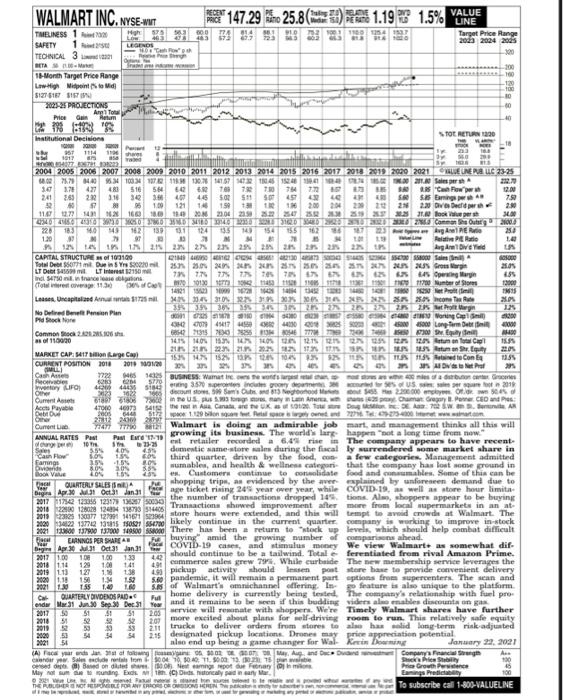

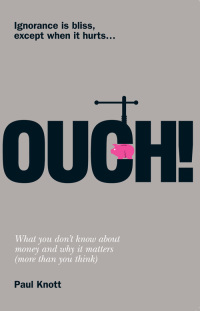

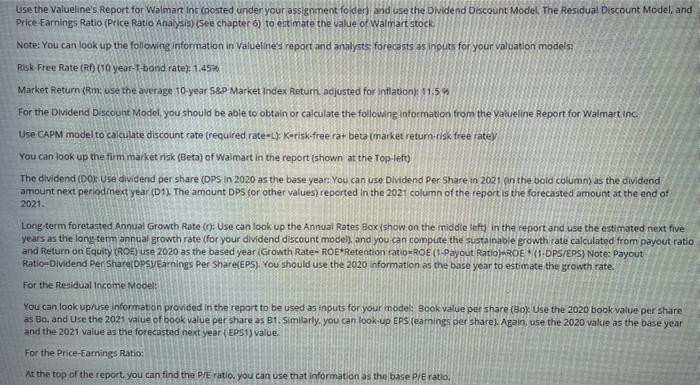

WALMART INC. NYSE-RIT 4 957 1917 2030 30 PRICE LINE TMBINESS 1 2 314 2133 483 Target Price Range SAFETY 1 2023 2024 2005 LEGENDS TECHNICAL 3 META 11-Month Target Price Range Low High Mpen to Mid 512751673 225 PROJECTIONS -80 Ang Total Price Gum 40 19 1998 Institutional Decision TOE RETURN 200 1114 11 27 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 CRUELNE PUG 23-25 . 7170 153410034 9813078141570492001 0.0 21.0 SD 30 427 481 516 564 8. Te 7 10 76 " Cow 12.00 2441 360 22 3:16 34 361 45 SOR 5. S07 491 5. Sa aming 7.99 05 1.00 121 14 159 10 200 22 20 21 22 Dec 2.80 110 72 143 28 160 101 254 * 30.5 21.0 for 0940 ISO 690 30000 30000 30000 200 Cannot send Outut 2000 183 145 162 139 3 24 12 154 155 162 86 PER 23 120 NE Relate Patio 11 TA 1 12.11 23 27 22 2:21 2 Ang blived CAPITAL STRUCTURE of 103100 219 LOOK 2000 SS SS Sains OND Total De Dus Yr 2000 251 252 25.7 2 2 Grous Bergen LTD LT 21 Indians 17 SAS en Morgen 10130109 11 11700 Number of 121 Leases. Un capitale il 34% 30% 30% 30% on the 24 30 3 3. 94 horn No Derived Penn Plan Pld Score CAS 1800 CANON Wartung Cap Small 800 OH 079 49417 498 40 00 131005777 100 1000 Long Term Datei Common 2.12.05 HADO 1415 10 15 10 215 2 15. MARKET CAP: HIT in Lage Cal 21 22 21 20 ANS 11.35 stunnar 22:05 153 152913 TRS 1185 Retired to con 13 CURRENT POSITION 2018 2019 20 GIMI ons was of 29 Car 2222 1633 Rece BUSINESS. Wamate wants a Grones Inventory IFO Naye 3570 Indigo US 2018 Other 123 1022 G5 Samsubd893 Neo 550.000 only one Ourent 6187 1808 in US pomory Lane Cramer Gray. Pere CEO and Acto Payable 4701040173 hetes Canare Tour Other Out St 1.129 bot. Paleta 2270 27.00 221122 Current 7 Walmart is doing an admirable job mart, and management think all this will ANNUAL RATES Past Past End growing its business. The world's larg happen at a long time from now." 10 33-2 Se 3.59 404 255 dementie same-store sale during the fiscal ly surrendered home market share in Cash Flow SON 15 Faming 154 15 HON third quarter driven by the food, categories Management admitted Ovde 8030N umables, and health & wellness won that the com has lost me ground in Bon V 20 commodate Some of this can be shopping QUARTERLY SALES tripes evidenced by Ver demand du Dagera A, 30 31 Oct 31 Jan 31 the number of transaction dropped the film year over year, while 201711712 1208 123178 17 Transactions huwed improvement after to 2014 216 120 130 1987 1986 tore hours crowd at Walmart. The sing the one weet working to improve in stock continue in the current quarter 2001 19 1370 1300 mo la There has been return to ERANNGS PER Year number of comparabehele combat difficult FUE A detaCOVIL 19 cases, and stimulus meny We Walmarte as somewhat dif- tailwind. Total ferentiated from rival Amazon Prime 2017 1.00 100 133 2018 1.14 129 108 141 commerce ale grew While curbeide The new membership service leverages the 2019 113 127 138 250 pickup activity should Inssen te provide convenient delivery 020 11 150 1 152 2021 13 T15 1. TA of Walmart' omnichannel offering feature to the platform CH QUARTERLY DIVDENS PADE Ful home delivery is currently being tented the with ful pro endar Mar 31 Jan 30 Sep 30 Dec 31 New Service will remate with shopper. We're Timely Walmart shares have further 2017 50 51 51 51 200 2010 51 52 22 207 more excited about plans for self-driving room to run. This relatively safe equity 59 30 2. 