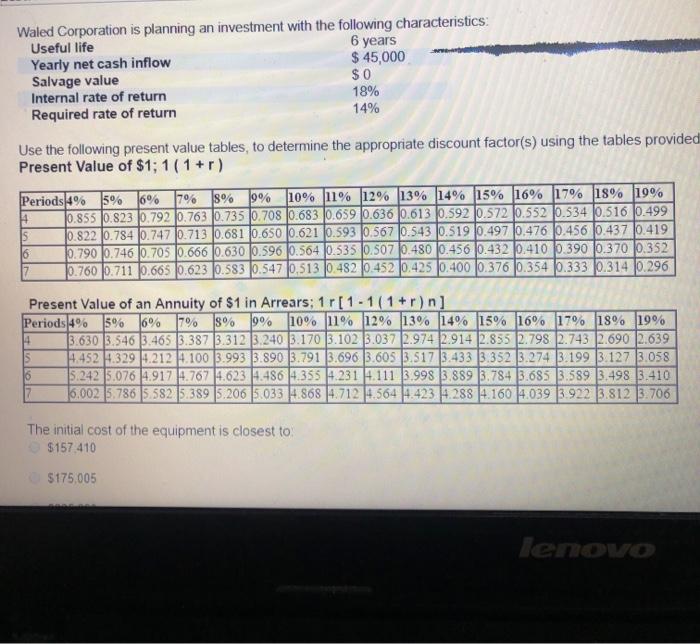

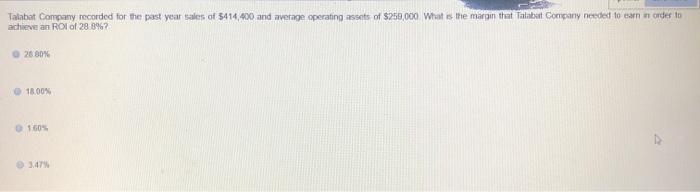

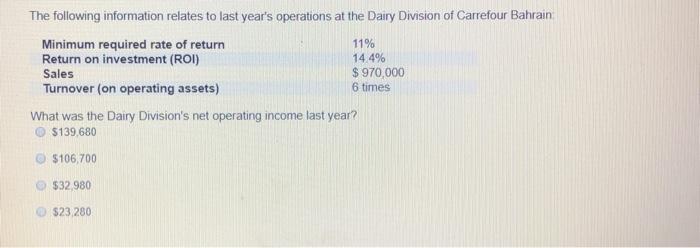

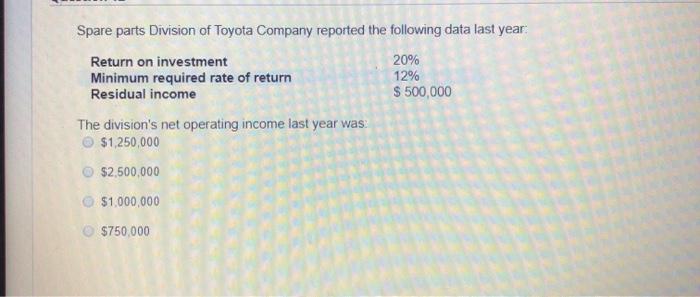

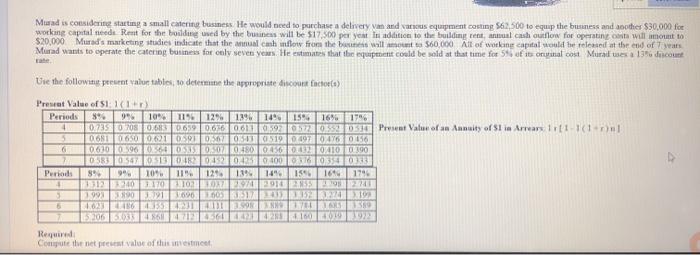

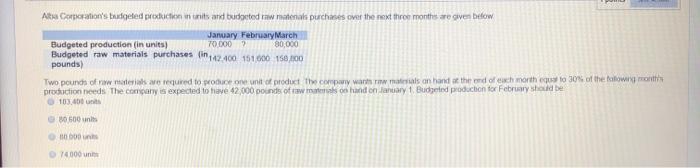

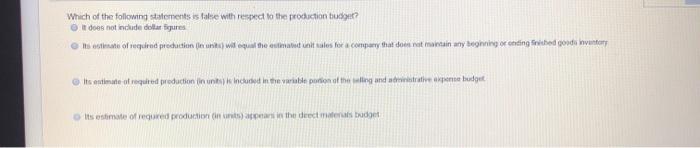

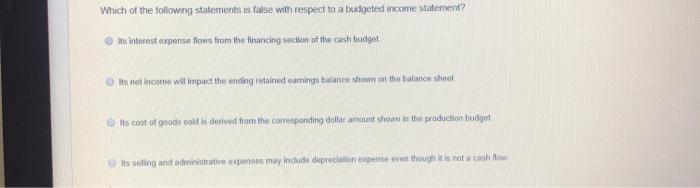

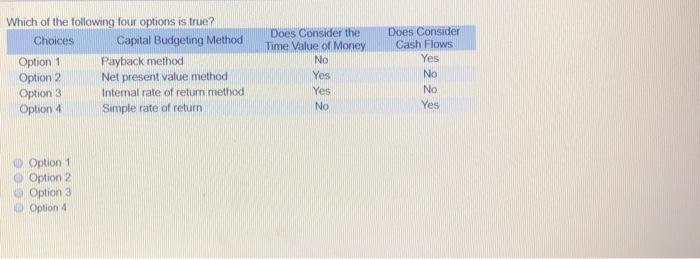

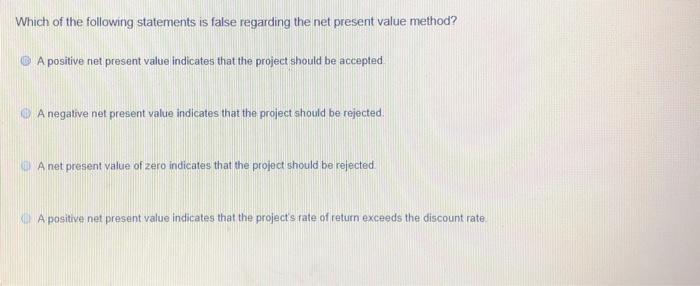

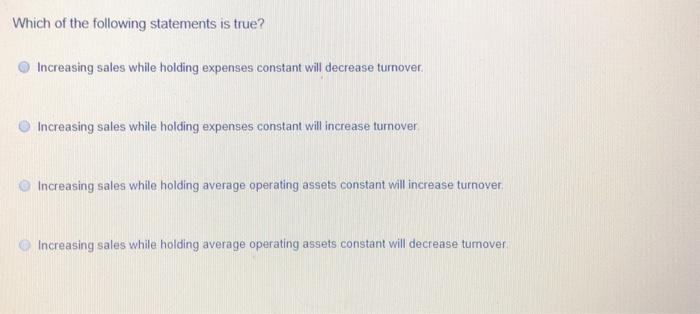

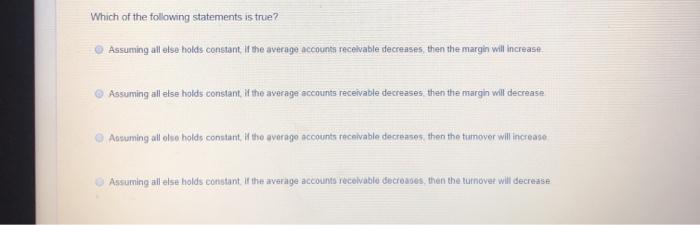

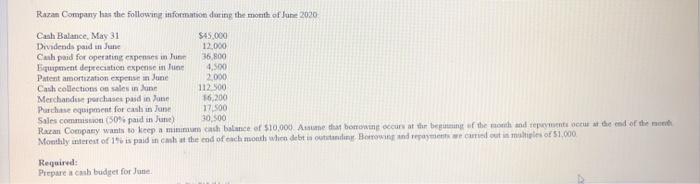

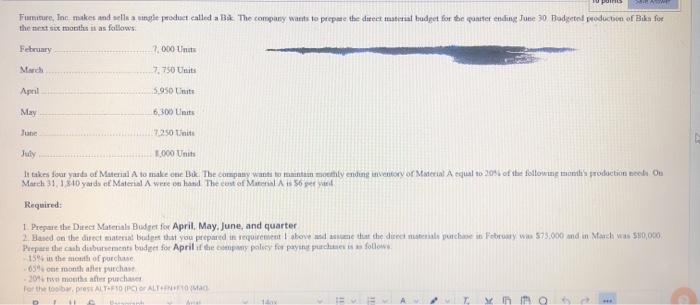

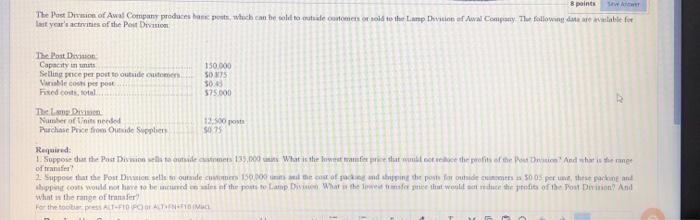

Waled Corporation is planning an investment with the following characteristics Useful life 6 years Yearly net cash inflow $ 45,000 Salvage value $0 Internal rate of return 18% Required rate of return 14% Use the following present value tables, to determine the appropriate discount factor(s) using the tables provided Present Value of $1;1(1+r) Periods 4% 5% 16% 796 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 0.855 10.823 0.792 10.763 0.735 0.708 0.683 10.659 0.636 0.613 10.592 0.572 0.552 10.534 0.516 0.499 IS 10.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 10.476 10.456 0.437 0.419 16 0.790 0.746 0.705 0.666 0.630 10.596 0.564 0.535 0.507 10.480 0.456 0.432 0,410 0.390 0.370 0.352 17 10.760 0.711 0.665 0.623 0.5830.547 0,513 0.482 0.452 0,425 0.400 0.376 0.354 0.333 0.314 0.296 4 Present Value of an Annuity of $1 in Arrears; 10[1-1(1+r)n] Periods 4% 3% 16% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 13.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 16 5:2425.076 4.917 4.767 4.623 1.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 16.002 5.786 5 582 5.389 5.206 5.033 4.868 4.712 4.564 4423 4.288 4.160 4.039 3.922 3.812 3.706 The initial cost of the equipment is closest to $157 410 $175,005 lenovo Talabat Company recorded for the past year sales of 414,400 and average operating assets of $259,000 What is the margin that Talabit Company needed to earn in ander to achieve an ROI of 28.8% 28 80% 18.00% 160 3.47 The following information relates to last year's operations at the Dairy Division of Carrefour Bahrain Minimum required rate of return 11% Return on investment (ROI) 14.4% Sales $ 970,000 Turnover (on operating