Answered step by step

Verified Expert Solution

Question

1 Approved Answer

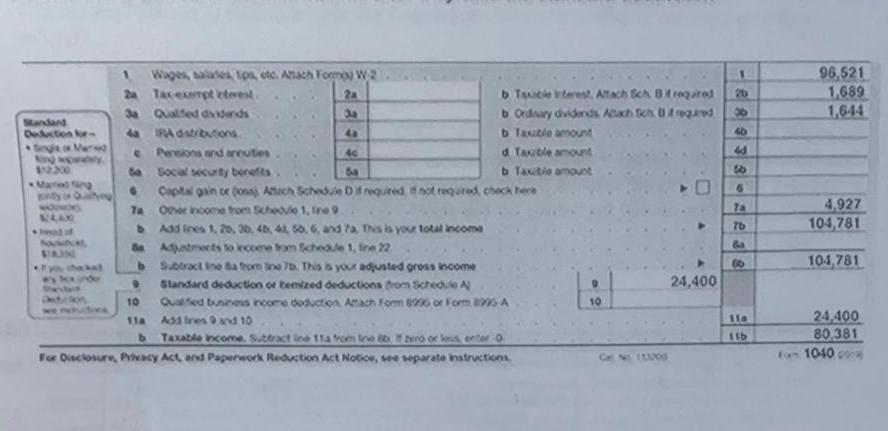

Wages, salaries, tops, etc. Attach Form W-2 1 96,521 2a Tax-exempt interest. 2a b. Tauble interest. Attach Sch Bt required Ja Qualified dividends 3a

Wages, salaries, tops, etc. Attach Form W-2 1 96,521 2a Tax-exempt interest. 2a b. Tauble interest. Attach Sch Bt required Ja Qualified dividends 3a Mandand Deduction for 4 IRA distributions. 43 b. Ordinary dividends Atach Sch B required b Taxable amount e Pensions and accuties $12.200 3 Social security benefits 40 54 d Table amount b. Taxible amount Maned ing G Capital gain or posaj Artech Schedule D if required if not required, check here D Ta Other income from Schedule 1, Ire 9 Ta 884A0 b Add Ines 1, 20, 36, 4b, 41, 56, 6, and 7a. This is your total income Ba Adjustments to income from Schedule 1, line 22 & 118.350 al b Subtract Ine Sa from line 7b. This is your adjusted gross income 289382238 1,689 1,644 4,927 104,781 104,781 9 Standard deduction or temized deductions from Schedule Aj 24,400 10 11a Qualified business income doduction Amach Form 8996 or Form 8996 A Add Ires 9 and 10 10 b Taxable income. Subtract ine 11a from Ine b zero or less enter-0 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions 11a 24,400 116 80,381 form 1040

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started