0 34 54 215 designated pickup locations. Drones may price appreciation potential 2001 51 a for Wal January 22, 2021 CAF yaar ander of Two ST Augant Deco Company Franch w Sudere om 8004 10 500 1.000 1.5wbie his Based ditet eaming pot May mo sumounding Excl.) Destorcalan anyar Prati Net PUBLISHER NOTRE FOR ANY CRORE DROONISEREN To subscribe call 1-803VALUELINE o and pay shoppers appear be buying which should Face postane 1 2018 la Use the valueline's Report for Walmart Int posted under your assignment folder) and use the Dividend Discount Model The Residual Discount Model, and Price-Earnings Ratio (Price Ratio Analysis) (See chapter 6) to estimate the value of Walmart stock Note: You can look up the following information in Valueline's report and analysts forecasts as inputs for your valuation models: Risk Free Rate (RD) (10 year-T-bond rate): 1.454 Market Return (Rm: use the average 10-year 5&P Market Index Retur adjusted for inflation: 11.5% For the Dividend Discount Model, you should be able to obtain or calculate the following information from the valueline Report for Walmartina Use CAPM model to calculate discount rate (required rate-L. Korisk-free rat beta (narket return.risk free rate) You can look up the firm market risk (Beta) of Walmart in the report (shown at the Top-left) The dividend (Dor Use dividend per share (DPS in 2020 as the bese year: You can use Dividend per Share in 2021 (on the bold column) as the dividend amount next period next year (D1) The amount DPS (or other values) reported in the 2021 column of the report is the forecasted amount at the end of 2021. Long-term foretasted Annual Growth Rate (9: Use can look up the Annual Rates Box (show on the middle left) in the report and use the estimated next five years as the long-term annual growth rate (for your dividend discount model, and you can compute the sustainable growth rate calculated from payout ratio and Return on Equity (ROE) use 2020 as the based year (Growth Rate- ROE*Retention ratio=ROE (1-Payout Ratio)ROE (1-DPS/EPS) Note: Payout Ratio-Dividend Per Share/DPSV Earnings Per Share(EPS). You should use the 2020 Information as the base year to estimate the growth rate. For the Residual income Model You can look up/use information provided in the report to be used as inputs for your model Book value per share (Box Use the 2020 book value per share as Bo. and Use the 2021 value of book value per share as 81. Similarly, you can look-up EPS (eamings per share). Again use the 2020 value as the base year and the 2021 value as the forecasted next year (EPS1) value. For the Price-Earnings Ratio: At the top of the report, you can find the P/E ratio, you can use that information as the base pe ratio, WALMART INC. NYSE-RIT 4 957 1917 2030 30 PRICE LINE TMBINESS 1 2 314 2133 483 Target Price Range SAFETY 1 2023 2024 2005 LEGENDS TECHNICAL 3 META 11-Month Target Price Range Low High Mpen to Mid 512751673 225 PROJECTIONS -80 Ang Total Price Gum 40 19 1998 Institutional Decision TOE RETURN 200 1114 11 27 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 CRUELNE PUG 23-25 . 