Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Waggle Corp decides it's going to engage in a complete liquidation. At the time of the liquidation is has assets with a FMV of

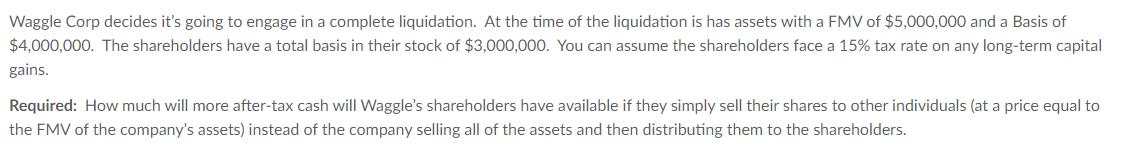

Waggle Corp decides it's going to engage in a complete liquidation. At the time of the liquidation is has assets with a FMV of $5,000,000 and a Basis of $4,000,000. The shareholders have a total basis in their stock of $3,000,000. You can assume the shareholders face a 15% tax rate on any long-term capital gains. Required: How much will more after-tax cash will Waggle's shareholders have available if they simply sell their shares to other individuals (at a price equal to the FMV of the company's assets) instead of the company selling all of the assets and then distributing them to the shareholders.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

If Waggle Corp decides to sell its assets and distribute the proceeds to its shareholders the shareholders would be subject to tax on the capital gains resulting from the sale of the assets However if the shareholders simply sell their shares to other individuals at a price equal to the fair market value FMV of the companys assets they would realize a capital gain ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started