assets) What was the Dairy Division's net operating income last year? $139,680 $106,700 6 times $32.980 $23,280 Spare parts Division of Toyota Company reported the following data last year Return on investment 20% Minimum required rate of return 12% Residual income $ 500,000 The division's net operating income last year was $1,250,000 $2,500,000 $1,000,000 50.000 Murad is considere starting a small catering business. He would need to purchase a delivery van anderes equipment costing 562 500 to equip the business and another $30,000 for working capital de Rent for the boldogwed by the business will be $17.500 per yest Indition to the building rental cash outflow for operating will mount to $20,000 Murad's marketing studies indicate that the cash flow from the besvall amount $60,000 Alt of working capital would be released at the end of years Murad wants to operate the catering business for only seven years. He estimate that the equipment could be sold at that time for 5 tisol cost Muralesa 136 dicunt Use the following present valur tables to determine the appropriate discount factors) Preset Vale of 1:11 Periods 89 996 10% 115 1294 1996 14 15 1996 0735 708 0.613 069 0678 0.61 4.92 02 033 030 Pret Value of an Annuity of S1 in Arrears 11011cm 5 068106500621010367105105190897110476 0856 6 0.630023960364050190204560210.100290 058300130204529.000 1033 Periods 8 10 11 129 13% 14" 1546 1614 1795 + 10 TO 10:20 2016 5 3991307676760 5 02869A139 2006 INDO Required Compte tenetest value of this mestment Alte Comcation's budgeted prextraction in this and budgeted raw matenaks purchases over the next three months are given below January February March Budgeted production (in units) 70.000 80,000 Budgeted raw materials purchases (in 142.400 15000 158.100 pounds) Two pounds of wisqured to produce one unit of product the company want to materials on and other of ch month us o 30% of the following months production needs The concany is expected to have 42 000 pounds of time and on January 1 Budgeted production for February should be 103.400 0500 HD 74000 un Which of the following statements is false with respect to the production budget? It does not include dollargures state of pred precation In unh) will the time it tales for a company that does not maintain any beginning or ending the good