7170 153410034 9813078141570492001 0.0 21.0 SD 30 427 481 516 564 8. Te 7 10 76 " Cow 12.00 2441 360 22 3:16 34 361 45 SOR 5. S07 491 5. Sa aming 7.99 05 1.00 121 14 159 10 200 22 20 21 22 Dec 2.80 110 72 143 28 160 101 254 * 30.5 21.0 for 0940 ISO 690 30000 30000 30000 200 Cannot send Outut 2000 183 145 162 139 3 24 12 154 155 162 86 PER 23 120 NE Relate Patio 11 TA 1 12.11 23 27 22 2:21 2 Ang blived CAPITAL STRUCTURE of 103100 219 LOOK 2000 SS SS Sains OND Total De Dus Yr 2000 251 252 25.7 2 2 Grous Bergen LTD LT 21 Indians 17 SAS en Morgen 10130109 11 11700 Number of 121 Leases. Un capitale il 34% 30% 30% 30% on the 24 30 3 3. 94 horn No Derived Penn Plan Pld Score CAS 1800 CANON Wartung Cap Small 800 OH 079 49417 498 40 00 131005777 100 1000 Long Term Datei Common 2.12.05 HADO 1415 10 15 10 215 2 15. MARKET CAP: HIT in Lage Cal 21 22 21 20 ANS 11.35 stunnar 22:05 153 152913 TRS 1185 Retired to con 13 CURRENT POSITION 2018 2019 20 GIMI ons was of 29 Car 2222 1633 Rece BUSINESS. Wamate wants a Grones Inventory IFO Naye 3570 Indigo US 2018 Other 123 1022 G5 Samsubd893 Neo 550.000 only one Ourent 6187 1808 in US pomory Lane Cramer Gray. Pere CEO and Acto Payable 4701040173 hetes Canare Tour Other Out St 1.129 bot. Paleta 2270 27.00 221122 Current 7 Walmart is doing an admirable job mart, and management think all this will ANNUAL RATES Past Past End growing its business. The world's larg happen at a long time from now." 10 33-2 Se 3.59 404 255 dementie same-store sale during the fiscal ly surrendered home market share in Cash Flow SON 15 Faming 154 15 HON third quarter driven by the food, categories Management admitted Ovde 8030N umables, and health & wellness won that the com has lost me ground in Bon V 20 commodate Some of this can be shopping QUARTERLY SALES tripes evidenced by Ver demand du Dagera A, 30 31 Oct 31 Jan 31 the number of transaction dropped the film year over year, while 201711712 1208 123178 17 Transactions huwed improvement after to 2014 216 120 130 1987 1986 tore hours crowd at Walmart. The sing the one weet working to improve in stock continue in the current quarter 2001 19 1370 1300 mo la There has been return to ERANNGS PER Year number of comparabehele combat difficult FUE A detaCOVIL 19 cases, and stimulus meny We Walmarte as somewhat dif- tailwind. Total ferentiated from rival Amazon Prime 2017 1.00 100 133 2018 1.14 129 108 141 commerce ale grew While curbeide The new membership service leverages the 2019 113 127 138 250 pickup activity should Inssen te provide convenient delivery 020 11 150 1 152 2021 13 T15 1. TA of Walmart' omnichannel offering feature to the platform CH QUARTERLY DIVDENS PADE Ful home delivery is currently being tented the with ful pro endar Mar 31 Jan 30 Sep 30 Dec 31 New Service will remate with shopper. We're Timely Walmart shares have further 2017 50 51 51 51 200 2010 51 52 22 207 more excited about plans for self-driving room to run. This relatively safe equity 59 30 2. 