Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wallaroo Energy Limited, an investment holding company listed on Australia Securities Exchange (ASX) plans to enter the solar energy market by setting up a

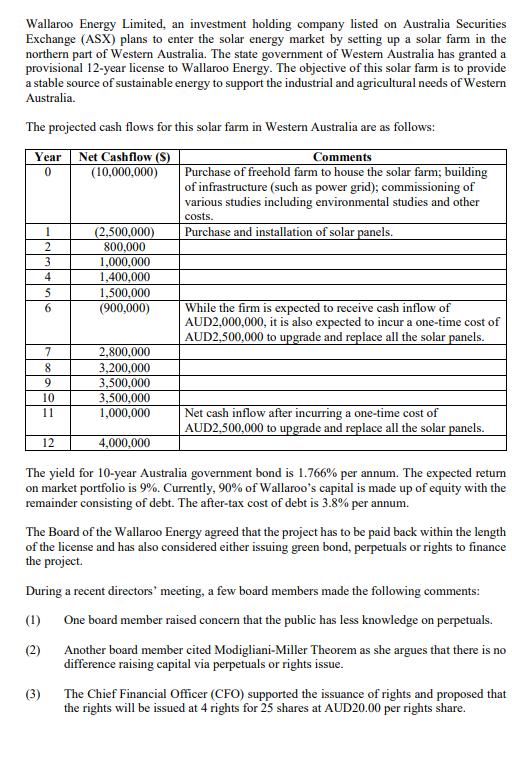

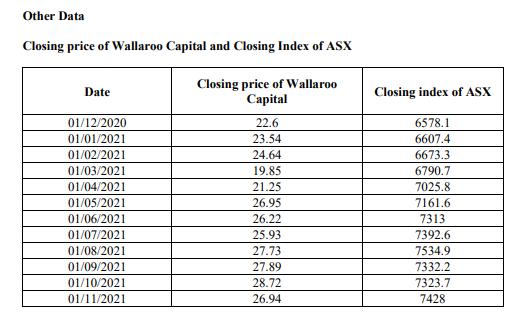

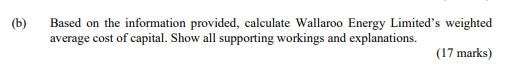

Wallaroo Energy Limited, an investment holding company listed on Australia Securities Exchange (ASX) plans to enter the solar energy market by setting up a solar farm in the northern part of Western Australia. The state government of Western Australia has granted a provisional 12-year license to Wallaroo Energy. The objective of this solar farm is to provide a stable source of sustainable energy to support the industrial and agricultural needs of Western Australia. The projected cash flows for this solar farm in Western Australia are as follows: Comments Year Net Cashflow (S) (10,000,000) 0 Purchase of freehold farm to house the solar farm; building of infrastructure (such as power grid); commissioning of various studies including environmental studies and other costs. Purchase and installation of solar panels. 1 2 3 4 5 6 7 8 9 10 11 12 (3) (2,500,000) 800,000 1,000,000 1,400,000 1,500,000 (900,000) 2,800,000 3,200,000 3,500,000 3,500,000 1,000,000 While the firm is expected to receive cash inflow of AUD2,000,000, it is also expected to incur a one-time cost of AUD2,500,000 to upgrade and replace all the solar panels. 4,000,000 The yield for 10-year Australia government bond is 1.766% per annum. The expected return on market portfolio is 9%. Currently, 90% of Wallaroo's capital is made up of equity with the remainder consisting of debt. The after-tax cost of debt is 3.8% per annum. Net cash inflow after incurring a one-time cost of AUD2,500,000 to upgrade and replace all the solar panels. The Board of the Wallaroo Energy agreed that the project has to be paid back within the length of the license and has also considered either issuing green bond, perpetuals or rights to finance the project. During a recent directors' meeting, a few board members made the following comments: (1) One board member raised concern that the public has less knowledge on perpetuals. (2) Another board member cited Modigliani-Miller Theorem as she argues that there is no difference raising capital via perpetuals or rights issue. The Chief Financial Officer (CFO) supported the issuance of rights and proposed that the rights will be issued at 4 rights for 25 shares at AUD20.00 per rights share. Other Data Closing price of Wallaroo Capital and Closing Index of ASX Date 01/12/2020 01/01/2021 01/02/2021 01/03/2021 01/04/2021 01/05/2021 01/06/2021 01/07/2021 01/08/2021 01/09/2021 01/10/2021 01/11/2021 Closing price of Wallaroo Capital 22.6 23.54 24.64 19.85 21.25 26.95 26.22 25.93 27.73 27.89 28.72 26.94 Closing index of ASX 6578.1 6607.4 6673.3 6790.7 7025.8 7161.6 7313 7392.6 7534.9 7332.2 7323.7 7428 (b) Based on the information provided, calculate Wallaroo Energy Limited's weighted average cost of capital. Show all supporting workings and explanations. (17 marks)

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Wallaroo Energy Limiteds weighted average cost of capital WACC we use the formula WACC ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started