Question

Walden Company makes and sells wooden furniture. A recent fire destroyed most of the companys accounting record. Mike Lawson, the manager of Walden Company, needs

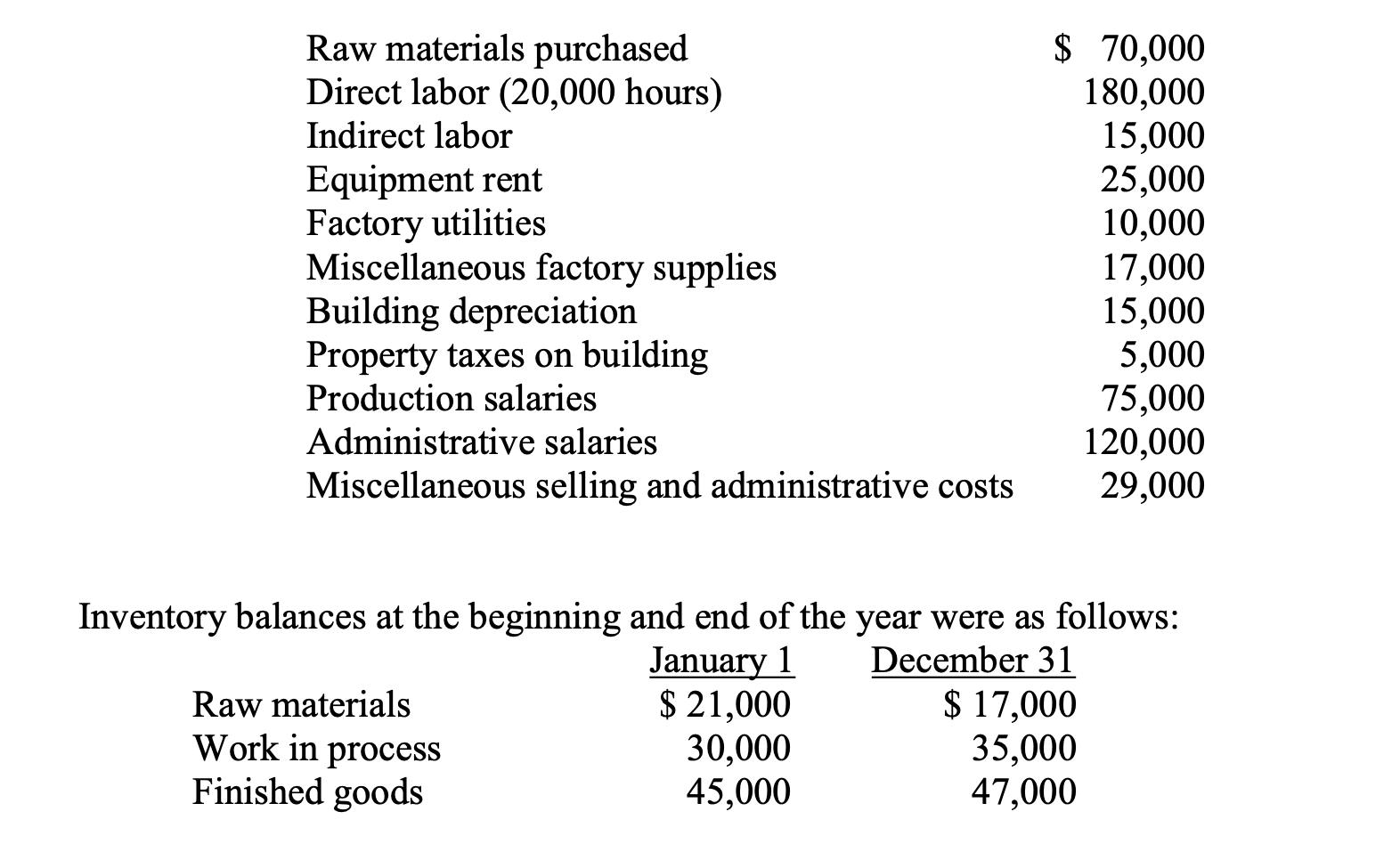

Walden Company makes and sells wooden furniture. A recent fire destroyed most of the company’s accounting record. Mike Lawson, the manager of Walden Company, needs to prepare an income statement for an upcoming meeting with the company’s board of directors. Because the key accounts are not usable, Mike asked the company’s accountants to obtain necessary information from other sources. After contacting various sources, the company has collected the following information about its activities for 2015. During the year 2015, the company's sales amounted to $600,000. The costs incurred by the company in 2015 were as follows:

About sixty percent of the factory building was devoted to manufacturing operations, so 60 percent of building depreciation and property taxes is treated as a factory cost. The company was subject to an income tax rate of 30 percent.

Required

Compute the following for the company for 2015:

A. Raw materials consumed

B. Factory overhead incurred

C. Cost of furniture manufactured

D. Cost of furniture sold

E. Selling and administrative expenses incurredPrepare a summary income statement for Walden Company for 2015.

4

WALDEN COMPANY (B)

Refer to the Walden (A) case.

One of the jobs that Walden completed during the year was for a furniture retailer who ordered a batch of futon frames. Direct materials consumed for this job amounted to $7,000. Three thousand hours of direct labor were spent on the job, at a cost of $20,000. Per the terms of the contract, the purchaser was to pay Walden the cost of making the frames plus a profit of twenty percent of the cost.

Required

Determine the price for the futons, according to the terms of the contract.

Raw materials purchased Direct labor (20,000 hours) Indirect labor Equipment rent Factory utilities Miscellaneous factory supplies Building depreciation Property taxes on building Production salaries $ 70,000 180,000 15,000 25,000 10,000 17,000 15,000 5,000 75,000 120,000 29,000 Administrative salaries Miscellaneous selling and administrative costs Inventory balances at the beginning and end of the year were as follows: January 1 $ 21,000 30,000 45,000 December 31 $ 17,000 35,000 47,000 Raw materials Work in process Finished goods

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answer Step by Step Explanation ARaw materials consumed 74000 B Factory overhead incurred 154000 C C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started