nentory Its aimate of required production in units included in the variable portion of the wingid artive pot budget Its estimate ofrecured production in the decades budget Which of the following statements is false with respect to a budgeted income statement? In interes4 expense flows from the financing section of the cash budget Its not income will impact the ending retained earning balance shown on the balance sheet It cost of goods sold is derived from the corresponding dollar amount shown in the production budget Isseling and administrative expenses may include depreciation expense even though it is not a cash flow Which of the following four options is true? Choices Capital Budgeting Method Option 1 Payback method Option 2 Net present value method Option 3 Internal rate of retum method Option 4 Simple rate of return Does Consider the Time Value of Money No Yes Yes No Does Consider Cash Flows Yes No No Yes Option 1 Option 2 Option 3 Option 4 Which of the following statements is false regarding the net present value method? A positive net present value indicates that the project should be accepted A negative net present value indicates that the project should be rejected. A net present value of zero indicates that the project should be rejected A positive net present value indicates that the projects rate of return exceeds the discount rate Which of the following statements is true? Increasing sales while holding expenses constant will decrease turnover. Increasing sales while holding expenses constant will increase turnover Increasing sales while holding average operating assets constant will increase turnover Increasing sales while holding average operating assets constant will decrease turnover Which of the following statements is true? Assuming all else holds constant if the average accounts receivable decreases, then the margin will increase Assuming all else holds constant. If the average accounts receivable decreases then the margin will decrease Assuming all also holds constant. If the average accounts receivable decreases, then the tumover will increase Assuming all else holds constant. If the average accounts receivable decreases, then the turnover will decrease Razan Company has the following information during the month of June 2020 Cash Balance May 31 $45.000 Dividenda pard in June 12.000 Cash paid for operating expenses in Pune 36.800 biquipment depreciation expensee 4.500 Patent amortization expense m June 2.000 Cash collections on sales in one 112 300 Merchandit purchases paid in one 16,200 Purchase equipment for cash in June 17.500 Sales como (50% paid in June 30 500 Raran Company wants to keep a minimum cash balance of $10,000. Asume that one occurs at the begint of them and the end of them Monthly interest of 1% is paid in cash at the end of each month when debt is out Brown payment is mal of 51.000 Required: Prepare a cash budget for June Furniture, Ino makes and sell a ningle product called a Bik The company wants to prepare the direct material budget for the qunter ending Tone 30 Budgeted production of Bika for the next six months as follows February 7.000 Units M 7,750 Units April 5.950 Unte M 6,300 Units 750 Unit July 1,000 Uniti It takes four yards of Material to make one Buk The company want to mohly endine investory of Material A equal to 20% of the followme more production beebi Ou March 31. 1.310 yat ds et Material weten hamil The east of Material : 56 Required: 1. Prepare the Direct Material Bodet for April May June, and quarter 2. Based on the directed but that you prepared in requirement about the directie purchase obrony w 573.000 and in March was $80,000 Prepare the cash dubtement budget for Apriliepy polery for pain purchase follow 15% in the month of porce 05% ont month after purchase 2011 months after purchase For the prest ALT I ALTIN 8 points Www The Past Down of Awal Company produce one potwoch can be told the women told to Lamp Division of Awal Company Tlu follow able for Last year's activities of the Post Devom The Post Dicono Capacity in its Selling price per port to outside to co per pot Fixed cost, tal 150.000 SOMS 300 575.000 Dem De Number of intended Purchase price from Outside Supplier 13500 5073 Required 1. Supposed the Past Disse sidemets 135,000. What is the lowest free to the profits of the house And what is the me of transfer 2. Support that the Por Dimin sellutadecimen 15000 and the port for tidecum 3 500 per un the parking and ihppcom would not have to be desinf the posts to Lamp Divi Waheem met well she ftoit of the Post Division And what the range of transfer For the other per