed. The following conditions will apply: For amounts up to R 45m, the interest rate applicable will be 8.5%. For the next R 10 m, the applicable interest rate will be 11%. For amounts exceeding R 55 m, the interest rate will increase to 15% The company is looking into the following projects for the coming financial year: Project A B D Cost R 85 mil R 65 mil R77 mil R 92 mil Return 10.6% 11.2% 9.1% 10.3% Required (a) Calculate Break Points and Capital Structure. (b) Calculate Component Costs (c) Calculate WACC % (d) Advice which projects to invest in by using a WACC graph. Balance Sheet Ended for the Year 2017 2015 2016 2017 Assets (000) Non-Current Assets 4000 4000 4000 Current Assets Property Inventory Debtors Cash 350 310 110 115 120 375 128 130 121 4535 4591 4633 Total Assets Equity Owners Retain Earnings 185 Ord Share Cap 2000 195 2000 206 2000 Liabilities Non-Current Liabilities Long-term Loan 1000 1000 1000 Mortgage Loan 500 500 500 Preference Share Capital Shares 750 750 750 Current Liabilities Overdraft 100 146 177 Total Liabilities 4535 4591 4633 WACC (Make use of the attached Balance Sheet) As an independent consultant, you have been hired by Cape Speed Boats to assist them on choosing the correct investments for them. Me Fish, the financial manager, has made the following information available to you to use. (a) The company's current Ordinary Share price is R120 per share. The last dividend paid was R 2.50. The company is expecting a growth rate of 7.5% for the next financial year. If all available retain earnings have been used, the company can issue more shares at a flotation cost of 11%. (b) The company's EBT for the year was R 114 m and the EAT was R 912 m. (C) The company can sell more Preference Shares if need be. For amounts up to R 55 m the flotation cost will be 9%. Any amounts exceeding R 55 m, the flotation cost will increase to 13%. (d) The company's Preference Shares are structured as follows: It's an 8% accumulative redeemable Preference Share with a par value of R 180 per share. (e) The company has the policy of paying 15% of earnings out in the form of dividends. (1) The company's bank has indicated that they can extend their long-term loan if needed. The following conditions will apply: For amounts up to R 45m, the interest rate applicable will be 8.5%. For the next R 10 m, the applicable interest rate will be 11%. For amounts exceeding R 55 m, the interest rate will increase to 15% The company is looking into the following projects for the coming financial year: Project A B D Cost R 85 mil R 65 mil R77 mil R 92 mil Return 10.6% 11.2% 9.1% 10.3% Required (a) Calculate Break Points and Capital Structure. (b) Calculate Component Costs (c) Calculate WACC % (d) Advice which projects to invest in by using a WACC graph. Balance Sheet Ended for the Year 2017 2015 2016 2017 Assets (000) Non-Current Assets 4000 4000 4000 Current Assets Property Inventory Debtors Cash 350 310 110 115 120 375 128 130 121 4535 4591 4633 Total Assets Equity Owners Retain Earnings 185 Ord Share Cap 2000 195 2000 206 2000 Liabilities Non-Current Liabilities Long-term Loan 1000 1000 1000 Mortgage Loan 500 500 500 Preference Share Capital Shares 750 750 750 Current Liabilities Overdraft 100 146 177 Total Liabilities 4535 4591 4633