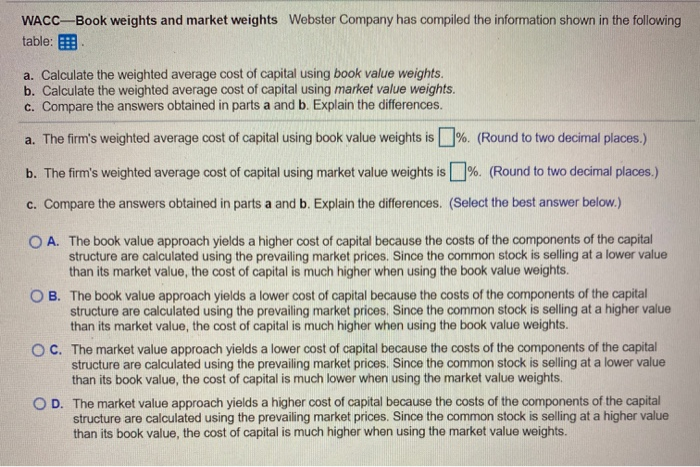

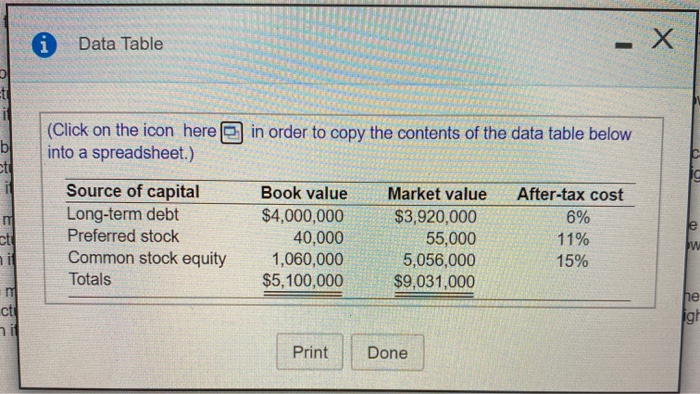

WACC-Book weights and market weights Webster Company has compiled the information shown in the following table: a. Calculate the weighted average cost of capital using book value weights. b. Calculate the weighted average cost of capital using market value weights. C. Compare the answers obtained in parts a and b. Explain the differences. a. The firm's weighted average cost of capital using book value weights is []%. (Round to two decimal places.) b. The firm's weighted average cost of capital using market value weights is 1%. (Round to two decimal places.) c. Compare the answers obtained in parts a and b. Explain the differences. (Select the best answer below.) O A. The book value approach yields a higher cost of capital because the costs of the components of the capital structure are calculated using the prevailing market prices. Since the common stock is selling at a lower value than its market value, the cost of capital is much higher when using the book value weights. OB. The book value approach yields a lower cost of capital because the costs of the components of the capital structure are calculated using the prevailing market prices. Since the common stock is selling at a higher value than its market value, the cost of capital is much higher when using the book value weights. OC. The market value approach yields a lower cost of capital because the costs of the components of the capital structure are calculated using the prevailing market prices. Since the common stock is selling at a lower value than its book value, the cost of capital is much lower when using the market value weights, OD. The market value approach yields a higher cost of capital because the costs of the components of the capital structure are calculated using the prevailing market prices. Since the common stock is selling at a higher value than its book value, the cost of capital is much higher when using the market value weights. Data Table . th (Click on the icon here into a spreadsheet.) in order to copy the contents of the data table below b ctt 630) it Source of capital Long-term debt Preferred stock Common stock equity Totals Book value $4,000,000 40,000 1,060,000 $5,100,000 Market value $3,920,000 55,000 5,056,000 $9,031,000 After-tax cost 6% 11% 15% W nif m ct: he igl Print Done