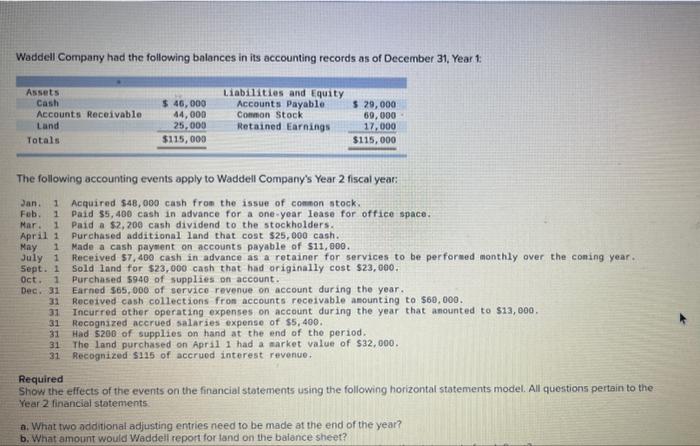

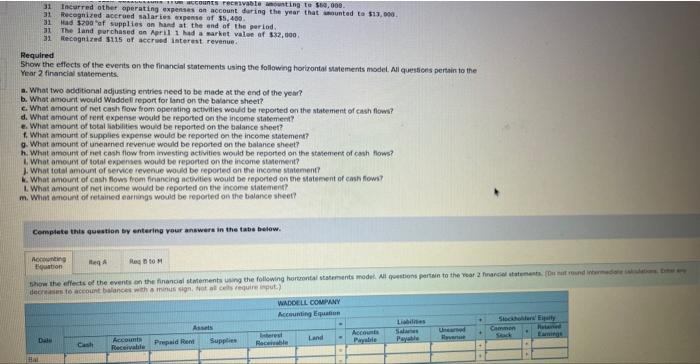

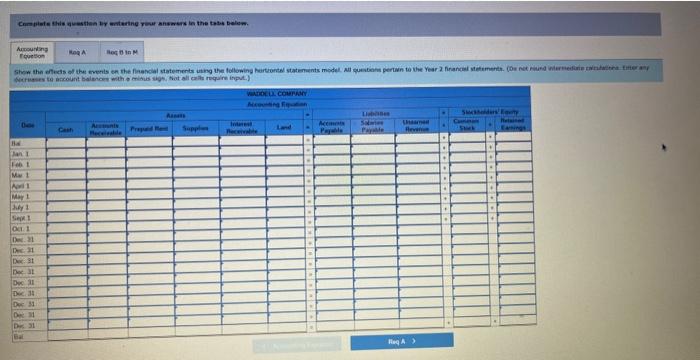

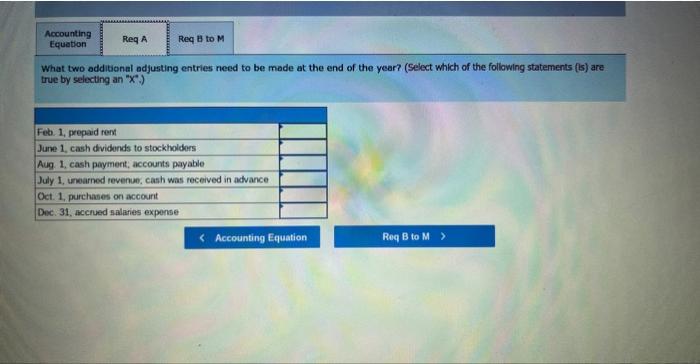

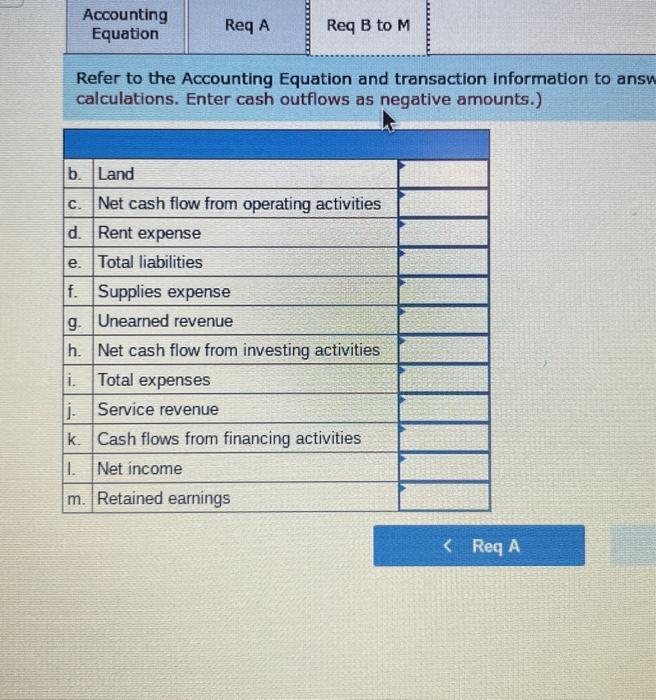

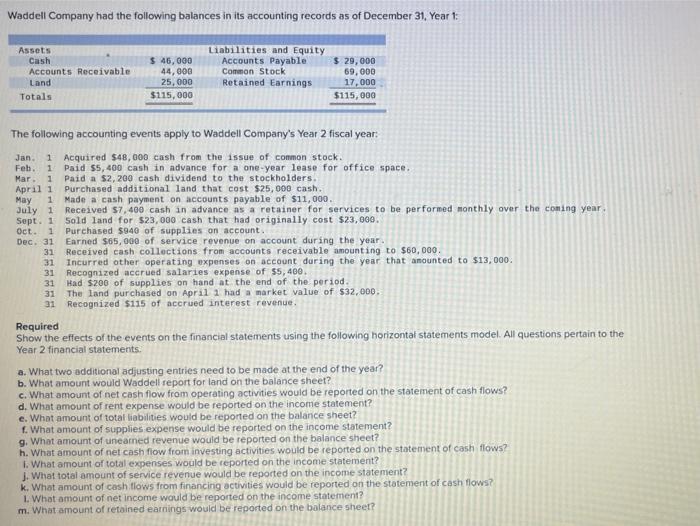

Waddell Company had the following balances in its accounting records as of December 31, Year 1: The following accounting events apply to Waddell Company's Year 2 fiscal year: 2an. 1 Acquired $48,000 cash from the issue of common stock. Feb. 1 Paid $5,400 cash in advance for a one-year lease for office space. Mar. 1 Paid a $2,200 cash dividend to the stockholders. April 1 Purchased additional land that cost 325,000 cash. May 1 Made a cash paysent on accounts payable of $11,000. July 1 Received $7,400 cash in advance as a retainer for services to be perforwed monthly over the coning year. 5ept. 1 sold land for $23,000 cash that had originally cost $23,000. oct. 1 Purchased 5940 of supplies on account. Dec. 31 Earned $65,000 of service revenue on account during the year. 31 Received cash collections fron accounts receivable anounting to $60,000. 31 Incurred other operating expenses on account during the year that anounted to $13,000. Recognized accrued salaries expense of $5,400. Had 5200 of supplies on hand at the end of the period. 31 The land purchased on Apri1 1 had a market value of $32,000. 31 Recognized $115 of accrued interest revenue. Required Show the effects of the events on the financial stotements using the following horizontal statements model. All questions pertain to the Year 2 financial stotements. 31 Incurred other pperating expensas an account daring the year that anaunted ta s13, 090. 31. Fecegnized accrued salaries enpense an $5,409. 31. Mad sopg of supplies on hand at the end of the poriod. 31 The land garchased on April 1 had a market valee of 382 , doo. 31. liecognizend 3115 of aceried isterat revenus. Required Show the effects of the everits on the financial statements using the following horizontal statements model. Al questicis pertain to the Year 2 financial statements. a. What two additional adjusting crtries need to be made at the end of the yeir? b. What anourit would Waddell report for Gand on the balance sheel? c. What amount of not cash fiow from operating activities would be reported on the statement of cash flows? d. What amount of rent expense wreuld be reported on the incoene statement? e. What amount of total latslities would be reported on the balance sheet? 1. What arnount of supplies expense would be reported on the income statement? 9. What amount of unearned revenue would be reported on the balance sheet? h. What amount of net cash flow from imesting activities would be reported on the stasemert of cash foas? 1. What amoum of iotal expenses would be reported on the inconie stalement? 1. What total amount of service reverue would be reporied on the income satement? 1. What amount of cash flows from financing actities would be reported on the saternent of cash flows? 