Question

Wage rate (dollars per hour) 12.00 10.75 10.00 0 LS+ tax LS LD 37 40 Quantity of labor (hours per week) 10) Assume that

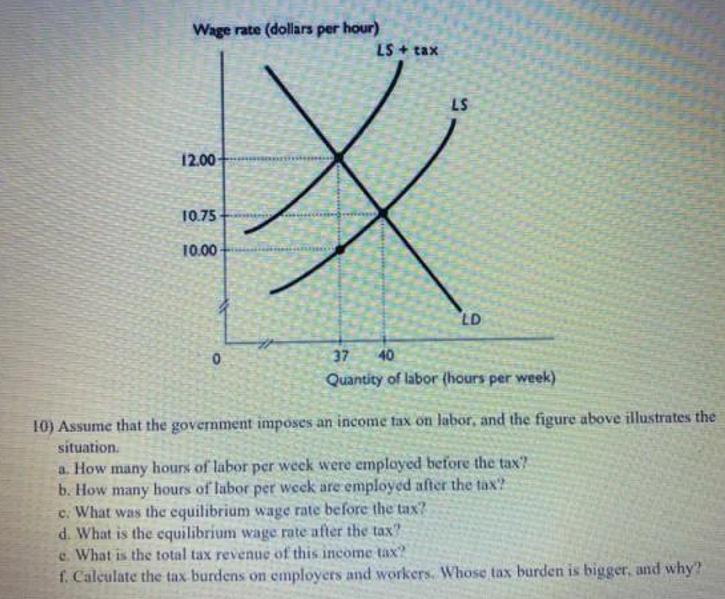

Wage rate (dollars per hour) 12.00 10.75 10.00 0 LS+ tax LS LD 37 40 Quantity of labor (hours per week) 10) Assume that the government imposes an income tax on labor, and the figure above illustrates the situation. a. How many hours of labor per week were employed before the tax? b. How many hours of labor per week are employed after the tax? c. What was the equilibrium wage rate before the tax? d. What is the equilibrium wage rate after the tax? e. What is the total tax revenue of this income tax? f. Calculate the tax burdens on employers and workers. Whose tax burden is bigger, and why?

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a How many hours of labor per week were employed before the tax Before the tax40 hours of labor were ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations Of Economics

Authors: Robin Bade, Michael Parkin

9th Edition

9780135897478, 0135897475

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App