0 34 54 215 designated pickup locations. Drones may price appreciation potential 2001 51 a for Wal January 22, 2021 CAF yaar ander of Two ST Augant Deco Company Franch w Sudere om 8004 10 500 1.000 1.5wbie his Based ditet eaming pot May mo sumounding Excl.) Destorcalan anyar Prati Net PUBLISHER NOTRE FOR ANY CRORE DROONISEREN To subscribe call 1-803VALUELINE o and pay shoppers appear be buying which should Face postane 1 2018 la Use the valueline's Report for Walmart Int posted under your assignment folder) and use the Dividend Discount Model The Residual Discount Model, and Price-Earnings Ratio (Price Ratio Analysis) (See chapter 6) to estimate the value of Walmart stock Note: You can look up the following information in Valueline's report and analysts forecasts as inputs for your valuation models: Risk Free Rate (RD) (10 year-T-bond rate): 1.454 Market Return (Rm: use the average 10-year 5&P Market Index Retur adjusted for inflation: 11.5% For the Dividend Discount Model, you should be able to obtain or calculate the following information from the valueline Report for Walmartina Use CAPM model to calculate discount rate (required rate-L. Korisk-free rat beta (narket return.risk free rate) You can look up the firm market risk (Beta) of Walmart in the report (shown at the Top-left) The dividend (Dor Use dividend per share (DPS in 2020 as the bese year: You can use Dividend per Share in 2021 (on the bold column) as the dividend amount next period next year (D1) The amount DPS (or other values) reported in the 2021 column of the report is the forecasted amount at the end of 2021. Long-term foretasted Annual Growth Rate (9: Use can look up the Annual Rates Box (show on the middle left) in the report and use the estimated next five years as the long-term annual growth rate (for your dividend discount model, and you can compute the sustainable growth rate calculated from payout ratio and Return on Equity (ROE) use 2020 as the based year (Growth Rate- ROE*Retention ratio=ROE (1-Payout Ratio)ROE (1-DPS/EPS) Note: Payout Ratio-Dividend Per Share/DPSV Earnings Per Share(EPS). You should use the 2020 Information as the base year to estimate the growth rate. For the Residual income Model You can look up/use information provided in the report to be used as inputs for your model Book value per share (Box Use the 2020 book value per share as Bo. and Use the 2021 value of book value per share as 81. Similarly, you can look-up EPS (eamings per share). Again use the 2020 value as the base year and the 2021 value as the forecasted next year (EPS1) value. For the Price-Earnings Ratio: At the top of the report, you can find the P/E ratio, you can use that information as the base pe ratio