1. What amount of net income woudd be reported on the income siateanent? m. What amount of retained earnings would be reported on the balance sheet? Cemptete this question by entering your answere in the tabe belew. Cna piof this a estion by monterting rour answers in the tatos beles. What two additional adjusting entries need to be mode at the end of the year? (Select which of the following statements (is) are true by selecting an " X.) Refer to the Accounting Equation and transaction information to ansv calculations. Enter cash outflows as negative amounts.) Waddell Company had the following balances in its accounting records as of December 31, Year 1: The following accounting events apply to Waddell Company's Year 2 fiscal year: Jan. I Acquired $48,000 cash from the issue of conmon stock. Feh. 1 Paid 55,400 cash in advance for a one-year lease for office space. Mar. 1 Paid a \$2, 200 cash dividend to the stockholders. April 1 Purchased additional land that cost 525,000 cash. May 1 Made a cash payment on accounts payable of $11,000. July 1 Received 57,400 cash in advance as a retainer for services to be performed monthly over the coning year. Sept. 1 sold land for $23,000 cash that had originally cost $23,000. oct. 1 Purchased $940 of supplies on account. Dec. 31 Earned $65,000 of service revenue on account during the year. 31 Received cash collections from accounts receivable amounting to $60,000. 31 Incurred other operating expenses on account during the year that anounted to $13,000. 31 Recognized accrued salaries expense of $5,400. 31 Had $200 of supplies on hand at the end of the period. 31 The land purchased on Apri1 1 had a market value of $32,000. 31 Recognized $115 of acerued interest revenue. Required Show the effects of the events on the financial statements using the following horizontal statements model. All questions pertain to the Year 2 financial statements. a. What two additional adjusting entries need to be made at the end of the year? b. What amount would Waddell report for land on the balance sheet? c. What amount of net cash flow from operating activities would be reported on the statement of cash flows? d. What amount of rent expense would be reported on the income statement? e. What amount of total liabilities would be reported on the balance sheet? f. What amount of supplies expense would be reported on the income statement? 9. What amount of unearned revenue would be reported on the balance sheet? h. What amount of net cash fiow from investing activities would be reported on the statement of cash flows? 1. What amount of total expenses would be reported on the income statement? 1. What total amount of service revenue would be reported on the income statement? k. What amount of cash tlows from financing activities would be reported on the statement of cash llows? 1. What amount of net income would be reported on the income statement? m. What amount of retained earnings would be reported on the bolance sheet