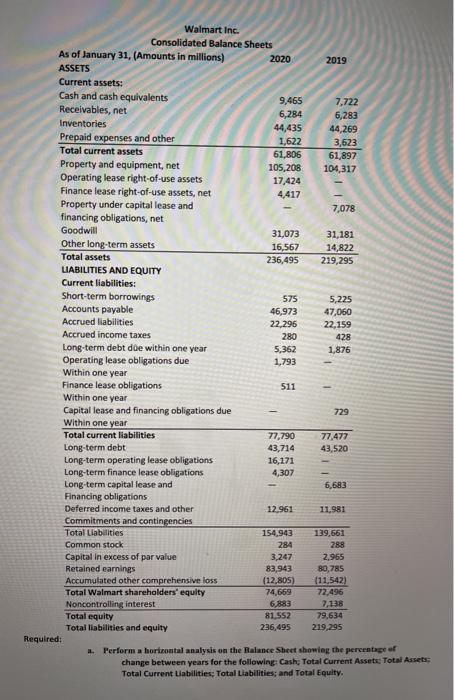

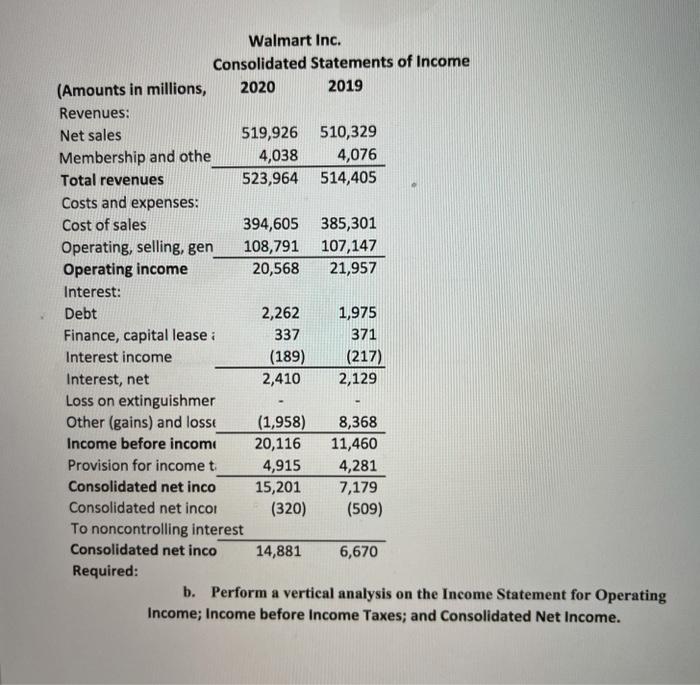

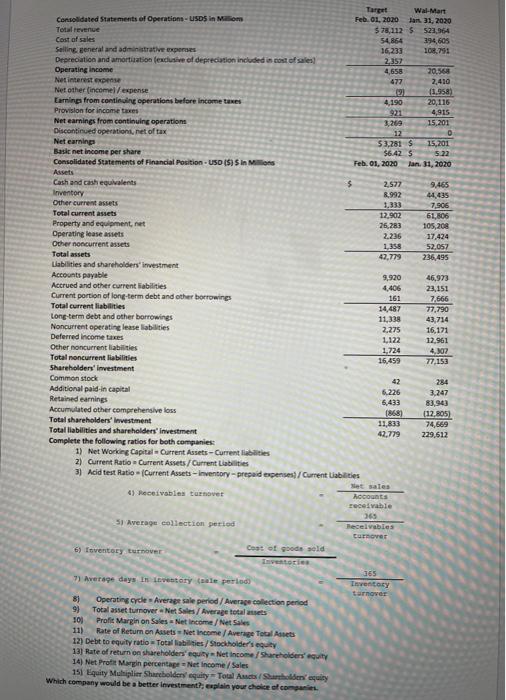

Walmart Inc. Consolidated Balance Sheets As of January 31, (Amounts in millions) 2020 2019 ASSETS Current assets: Cash and cash equivalents 9,465 7,722 Receivables, net 6,284 6,283 Inventories 44,435 44,269 Prepaid expenses and other 1,622 3,623 Total current assets 61,806 61,897 Property and equipment, net 105,208 104,317 Operating lease right-of-use assets 17,424 Finance lease right-of-use assets, net 4,417 Property under capital lease and 7,078 financing obligations, net Goodwill 31,073 31,181 Other long-term assets 16,567 14,822 Total assets 236,495 219,295 LIABILITIES AND EQUITY Current liabilities: Short-term borrowings 575 5,225 Accounts payable 46,973 47,060 Accrued liabilities 22,296 22,159 Accrued income taxes 280 428 Long-term debt doe within one year 5,362 1,876 Operating lease obligations due 1,793 Within one year Finance lease obligations 511 Within one year Capital lease and financing obligations due 729 Within one year Total current liabilities 77,790 77,477 Long-term debt 43,714 43,520 Long-term operating lease obligations 16,171 Long-term finance lease obligations 4,307 Long-term capital lease and 6,683 Financing obligations Deferred income taxes and other 12.961 11,981 Commitments and contingencies Total Liabilities 154.943 139,661 Common stock 284 288 Capital in excess of par value 3,247 2.965 Retained earnings 83,943 Accumulated other comprehensive loss (12,805) (11,542) Total Walmart shareholders' equity 74,669 72.496 Noncontrolling interest 6,883 7,138 Total equity 81,552 79,634 Total liabilities and equity 236,495 219,295 Required: Perform a horizontal analysis on the Balance Sheet showing the percentage of change between years for the following: Cash: Total Current Assets: Total Assets Total Current Liabilities: Total Liabilities, and Total Equity. 1 1 - 80,785 Walmart Inc. Consolidated Statements of Income (Amounts in millions, 2020 2019 Revenues: Net sales 519,926 510,329 Membership and othe 4,038 4,076 Total revenues 523,964 514,405 Costs and expenses: Cost of sales 394,605 385,301 Operating, selling, gen 108,791 107,147 Operating income 20,568 21,957 Interest: Debt 2,262 1,975 Finance, capital lease : 337 371 Interest income (189) (217) Interest, net 2,410 2,129 Loss on extinguishmer Other (gains) and losse (1,958) 8,368 Income before income 20,116 11,460 Provision for income t 4,915 4,281 Consolidated net inco 15,201 7,179 Consolidated net incor (320) (509) To noncontrolling interest Consolidated net inco 14,881 6,670 Required: b. Perform a vertical analysis on the Income Statement for Operating Income; Income before Income Taxes; and Consolidated Net Income. Target Wal- Mart Consolidated Statements of Operation - USDin Mom Feb. 01, 2020 Jan 31, 2020 Total revenue $78,212 $ 523,364 Cost of sales 54.864 294605 Selling general and administrative experies 16,233 LOR.791 Depreciation and amortization (exclusive of depreciation included is cost of sales 2357 Operating income 4,658 20.568 Net interest expense 477 2,410 Net other (incomel/expense 121 1.558 Earnings from continuing operations before income taxes 4,190 20,116 Provision for income taxes 921 4,915 Net earnings from continuing operation 3,269 15,201 Discontinued operations, net of tax 12 D Net earning 53,281 $ 15,201 Basi net income per share $6.42 S 5.22 Consolidated Statements of Financial Position - USD ($) Sin Millions Feb. 01, 2020 Jan 31, 2020 Assets Cash and cash equivalents 5 2.577 9.465 Inventory 8.992 44,435 Other current assets 3.333 7,906 Total current assets. 12.902 61,806 Property and equipment, net 26,283 105,208 Operating lease assets 2.236 17.424 Other noncurrent assets 1.356 52,057 Total assets 42,779 236,495 Labilities and shareholders investment Accounts payable 9,920 46,973 Accrued and other current abilities 4,406 23,151 Current portion of long-term debt and other borrowings 161 7,666 Total current liabilities 14,487 77,790 Long-term debt and other borrowings 11,338 43,714 Noncurrent operating lease abilities 2,275 16,171 Deferred income taxes 1,122 12.961 Other noncurrent liabilities 1,724 4.307 Total noncurrent liabilities 16,459 77,153 Shareholders' Investment Common stock 284 Additional paid-in capital 6.226 3,247 Retained earnings 5.433 83,943 Accumulated other comprehensive loss (868) (12.805) Total shareholders' Investment 11,833 74,669 Total liabilities and shareholders' Investment 42.779 229.612 Complete the following ratios for both companies 1) Net Working Capital - Current Assets - Current sities 2) Current Ratio Current Assets/Current Liabilities 3) Acid test Ratio (Current Assets - Inventory-prepaid expenses / Current Liabilities at sales 4) Receivables turnovet Accounts ( receivable 365 51 Average collection period Receivables turnover 6) Coventory turn Cost of goods sold Tentories 365 7) Average days In Lovestory (ale period Inventory turnover 81 Operating cycle Average sale period / Average collection period 9) Total asset turnover Net Sales/ Average totales 10 Profit Margin on Sales Net Income / Net Sales 11) Rate of Return on Assets Net Income / Average Total Assets 12) Debt to equity ratio - Total liabilities/Stockholder's equity 13 Rate of return on shareholders' equity Net Income / Shareholders' equity 14) Net Profit Margin percentage Net Income / Sales 151 Equity Multiplier Shareholders' equity Toul An Sartholde equity Which company would be a better investment?, explain your choice of con